Monthly updates of the National Accounts are postponed until further notice. In the meantime, monthly data series will be published every three months together with quarterly national accounts.

At the next publication on 9 February 2026, some corrections will be made in the time series. These changes will mainly affect figures for the manufacturing industry.

Statistikk innhold

Statistics on

National accounts

The national accounts provide an overview of the state and development in the Norwegian economy. Key figures are gross domestic product (GDP), consumption, gross investment, exports and imports, employment and wages, profitability in industries and productivity. 1st to 3rd quarter is published with monthly national accounts in May, August and November. 4th quarter will be published February the following year, figures for t-2 in August.

Selected figures from these statistics

- Final expenditure and gross domestic product. Seasonally adjusted. Percentage change in volumeDownload table as ...Final expenditure and gross domestic product. Seasonally adjusted. Percentage change in volume1

2024 2025 4th quarter 2025 October 2025 November 2025 December 2025 Gross domestic product 1.4 1.1 -0.3 -1.6 0.0 0.3 Gross domestic product Mainland Norway 0.6 1.8 0.4 0.7 0.1 0.0 Petroleum activities and ocean transport 3.9 -0.9 -2.6 -8.3 0.0 1.0 Final domestic use of goods and services 0.3 0.9 -1.2 -6.3 4.5 1.0 Final consumption expenditure of households and NPISH 1.3 2.7 1.0 -1.1 3.6 1.7 Final consumption expenditure of general government 1.7 1.5 0.4 0.1 0.1 0.3 Gross fixed capital formation (GFCF) -1.4 1.3 7.2 3.6 0.1 4.0 Total exports 5.8 2.4 3.6 7.4 -4.4 -0.6 Total imports 5.0 2.6 3.6 -0.1 3.7 0.7 Employed persons 0.7 0.7 0.2 Total hours worked 0.5 0.5 0.0 1Figures from 2024 onwards are preliminary. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Monthly. Seasonally adjusted figures. Percentage change in volume from the previous periodDownload table as ...Final expenditure and gross domestic product. Monthly. Seasonally adjusted figures. Percentage change in volume from the previous period1

May 2025 June 2025 July 2025 August 2025 September 2025 October 2025 November 2025 December 2025 Final consumption expenditure of households and NPISHs -0.5 0.7 1.6 -0.4 -1.0 -1.1 3.6 1.7 ¬ Household final consumption expenditure -0.3 0.6 0.8 0.4 -0.7 -1.2 3.6 1.7 ¬¬ Goods 0.1 0.2 1.0 1.0 -1.3 -2.9 8.1 2.5 ¬¬ Services 0.1 0.2 0.7 -0.3 -0.1 0.2 0.3 0.8 ¬¬ Direct purchases abroad by resident households -3.3 3.6 1.3 0.8 1.8 -1.1 0.9 4.0 ¬¬ Direct purchases by non-residents 3.5 -2.9 2.8 -1.9 5.7 1.3 -2.2 2.4 ¬ Final consumption expenditure of NPISHs -3.7 2.2 15.6 -12.1 -4.9 0.3 3.5 0.5 Final consumption expenditure of general governmen 0.4 0.1 -0.1 -0.1 0.2 0.1 0.1 0.3 ¬ Final consumption expenditure of central government 0.7 0.1 -0.2 0.3 0.4 -0.1 0.3 0.7 ¬¬¬ Central government, civilian 0.7 0.0 -0.4 0.2 0.4 -0.3 0.2 0.7 ¬¬¬ Central government, defence 1.0 0.7 0.7 0.8 0.7 0.9 0.7 0.8 ¬ Final consumption expenditure of local government 0.0 0.1 0.0 -0.4 -0.1 0.3 0.0 -0.2 Gross fixed capital formation (GFCF) 0.2 1.2 -2.0 0.4 3.0 3.6 0.1 4.0 ¬ Extraction and transport via pipelines (GFCF) 3.6 -3.2 -0.5 1.5 0.6 4.8 -3.2 1.2 ¬ Ocean transport (GFCF) -32.4 671.9 -88.5 1.2 809.7 .. .. 1 142.2 ¬ Mainland Norway (GFCF) -0.7 1.9 -1.9 0.1 3.1 4.1 0.8 3.9 ¬¬ Mainland Norway excluding general government (GFCF) 3.5 2.8 -3.1 -0.3 4.4 -0.7 2.1 5.4 ¬¬¬ Industries (GFCF) 5.6 2.6 -3.5 -0.8 6.2 -0.9 2.3 6.4 ¬¬¬¬ Services activities incidential to extraction (GFCF) 4.2 -2.2 29.1 -0.1 3.7 14.2 -1.9 3.3 ¬¬¬¬ Other services (GFCF) 3.7 2.8 -3.4 -0.4 6.8 -2.9 3.2 9.2 ¬¬¬¬ Manufacturing and mining (GFCF) 1.8 -0.5 4.6 1.1 1.2 4.3 -1.3 1.5 ¬¬¬¬ Production of other goods (GFCF) 16.7 4.7 -13.1 -4.0 9.4 0.3 3.0 0.7 ¬¬¬ Dwelling service (households) (GFCF) -1.3 3.3 -2.2 0.9 0.1 -0.2 1.4 2.7 ¬¬¬ General government (GFCF) -9.8 -0.3 1.4 1.0 -0.1 16.2 -2.0 0.5 Acquisitions less disposals of valuables -3.3 -2.1 2.4 -4.8 -0.2 0.0 -0.3 4.7 Changes in stocks and statistical discrepancies -76.7 152.5 .. .. .. .. .. .. Gross capital formation -4.8 3.6 -6.3 -4.5 17.2 -20.6 11.2 0.3 Final domestic use of goods and services -1.5 1.3 -1.0 -1.4 3.8 -6.3 4.5 1.0 Final demand from Mainland Norway (excl. changes in stocks) -0.3 0.8 0.4 -0.2 0.2 0.3 2.0 1.8 Final demand from general government -1.6 0.0 0.2 0.1 0.1 3.0 -0.3 0.3 Total exports 0.4 -0.4 3.2 2.0 -1.6 7.4 -4.4 -0.6 ¬ Traditional goods (export) -4.6 1.5 5.6 5.4 -12.8 15.7 -7.9 -6.9 ¬ Crude oil and natural gas (export) 2.6 -0.4 1.7 1.6 3.3 4.9 -3.7 1.7 ¬ Ships, oil platforms and aircraft (export) 13.5 -73.8 253.3 -33.3 -30.6 153.3 -61.7 144.9 ¬ Services (export) 1.4 -0.7 1.7 -0.3 2.5 2.3 -0.2 0.5 Total use of goods and services -0.8 0.7 0.5 -0.1 1.8 -1.3 0.9 0.4 Total imports -3.3 1.6 1.4 -1.5 2.2 -0.1 3.7 0.7 ¬ Traditional goods (import) -2.9 1.6 0.6 -0.9 0.8 0.5 6.1 -0.2 ¬ Crude oil and natural gas (import) 30.6 9.3 6.7 -53.5 93.2 17.2 -16.9 -5.8 ¬ Ships, oil platforms and aircraft (import) -61.4 -14.5 39.5 -13.3 -12.1 -42.7 55.8 25.2 ¬ Services (import) -1.1 1.8 1.6 0.3 2.6 -0.8 0.2 2.0 Gross domestic product, market values2 0.0 0.4 0.3 0.3 1.6 -1.6 0.0 0.3 Gross domestic product Mainland Norway, market values2 -0.2 0.1 0.4 -0.3 -0.4 0.7 0.1 0.0 Petroleum activities and ocean transport3 0.6 1.2 -0.2 2.4 7.7 -8.3 0.0 1.0 Gross domestic product Mainland Norway, basic values -0.1 0.1 0.5 -0.4 -0.5 0.7 -0.1 0.0 ¬ Mainland Norway excluding general government (GDP) -0.4 0.1 0.6 -0.4 -0.6 0.7 -0.1 -0.1 ¬¬ Manufacturing and mining (GDP) -0.8 -0.2 -0.5 1.8 -2.4 -1.2 2.5 -0.4 ¬¬ Production of other goods (GDP) -0.3 -1.1 1.3 -3.5 2.1 -1.4 -1.1 0.4 ¬¬ Service activities (GDP) -0.3 0.4 0.7 -0.1 -0.9 1.6 -0.3 -0.1 ¬ General government (GDP) 0.6 0.1 0.0 -0.3 -0.1 0.5 0.0 0.0 Taxes and subsidies products -0.2 0.7 -0.2 0.2 0.5 1.0 1.0 0.7 1Figures from 2024 onwards are preliminary 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices 3Includes oil and gas extraction, transport via pipelines and ocean transport Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Rolling three-month sum. Seasonally adjusted. Percentage change in volumeDownload table as ...Final expenditure and gross domestic product. Rolling three-month sum. Seasonally adjusted. Percentage change in volume1 2

March 2025 - May 2025 April 2025 - June 2025 May 2025 - July 2025 June 2025 - August 2025 July 2025 - September 2025 August 2025 - October 2025 September 2025 - November 2025 October 2025 - December 2025 Final consumption expenditure of households and NPISHs 0.2 0.6 1.1 1.6 1.3 -0.1 -0.3 1.0 ¬ Household final consumption expenditure 0.2 0.4 0.9 1.3 1.1 0.2 0.2 1.4 ¬¬ Goods 1.2 1.7 2.3 2.0 1.3 -0.1 0.3 2.7 ¬¬ Services 0.3 0.2 0.6 0.6 0.6 0.2 0.2 0.5 ¬¬ Direct purchases abroad by resident households -3.7 -4.0 -2.6 1.6 3.8 3.8 2.3 2.3 ¬¬ Direct purchases by non-residents 2.0 1.6 2.8 0.0 2.6 3.2 5.4 3.7 ¬ Final consumption expenditure of NPISHs -1.1 2.7 5.0 7.2 4.8 -5.9 -7.4 -5.1 Final consumption expenditure of general governmen 0.9 0.4 0.4 0.1 0.1 0.0 0.2 0.4 ¬ Final consumption expenditure of central government 1.6 0.7 0.6 0.2 0.4 0.4 0.6 0.7 ¬¬¬ Central government, civilian 1.3 0.3 0.2 -0.2 0.1 0.1 0.3 0.4 ¬¬¬ Central government, defence 3.5 3.3 3.0 2.5 2.3 2.3 2.4 2.4 ¬ Final consumption expenditure of local government 0.1 0.1 0.1 -0.1 -0.3 -0.4 -0.2 0.0 Gross fixed capital formation (GFCF) 0.2 3.1 1.9 0.8 0.1 2.6 5.0 7.2 ¬ Extraction and transport via pipelines (GFCF) 7.3 12.9 9.1 2.1 -0.4 2.0 3.5 3.9 ¬ Ocean transport (GFCF) -72.2 30.5 254.5 35.5 -2.3 -26.1 -24.9 6.9 ¬ Mainland Norway (GFCF) -1.2 0.5 -0.3 0.3 0.2 2.9 5.6 8.2 ¬¬ Mainland Norway excluding general government (GFCF) 0.0 -0.7 1.4 1.1 1.0 1.2 3.3 5.4 ¬¬¬ Industries (GFCF) -0.4 -1.1 1.9 1.2 1.4 1.5 4.6 6.7 ¬¬¬¬ Services activities incidential to extraction (GFCF) -10.8 -2.7 8.5 16.6 30.4 25.4 21.8 16.8 ¬¬¬¬ Other services (GFCF) -3.5 -3.1 0.4 1.2 1.6 1.7 4.3 6.7 ¬¬¬¬ Manufacturing and mining (GFCF) 1.3 4.4 5.4 5.0 6.1 6.3 6.0 5.2 ¬¬¬¬ Production of other goods (GFCF) 12.0 1.7 4.1 -3.4 -5.6 -5.7 2.5 7.3 ¬¬¬ Dwelling service (households) (GFCF) 1.1 0.4 0.2 0.7 0.1 0.5 0.3 2.0 ¬¬¬ General government (GFCF) -4.0 3.4 -4.4 -1.6 -1.7 7.3 11.2 15.2 Acquisitions less disposals of valuables 0.8 -2.9 -4.5 -3.9 -3.4 -4.1 -2.7 -0.4 Changes in stocks and statistical discrepancies 501.9 -29.7 -76.6 -108.0 -83.5 -400.8 1 072.1 -2 007.1 Gross capital formation 6.0 1.2 -3.7 -6.4 -3.3 -4.4 -0.9 -6.8 Final domestic use of goods and services 1.9 0.7 -0.4 -0.9 -0.3 -1.2 -0.3 -1.2 Final demand from Mainland Norway (excl. changes in stocks) 0.1 0.5 0.6 0.9 0.7 0.6 1.1 2.4 Final demand from general government -0.1 0.9 -0.5 -0.2 -0.2 1.4 2.2 3.1 Total exports -1.6 0.6 1.5 3.6 3.8 5.4 4.1 3.6 ¬ Traditional goods (export) 1.4 1.8 1.1 5.6 4.1 5.5 -1.3 -0.6 ¬ Crude oil and natural gas (export) -0.8 3.4 4.4 4.7 4.5 6.6 7.1 5.7 ¬ Ships, oil platforms and aircraft (export) -57.4 -48.9 -52.1 -24.5 -8.2 -2.7 6.8 27.7 ¬ Services (export) -3.8 -4.2 -1.8 -0.3 2.3 3.1 4.4 3.9 Total use of goods and services 0.6 0.7 0.3 0.7 1.2 1.2 1.3 0.6 Total imports 0.1 -0.3 -1.3 -0.1 1.1 1.4 2.8 3.6 ¬ Traditional goods (import) 3.1 0.5 -0.8 -0.3 0.4 0.8 2.8 4.8 ¬ Crude oil and natural gas (import) 2.2 -0.1 17.6 0.6 -3.7 -13.6 17.6 16.4 ¬ Ships, oil platforms and aircraft (import) -47.6 1.9 -49.3 -34.9 -29.5 -19.2 -27.3 -25.1 ¬ Services (import) -1.0 -1.5 -0.4 1.7 3.6 3.5 2.9 1.9 Gross domestic product, market values3 0.8 1.0 0.8 0.9 1.3 1.2 0.9 -0.3 Gross domestic product Mainland Norway, market values 0.6 0.5 0.4 0.4 0.1 0.0 0.1 0.4 Petroleum activities and ocean transport4 1.2 2.4 2.0 2.6 5.0 4.9 3.3 -2.6 Gross domestic product Mainland Norway, basic values 0.6 0.5 0.4 0.4 0.1 -0.1 -0.1 0.2 ¬ Mainland Norway excluding general government (GDP) 0.6 0.7 0.4 0.4 0.1 -0.1 -0.2 0.1 ¬¬ Manufacturing and mining (GDP) 1.9 2.5 0.6 0.4 -0.6 -0.7 -1.4 -0.7 ¬¬ Production of other goods (GDP) 0.8 0.1 0.0 -1.3 -1.3 -2.2 -1.2 -1.8 ¬¬ Service activities (GDP) 0.4 0.5 0.5 0.8 0.5 0.4 0.2 0.7 ¬ General government (GDP) 0.5 0.2 0.4 0.2 0.0 -0.2 0.0 0.3 Taxes and subsidies products 0.6 0.3 0.5 0.7 0.6 1.1 1.6 2.4 1Figures from 2024 onwards are prelimanry 2Rolling three-month growth is calculated by comparing a three-month period with the previous three-month period, for example growth in May to July compared with February to April. Furthermore, March, June, September and December represent the quarters in a year. For example, March will represent the first quarter. 3Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 4Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. At current prices. NOK millionDownload table as ...Final expenditure and gross domestic product. Quarter and year. At current prices. NOK million1

2024 2025 4th quarter 2024 1st quarter 2025 2nd quarter 2025 3rd quarter 2025 4th quarter 2025 Final consumption expenditure of households and NPISHs 2 212 165 2 346 388 585 520 556 332 587 992 572 637 629 426 ¬ Household final consumption expenditure 2 084 291 2 211 965 552 059 523 943 553 730 539 397 594 895 ¬¬ Goods 831 627 900 482 230 410 199 474 225 083 218 140 257 785 ¬¬ Services 1 164 079 1 228 992 297 009 305 810 305 883 304 955 312 344 ¬¬ Direct purchases abroad by resident households 170 141 181 558 39 777 35 993 46 971 57 006 41 589 ¬¬ Direct purchases by non-residents -81 556 -99 067 -15 137 -17 334 -24 208 -40 703 -16 823 ¬ Final consumption expenditure of NPISHs 127 875 134 423 33 462 32 390 34 262 33 240 34 531 Final consumption expenditure of general governmen 1 187 108 1 245 266 301 190 302 150 319 367 309 327 314 423 ¬ Final consumption expenditure of central government 608 481 647 908 157 047 155 359 166 114 159 699 166 736 ¬¬¬ Central government, civilian 529 055 556 112 135 904 134 346 142 454 137 285 142 027 ¬¬¬ Central government, defence 79 426 91 796 21 143 21 013 23 661 22 414 24 708 ¬ Final consumption expenditure of local government 578 627 597 358 144 143 146 790 153 253 149 627 147 687 Gross fixed capital formation (GFCF) 1 235 211 1 289 959 350 294 289 220 317 684 309 613 373 443 ¬ Extraction and transport via pipelines (GFCF) 259 345 283 444 70 965 63 022 73 231 71 126 76 065 ¬ Ocean transport (GFCF) 9 405 2 823 5 627 541 746 691 845 ¬ Mainland Norway (GFCF) 966 461 1 003 692 273 702 225 656 243 707 237 796 296 533 ¬¬ Industries (GFCF) 476 461 501 040 130 341 117 658 124 333 118 601 140 448 ¬¬¬ Services activities incidential to extraction (GFCF) 10 556 9 482 2 866 1 790 1 802 2 670 3 218 ¬¬¬ Other services (GFCF) 317 271 328 790 86 359 80 896 81 051 77 235 89 607 ¬¬¬ Manufacturing and mining (GFCF) 73 244 77 218 21 469 16 221 18 512 18 472 24 013 ¬¬¬ Production of other goods (GFCF) 75 391 85 551 19 647 18 751 22 968 20 223 23 609 ¬¬ welling service (households) (GFCF) 207 290 208 648 50 685 51 660 51 795 51 610 53 583 ¬¬ General government (GFCF) 282 709 294 004 92 675 56 339 67 579 67 585 102 502 Acquisitions less disposals of valuables 311 329 81 80 84 80 86 Changes in stocks and statistical discrepancies 38 275 -9 479 -12 107 51 721 -6 946 3 268 -57 522 Gross capital formation 1 273 797 1 280 810 338 268 341 021 310 822 312 962 316 006 Final domestic use of goods and services 4 673 070 4 872 464 1 224 978 1 199 503 1 218 180 1 194 925 1 259 856 Final demand from Mainland Norway (excl. changes in stocks) 4 365 734 4 595 346 1 160 412 1 084 138 1 151 066 1 119 760 1 240 382 Final demand from general government 1 469 818 1 539 270 393 866 358 488 386 945 376 912 416 924 Total exports 2 496 349 2 503 520 671 971 671 262 592 981 608 975 630 302 ¬ Traditional goods (export) 671 680 724 461 182 668 176 528 170 875 181 146 195 913 ¬ Crude oil and natural gas (export) 1 169 314 1 099 907 318 705 331 879 255 900 248 067 264 061 ¬ Ships, oil platforms and aircraft (export) 12 115 15 407 3 740 5 997 3 109 3 014 3 287 ¬ Services (export) 643 240 663 746 166 858 156 859 163 098 176 748 167 041 Total use of goods and services 7 169 419 7 375 984 1 896 950 1 870 765 1 811 162 1 803 900 1 890 158 Total imports 1 786 978 1 858 337 472 670 438 317 463 969 471 644 484 407 ¬ Traditional goods (import) 1 036 982 1 084 743 271 805 259 044 269 942 265 572 290 185 ¬ Crude oil and natural gas (import) 20 744 20 679 4 487 5 587 3 978 5 879 5 235 ¬ Ships, oil platforms and aircraft (import) 41 163 23 537 18 972 7 205 7 062 4 759 4 511 ¬ Services (import) 688 089 729 378 177 406 166 481 182 987 195 434 184 476 Gross domestic product, market values2 5 382 441 5 517 648 1 424 280 1 432 448 1 347 193 1 332 256 1 405 751 Gross domestic product Mainland Norway, market values2 4 191 794 4 400 438 1 091 658 1 093 061 1 092 461 1 070 138 1 144 778 Petroleum activities and ocean transport3 1 190 647 1 117 209 332 622 339 387 254 732 262 118 260 973 Gross domestic product Mainland Norway, basic values 3 717 522 3 911 968 963 711 980 775 970 422 949 127 1 011 643 ¬ Mainland Norway excluding general government (GDP) 2 823 977 2 970 602 736 991 754 375 727 234 714 961 774 032 ¬¬ Manufacturing and mining (GDP) 317 339 343 870 81 474 85 091 89 462 82 006 87 311 ¬¬ Production of other goods (GDP) 446 790 468 495 116 966 127 521 101 121 113 269 126 584 ¬¬ Service activities (GDP) 2 059 848 2 158 238 538 551 541 763 536 651 519 686 560 137 ¬ General government (GDP) 893 544 941 365 226 720 226 400 243 188 234 166 237 611 Taxes and subsidies products 474 272 488 471 127 947 112 286 122 040 121 010 133 135 1Figures from 2024 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. At constant 2023-prices. NOK millionDownload table as ...Final expenditure and gross domestic product. Quarter and year. At constant 2023-prices. NOK million1

2024 2025 4th quarter 2024 1st quarter 2025 2nd quarter 2025 3rd quarter 2025 4th quarter 2025 Final consumption expenditure of households and NPISHs 2 139 469 2 197 534 563 473 522 678 550 830 536 831 587 196 ¬ Household final consumption expenditure 2 015 499 2 070 629 531 728 491 657 518 762 505 327 554 883 ¬¬ Goods 815 727 859 743 225 672 192 667 215 662 206 641 244 773 ¬¬ Services 1 115 390 1 135 019 283 120 281 691 282 230 283 778 287 320 ¬¬ Direct purchases abroad by resident households 163 045 168 547 37 443 33 830 43 740 52 599 38 378 ¬¬ Direct purchases by non-residents -78 664 -92 680 -14 508 -16 532 -22 870 -37 691 -15 588 ¬ Final consumption expenditure of NPISHs 123 970 126 905 31 745 31 021 32 067 31 504 32 312 Final consumption expenditure of general governmen 1 143 588 1 160 805 288 796 287 307 289 959 290 435 293 104 ¬ Final consumption expenditure of central government 586 273 602 688 148 783 149 062 150 156 150 096 153 375 ¬¬¬ Central government, civilian 509 876 517 682 128 891 128 608 129 203 128 575 131 295 ¬¬¬ Central government, defence 76 397 85 007 19 892 20 454 20 952 21 521 22 079 ¬ Final consumption expenditure of local government 557 315 558 117 140 013 138 245 139 804 140 339 139 729 Gross fixed capital formation (GFCF) 1 180 549 1 195 826 330 034 269 931 293 001 287 765 345 130 ¬ Extraction and transport via pipelines (GFCF) 244 283 264 206 65 422 58 049 66 768 67 375 72 014 ¬ Ocean transport (GFCF) 8 913 2 504 5 195 498 670 648 688 ¬ Mainland Norway (GFCF) 927 354 929 115 259 418 211 383 225 563 219 742 272 428 ¬¬¬ Industries (GFCF) 456 578 465 363 123 391 110 092 115 729 110 151 129 391 ¬¬¬¬ Services activities incidential to extraction (GFCF) 10 059 8 782 2 686 1 666 1 663 2 490 2 963 ¬¬¬¬ Other services (GFCF) 304 140 305 340 81 767 75 708 75 396 71 696 82 540 ¬¬¬¬ Manufacturing and mining (GFCF) 70 178 71 717 20 328 15 191 17 218 17 190 22 118 ¬¬¬¬ Production of other goods (GFCF) 72 201 79 523 18 610 17 526 21 452 18 775 21 769 ¬¬¬ Dwelling service (households) (GFCF) 199 750 192 610 48 312 48 634 47 640 47 260 49 075 ¬¬¬ General government (GFCF) 271 026 271 143 87 715 52 657 62 194 62 330 93 963 Acquisitions less disposals of valuables 287 294 74 72 75 71 76 Changes in stocks and statistical discrepancies 38 878 -11 020 -10 995 50 282 -10 991 5 658 -55 969 Gross capital formation 1 219 713 1 185 100 319 113 320 285 282 085 293 494 289 236 Final domestic use of goods and services 4 502 770 4 543 439 1 171 382 1 130 269 1 122 874 1 120 760 1 169 535 Final demand from Mainland Norway (excl. changes in stocks) 4 210 410 4 287 454 1 111 686 1 021 367 1 066 352 1 047 008 1 152 728 Final demand from general government 1 414 614 1 431 947 376 510 339 963 352 153 352 765 387 066 Total exports 2 604 461 2 666 733 669 376 637 510 640 391 674 026 714 806 ¬ Traditional goods (export) 680 841 724 627 185 029 168 816 173 245 188 660 193 906 ¬ Crude oil and natural gas (export) 1 285 928 1 296 614 319 587 314 392 311 440 312 784 357 998 ¬ Ships, oil platforms and aircraft (export) 11 856 14 000 3 649 5 426 2 774 2 547 3 253 ¬ Services (export) 625 837 631 491 161 110 148 876 152 932 170 035 159 649 Total use of goods and services 7 107 232 7 210 171 1 840 758 1 767 779 1 763 265 1 794 786 1 884 342 Total imports 1 726 823 1 771 371 448 451 414 535 441 961 453 130 461 746 ¬ Traditional goods (import) 1 028 156 1 064 143 264 410 251 679 267 702 262 120 282 643 ¬ Crude oil and natural gas (import) 22 773 25 874 5 050 6 302 5 159 7 690 6 724 ¬ Ships, oil platforms and aircraft (import) 38 382 20 238 16 983 6 180 6 294 4 439 3 325 ¬ Services (import) 637 512 661 116 162 008 150 375 162 806 178 881 169 054 Gross domestic product, market values 5 380 408 5 438 800 1 392 306 1 353 244 1 321 304 1 341 656 1 422 596 Gross domestic product Mainland Norway, market values 4 047 656 4 118 602 1 052 797 1 025 315 1 010 084 1 010 431 1 072 772 Petroleum activities and ocean transport 1 332 752 1 320 199 339 510 327 929 311 221 331 225 349 824 Gross domestic product Mainland Norway, basic values 3 596 297 3 659 130 932 632 918 119 895 533 898 205 947 274 ¬ Mainland Norway excluding general government (GDP) 2 743 711 2 795 919 717 786 703 977 679 361 682 651 729 931 ¬¬ Manufacturing and mining (GDP) 309 444 321 830 80 567 80 799 80 685 78 006 82 339 ¬¬ Production of other goods (GDP) 461 293 463 832 122 934 121 722 103 686 116 719 121 705 ¬¬ Service activities (GDP) 1 972 974 2 010 258 514 285 501 455 494 990 487 926 525 887 ¬ General government (GDP) 852 586 863 211 214 846 214 142 216 172 215 554 217 343 Taxes and subsidies products 451 359 459 471 120 165 107 196 114 551 112 226 125 498 1Figures from 2024 onwards are preliminary Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Percentage change in volume from the same period in the previous yearDownload table as ...Final expenditure and gross domestic product. Quarter and year. Percentage change in volume from the same period in the previous year1

2024 2025 4th quarter 2024 1st quarter 2025 2nd quarter 2025 3rd quarter 2025 4th quarter 2025 Final consumption expenditure of households and NPISHs 1.3 2.7 2.6 3.2 1.4 2.1 4.2 ¬ Household final consumption expenditure 1.3 2.7 2.8 3.2 1.3 2.1 4.4 ¬¬ Goods 1.1 5.4 2.8 3.7 3.6 5.3 8.5 ¬¬ Services 1.3 1.8 2.7 3.1 0.9 1.6 1.5 ¬¬ Direct purchases abroad by resident households 8.1 3.4 13.3 6.6 3.0 2.4 2.5 ¬¬ Direct purchases by non-residents 13.7 17.8 31.5 16.1 25.2 19.1 7.4 ¬ Final consumption expenditure of NPISHs 1.6 2.4 0.0 3.1 2.5 2.1 1.8 Final consumption expenditure of general governmen 1.7 1.5 0.7 1.7 1.6 1.2 1.5 ¬ Final consumption expenditure of central government 2.8 2.8 1.0 2.8 2.8 2.5 3.1 ¬¬¬ Central government, civilian 2.1 1.5 -0.2 1.6 1.4 1.2 1.9 ¬¬¬ Central government, defence 8.1 11.3 10.3 10.5 12.0 11.5 11.0 ¬ Final consumption expenditure of local government 0.7 0.1 0.3 0.5 0.4 -0.1 -0.2 Gross fixed capital formation (GFCF) -1.4 1.3 2.0 2.1 0.6 -2.4 4.6 ¬ Extraction and transport via pipelines (GFCF) 4.8 8.2 0.8 5.2 8.8 8.1 10.1 ¬ Ocean transport (GFCF) -58.3 -71.9 399.8 152.3 -17.7 -76.1 -86.8 ¬ Mainland Norway (GFCF) -1.7 0.2 0.6 1.1 -1.5 -4.4 5.0 ¬¬ Industries (GFCF) 0.7 1.9 3.4 5.0 -1.0 -1.2 4.9 ¬¬¬ Services activities incidential to extraction (GFCF) 140.8 -12.7 118.7 -10.8 -24.0 -24.9 10.3 ¬¬¬ Other services (GFCF) 1.1 0.4 8.5 6.1 -2.6 -2.6 0.9 ¬¬¬ Manufacturing and mining (GFCF) -1.0 2.2 -4.1 -7.4 -0.4 6.3 8.8 ¬¬¬ Production of other goods (GFCF) -6.9 10.1 -13.8 14.6 7.4 2.4 17.0 ¬¬ Dwelling service (households) (GFCF) -12.2 -3.6 -8.6 -4.7 -6.6 -4.3 1.6 ¬¬ General government (GFCF) 3.3 0.0 2.5 -0.9 1.5 -9.5 7.1 Acquisitions less disposals of valuables 2.8 2.5 2.3 2.8 2.9 2.0 2.3 Changes in stocks and statistical discrepancies -28.5 .. .. 14.5 .. -67.5 .. Gross capital formation -2.6 -2.8 -3.0 3.8 0.8 -6.0 -9.4 Final domestic use of goods and services 0.3 0.9 0.6 3.0 1.3 -0.4 -0.2 Final demand from Mainland Norway (excl. changes in stocks) 0.8 1.8 1.6 2.3 0.8 0.4 3.7 Final demand from general government 2.0 1.2 1.1 1.3 1.6 -0.9 2.8 Total exports 5.8 2.4 4.3 0.9 -3.3 5.1 6.8 ¬ Traditional goods (export) 3.4 6.4 5.2 6.5 4.7 9.8 4.8 ¬ Crude oil and natural gas (export) 4.9 0.8 -2.5 -4.4 -8.0 4.7 12.0 ¬ Ships, oil platforms and aircraft (export) 30.4 18.1 257.1 70.1 -4.1 19.9 -10.9 ¬ Services (export) 10.2 0.9 17.5 5.6 -1.4 0.9 -0.9 Total use of goods and services 2.3 1.4 1.9 2.2 -0.4 1.6 2.4 Total imports 5.0 2.6 8.0 6.9 0.8 0.2 3.0 ¬ Traditional goods (import) 3.3 3.5 5.5 7.7 -0.7 0.6 6.9 ¬ Crude oil and natural gas (import) -13.9 13.6 -21.6 26.0 18.8 -8.2 33.2 ¬ Ships, oil platforms and aircraft (import) 21.0 -47.3 128.4 13.4 -1.4 -53.6 -80.4 ¬ Services (import) 7.9 3.7 7.4 4.8 3.0 2.8 4.3 Gross domestic product, market values2 1.4 1.1 0.1 0.9 -0.8 2.1 2.2 Gross domestic product Mainland Norway, market values2 0.6 1.8 0.9 3.1 0.7 1.4 1.9 Petroleum activities and ocean transport3 3.9 -0.9 -2.4 -5.6 -5.3 4.4 3.0 Gross domestic product Mainland Norway, basic values 0.8 1.7 0.9 3.3 0.6 1.5 1.6 ¬ Mainland Norway excluding general government (GDP) 0.4 1.9 0.8 3.9 0.4 1.6 1.7 ¬¬ Manufacturing and mining (GDP) 0.9 4.0 2.4 6.7 3.8 3.4 2.2 ¬¬ Production of other goods (GDP) -1.6 0.6 -1.7 3.3 0.4 -0.5 -1.0 ¬¬ Service activities (GDP) 0.9 1.9 1.2 3.6 -0.1 1.9 2.3 ¬ General government (GDP) 1.9 1.2 1.1 1.6 1.3 0.9 1.2 Taxes and subsidies products -0.3 1.8 0.8 1.3 0.7 0.6 4.4 1Figures from 2024 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Percentage change in prices from the same period in the previous yearDownload table as ...Final expenditure and gross domestic product. Quarter and year. Percentage change in prices from the same period in the previous year1

2024 2025 4th quarter 2024 1st quarter 2025 2nd quarter 2025 3rd quarter 2025 4th quarter 2025 Final consumption expenditure of households and NPISHs 3.4 3.3 2.2 3.2 3.2 3.5 3.2 ¬ Household final consumption expenditure 3.4 3.3 2.3 3.2 3.2 3.5 3.3 ¬¬ Goods 1.9 2.7 1.1 2.1 2.1 3.5 3.2 ¬¬ Services 4.4 3.8 3.6 3.7 3.9 3.7 3.6 ¬¬ Direct purchases abroad by resident households 4.4 3.2 -0.3 4.8 3.8 2.8 2.0 ¬¬ Direct purchases by non-residents 3.7 3.1 2.8 3.4 2.0 3.5 3.4 ¬ Final consumption expenditure of NPISHs 3.2 2.7 1.1 3.7 3.0 2.8 1.4 Final consumption expenditure of general governmen 3.8 3.3 2.7 3.4 3.6 3.5 2.9 ¬ Final consumption expenditure of central government 3.8 3.6 3.1 3.3 4.1 3.9 3.0 ¬¬¬ Central government, civilian 3.8 3.5 3.3 3.4 4.1 4.1 2.6 ¬¬¬ Central government, defence 4.0 3.9 1.4 2.8 3.9 3.3 5.3 ¬ Final consumption expenditure of local government 3.8 3.1 2.2 3.5 3.1 3.1 2.7 Gross fixed capital formation (GFCF) 4.6 3.1 3.6 4.4 3.3 3.1 1.9 ¬ Extraction and transport via pipelines (GFCF) 6.2 1.1 4.9 4.4 2.5 0.7 -2.6 ¬ Ocean transport (GFCF) 5.5 6.8 -62.7 5.1 2.3 7.4 13.4 ¬ Mainland Norway (GFCF) 4.2 3.7 4.0 4.3 3.5 3.8 3.2 ¬¬ Industries (GFCF) 4.4 3.2 4.8 4.1 2.6 3.3 2.8 ¬¬¬ Services activities incidential to extraction (GFCF) 4.9 2.9 -7.3 4.1 3.2 2.7 1.8 ¬¬¬ Other services (GFCF) 4.3 3.2 4.6 4.2 2.7 3.4 2.8 ¬¬¬ Manufacturing and mining (GFCF) 4.4 3.2 6.1 3.8 2.9 3.1 2.8 ¬¬¬ Production of other goods (GFCF) 4.4 3.0 4.9 4.3 2.3 3.0 2.7 ¬¬ Dwelling service (households) (GFCF) 3.8 4.4 4.1 4.4 4.4 4.6 4.1 ¬¬ General government (GFCF) 4.3 4.0 2.8 4.7 4.2 4.0 3.2 Acquisitions less disposals of valuables 8.4 3.4 6.4 3.6 3.1 3.4 3.5 Changes in stocks and statistical discrepancies -1.6 -12.6 -29.8 5.3 -39.3 -48.2 -6.7 Gross capital formation 4.4 3.5 2.6 4.4 4.9 1.8 3.1 Final domestic use of goods and services 3.8 3.3 2.4 3.6 3.7 3.0 3.0 Final demand from Mainland Norway (excl. changes in stocks) 3.7 3.4 2.7 3.5 3.4 3.5 3.1 Final demand from general government 3.9 3.5 2.7 3.6 3.7 3.6 3.0 Total exports -4.2 -2.1 -0.3 14.8 -3.6 -4.8 -12.2 ¬ Traditional goods (export) -1.3 1.3 1.4 5.0 -2.3 0.6 2.3 ¬ Crude oil and natural gas (export) -9.1 -6.7 -0.7 26.3 -8.7 -12.6 -26.0 ¬ Ships, oil platforms and aircraft (export) 2.2 7.7 -17.4 19.2 2.6 11.3 -1.4 ¬ Services (export) 2.8 2.3 -1.7 3.4 2.6 2.2 1.0 Total use of goods and services 0.9 1.4 1.4 7.4 1.3 0.1 -2.7 Total imports 3.5 1.4 3.0 3.8 1.2 1.4 -0.5 ¬ Traditional goods (import) 0.9 1.1 0.8 3.8 0.0 0.9 -0.1 ¬ Crude oil and natural gas (import) -8.9 -12.3 -14.0 -2.6 -14.4 -17.8 -12.4 ¬ Ships, oil platforms and aircraft (import) 7.2 8.4 9.6 17.5 3.1 4.3 21.5 ¬ Services (import) 7.9 2.2 6.5 3.8 3.2 2.5 -0.3 Gross domestic product, market values2 0.0 1.4 0.9 8.5 1.3 -0.3 -3.4 Gross domestic product Mainland Norway, market values2 3.6 3.2 2.6 3.5 3.1 3.2 2.9 Petroleum activities and ocean transport3 -10.7 -5.3 -4.4 26.1 -6.5 -12.0 -23.9 Gross domestic product Mainland Norway, basic values 3.4 3.4 2.6 3.7 3.4 3.3 3.4 ¬ Mainland Norway excluding general government (GDP) 2.9 3.2 2.5 3.6 3.0 3.0 3.3 ¬¬ Manufacturing and mining (GDP) 2.6 4.2 3.4 6.5 7.5 -1.9 4.9 ¬¬ Production of other goods (GDP) -3.1 4.3 -2.7 1.0 -1.4 7.8 9.3 ¬¬ Service activities (GDP) 4.4 2.8 3.5 3.9 3.2 2.7 1.7 ¬ General government (GDP) 4.8 4.1 2.9 4.0 4.4 4.3 3.6 Taxes and subsidies products 5.1 1.2 3.1 1.8 0.9 2.5 -0.4 1Figures from 2024 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. At current prices. NOK millionDownload table as ...Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. At current prices. NOK million1

2024 2025 4th quarter 2024 1st quarter 2025 2nd quarter 2025 3rd quarter 2025 4th quarter 2025 Final consumption expenditure of households and NPISHs 2 212 165 2 346 388 561 290 574 985 580 276 593 007 601 409 ¬ Household final consumption expenditure 2 084 291 2 211 965 528 587 542 215 546 467 558 299 567 644 ¬¬ Goods 831 627 900 482 210 184 218 323 221 588 227 513 233 781 ¬¬ Services 1 164 079 1 228 992 297 960 301 678 305 384 310 205 313 606 ¬¬ Direct purchases abroad by resident households 170 141 181 558 44 645 45 935 43 697 45 659 46 468 ¬¬ Direct purchases by non-residents -81 556 -99 067 -24 203 -23 721 -24 201 -25 079 -26 211 ¬ Final consumption expenditure of NPISHs 127 875 134 423 32 703 32 770 33 808 34 708 33 765 Final consumption expenditure of general governmen 1 187 108 1 245 266 301 759 306 737 310 254 313 225 314 960 ¬ Final consumption expenditure of central government 608 481 647 908 154 919 158 281 161 772 163 250 164 405 ¬¬¬ Central government, civilian 529 055 556 112 134 245 136 633 139 084 140 001 140 245 ¬¬¬ Central government, defence 79 426 91 796 20 673 21 648 22 688 23 249 24 159 ¬ Final consumption expenditure of local government 578 627 597 358 146 841 148 455 148 482 149 975 150 556 Gross fixed capital formation (GFCF) 1 235 211 1 289 959 321 445 306 945 320 291 318 556 343 786 ¬ Extraction and transport via pipelines (GFCF) 259 345 283 444 68 594 64 791 73 723 71 338 73 550 ¬ Ocean transport (GFCF) 9 405 2 823 5 632 547 734 693 849 ¬ Mainland Norway (GFCF) 966 461 1 003 692 247 218 241 608 245 835 246 524 269 387 ¬¬ Industries (GFCF) 476 461 501 040 123 185 122 242 122 257 123 462 132 968 ¬¬¬ Services activities incidential to extraction (GFCF) 10 556 9 482 2 640 2 004 1 942 2 548 2 968 ¬¬¬ Other services (GFCF) 317 271 328 790 83 725 81 571 79 886 80 511 86 752 ¬¬¬ Manufacturing and mining (GFCF) 73 244 77 218 18 460 17 636 18 779 19 837 20 930 ¬¬¬ Production of other goods (GFCF) 75 391 85 551 18 360 21 031 21 650 20 565 22 317 ¬¬ Dwelling service (households) (GFCF) 207 290 208 648 50 685 50 928 51 876 52 220 53 625 ¬¬ General government (GFCF) 282 709 294 004 73 349 68 438 71 701 70 843 82 794 Acquisitions less disposals of valuables 311 329 77 80 82 85 83 Changes in stocks and statistical discrepancies 38 275 -9 479 6 769 13 522 8 791 1 845 -28 350 Gross capital formation 1 273 797 1 280 810 328 291 320 548 329 165 320 486 315 518 Final domestic use of goods and services 4 673 070 4 872 464 1 191 341 1 202 270 1 219 694 1 226 718 1 231 887 Final demand from Mainland Norway (excl. changes in stocks) 4 365 734 4 595 346 1 110 267 1 123 329 1 136 365 1 152 757 1 185 756 Final demand from general government 1 469 818 1 539 270 375 108 375 174 381 955 384 068 397 754 Total exports 2 496 349 2 503 520 638 989 679 560 620 535 609 378 596 165 ¬ Traditional goods (export) 671 680 724 461 174 983 178 190 174 178 184 240 187 864 ¬ Crude oil and natural gas (export) 1 169 314 1 099 907 290 758 327 958 280 685 257 911 235 337 ¬ Ships, oil platforms and aircraft (export) 12 115 15 407 3 740 5 997 3 109 3 014 3 287 ¬ Services (export) 643 240 663 746 169 509 167 415 162 563 164 212 169 677 Total use of goods and services 7 169 419 7 375 984 1 830 330 1 881 830 1 840 229 1 836 096 1 828 052 Total imports 1 786 978 1 858 337 465 448 461 887 456 790 462 696 477 256 ¬ Traditional goods (import) 1 036 982 1 084 743 263 137 268 955 265 779 268 776 281 662 ¬ Crude oil and natural gas (import) 20 744 20 679 4 513 5 357 5 028 4 690 5 328 ¬ Ships, oil platforms and aircraft (import) 41 163 23 537 18 972 7 205 7 062 4 759 4 511 ¬ Services (import) 688 089 729 378 178 826 180 371 178 921 184 471 185 755 Gross domestic product, market values 5 382 441 5 517 648 1 364 882 1 419 943 1 383 439 1 373 400 1 350 796 Gross domestic product Mainland Norway, market values 4 191 794 4 400 438 1 064 711 1 086 774 1 098 657 1 105 834 1 114 678 Petroleum activities and ocean transport2 1 190 647 1 117 209 300 171 333 169 284 782 267 565 236 118 Gross domestic product Mainland Norway, basic values 3 717 522 3 911 968 944 268 966 217 977 877 982 973 990 025 ¬ Mainland Norway excluding general government (GDP) 2 823 977 2 970 602 716 517 734 862 743 640 745 884 751 430 ¬¬ Manufacturing and mining (GDP) 317 339 343 870 81 444 85 011 90 023 84 654 87 314 ¬¬ Production of other goods (GDP) 446 790 468 495 109 950 117 548 114 605 117 991 117 867 ¬¬ Service activities (GDP) 2 059 848 2 158 238 525 124 532 302 539 011 543 239 546 250 ¬ General government (GDP) 893 544 941 365 227 751 231 355 234 237 237 089 238 594 Taxes and subsidies products 474 272 488 471 120 443 120 557 120 780 122 861 124 653 1Figures from 2024 onwards are prelimanry 2Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ... - Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. Percentage change in volume from the previous period.Download table as ...Final expenditure and gross domestic product. Quarter and year. Seasonally adjusted figures. Percentage change in volume from the previous period.1

2024 2025 4th quarter 2024 1st quarter 2025 2nd quarter 2025 3rd quarter 2025 4th quarter 2025 Final consumption expenditure of households and NPISHs 1.3 2.7 -0.2 0.9 0.6 1.3 1.0 ¬ Household final consumption expenditure 1.3 2.7 0.1 1.0 0.4 1.1 1.4 ¬¬ Goods 1.1 5.4 0.8 1.8 1.7 1.3 2.7 ¬¬ Services 1.3 1.8 0.5 0.2 0.2 0.6 0.5 ¬¬ Direct purchases abroad by resident households 8.1 3.4 2.8 0.0 -4.0 3.8 2.3 ¬¬ Direct purchases by non-residents 13.7 17.8 17.9 -3.0 1.6 2.6 3.7 ¬ Final consumption expenditure of NPISHs 1.6 2.4 -5.5 -0.2 2.7 4.8 -5.1 Final consumption expenditure of general governmen 1.7 1.5 0.0 0.7 0.4 0.1 0.4 ¬ Final consumption expenditure of central government 2.8 2.8 0.1 1.3 0.7 0.4 0.7 ¬¬¬ Central government, civilian 2.1 1.5 -0.3 1.1 0.3 0.1 0.4 ¬¬¬ Central government, defence 8.1 11.3 2.9 2.5 3.3 2.3 2.4 ¬ Final consumption expenditure of local government 0.7 0.1 0.0 0.0 0.1 -0.3 0.0 Gross fixed capital formation (GFCF) -1.4 1.3 0.2 -5.4 3.1 0.1 7.2 ¬ Extraction and transport via pipelines (GFCF) 4.8 8.2 2.2 -5.7 12.9 -0.4 3.9 ¬ Ocean transport (GFCF) -58.3 -71.9 92.3 -90.2 30.5 -2.3 6.9 ¬ Mainland Norway (GFCF) -1.7 0.2 -1.4 -3.4 0.5 0.2 8.2 ¬¬ Industries (GFCF) 0.7 1.9 1.1 -2.1 -1.1 1.4 6.7 ¬¬¬ Services activities incidential to extraction (GFCF) 140.8 -12.7 -22.5 -25.8 -2.7 30.4 16.8 ¬¬¬ Other services (GFCF) 1.1 0.4 3.7 -4.2 -3.1 1.6 6.7 ¬¬¬ Manufacturing and mining (GFCF) -1.0 2.2 1.7 -5.9 4.4 6.1 5.2 ¬¬¬ Production of other goods (GFCF) -6.9 10.1 -6.4 14.9 1.7 -5.6 7.3 ¬¬ Dwelling service (households) (GFCF) -12.2 -3.6 -4.0 -0.9 0.4 0.1 2.0 ¬¬ General government (GFCF) 3.3 0.0 -3.6 -7.4 3.4 -1.7 15.2 Acquisitions less disposals of valuables 2.8 2.5 -4.3 14.4 -2.9 -3.4 -0.4 Changes in stocks and statistical discrepancies -28.5 .. -85.0 769.1 -29.7 -83.5 .. Gross capital formation -2.6 -2.8 -3.5 -0.2 1.2 -3.3 -6.8 Final domestic use of goods and services 0.3 0.9 -1.1 0.6 0.7 -0.3 -1.2 Final demand from Mainland Norway (excl. changes in stocks) 0.8 1.8 -0.4 -0.1 0.5 0.7 2.4 Final demand from general government 2.0 1.2 -0.7 -0.9 0.9 -0.2 3.1 Total exports 5.8 2.4 1.8 -1.4 0.6 3.8 3.6 ¬ Traditional goods (export) 3.4 6.4 4.0 -0.3 1.8 4.1 -0.6 ¬ Crude oil and natural gas (export) 4.9 0.8 -1.5 -1.8 3.4 4.5 5.7 ¬ Ships, oil platforms and aircraft (export) 30.4 18.1 71.9 48.7 -48.9 -8.2 27.7 ¬ Services (export) 10.2 0.9 5.1 -3.2 -4.2 2.3 3.9 Total use of goods and services 2.3 1.4 0.0 -0.2 0.7 1.2 0.6 Total imports 5.0 2.6 0.7 -1.4 -0.3 1.1 3.6 ¬ Traditional goods (import) 3.3 3.5 -1.5 1.3 0.5 0.4 4.8 ¬ Crude oil and natural gas (import) -13.9 13.6 -23.1 18.6 -0.1 -3.7 16.4 ¬ Ships, oil platforms and aircraft (import) 21.0 -47.3 77.6 -63.6 1.9 -29.5 -25.1 ¬ Services (import) 7.9 3.7 0.7 0.2 -1.5 3.6 1.9 Gross domestic product, market values2 1.4 1.1 -0.3 0.2 1.0 1.3 -0.3 Gross domestic product Mainland Norway, market values2 0.6 1.8 -0.2 0.8 0.5 0.1 0.4 Petroleum activities and ocean transport3 3.9 -0.9 -0.5 -1.7 2.4 5.0 -2.6 Gross domestic product Mainland Norway, basic values 0.8 1.7 -0.1 0.8 0.5 0.1 0.2 ¬ Mainland Norway excluding general government (GDP) 0.4 1.9 -0.1 0.9 0.7 0.1 0.1 ¬¬ Manufacturing and mining (GDP) 0.9 4.0 0.1 1.1 2.5 -0.6 -0.7 ¬¬ Production of other goods (GDP) -1.6 0.6 -1.6 2.1 0.1 -1.3 -1.8 ¬¬ Service activities (GDP) 0.9 1.9 0.2 0.6 0.5 0.5 0.7 ¬ General government (GDP) 1.9 1.2 0.0 0.7 0.2 0.0 0.3 Taxes and subsidies products -0.3 1.8 -1.1 0.8 0.3 0.6 2.4 1Figures from 2024 onwards are prelimanry 2Gross domestic product is measured at market prices, while value added by industry is measured at basic prices. 3Includes oil and gas extraction, transport via pipelines and ocean transport. Explanation of symbolsDownload table as ...

Detailed tables:

About the statistics

The information under «About the statistics» was last updated 23 February 2023.

See Concepts and definitions in national accounts for explanations.

Valuation

Registration of values: A transaction may be registered at different values, depending on under which circumstances it is registered. Different concepts regarding valuation are also relevant for the general aspect of registration (cf. cash values or accruals values, and other principles for the recording of statistical data). The transactions of variables in the national accounts follow the accrual principle. Thus, taxes and subsidies on production should be registered as accrued values and not as cash values as recorded in the government accounts.

In the description of the transaction of goods and services several price concepts are used. Output is valued at basic prices. Basic price is the price the seller receives, after corresponding taxes on the product are deducted (and subsidies added). The use categories, both intermediate consumption and final use, are valued at purchaser prices, that is the price the purchaser must pay. Exports are valued at fob (free on board), while imports are valued at cif (cost-insurance-freight).

The value added of an industry is "valued" at basic prices (calculated as output at basic prices less intermediate consumption at purchaser prices). The total value added of all the industries is also "valued" at basic prices.

GDP is "valued" at market prices, which means that taxes on products, including VAT, less subsidies on products are added to the total value added of the industries at basic prices.

The accounting system of the Norwegian national accounts is based on the international standards for national accounts, i.e. 2008 SNA and ESA 2010. The accounting system outlines the framework and contents for production of national accounts statistics. The level of detail in the classifications used for compilation of quarterly and preliminary annual national accounts are more aggregated than in that used for calculation of the annual national accounts.

In addition to accounting structure, the international standards give recommendations of groupings or classifications to be used in the national accounts:

Activity classification

The classification of Industries in the National Accounts follows the Norwegian Standard Industrial Classification (SN2007), which is based on NACE Rev.2. Several levels of aggregation have been introduced for publication and reporting purposes.

Classification of non-financial assets and gross fixed capital formation

Non-financial assets are classified by type of aggregates defined in 2008 SNA, such as fixed assets, inventories, valuables, and non-produced assets, including both tangible assets such as land, subsoil-assets, water resources etc., and intangible assets such as transferable contracts etc. Gross fixed capital formation is grouped by main type within building and construction, machinery and equipment and transportation equipment.

Product classification

The product classification used in the national accounts is based on the EU's standard product classification CPA - Statistical Classification of Products by Activity in the European Community. The CPA groups products by activities, i.e. it defines characteristic products within each activity and connects them to the activity classification NACE Rev.2. The annual accounts supply and use tables contain about 700 products, in addition to which some products are also incorporated purely for technical reasons. The system to elaborate preliminary annual and quarterly accounts contains about 90 products. The separation on products might to large extent be considered as a tool to balance the national account system and to undertake calculations in constants prices.

Classification of individual consumption by purpose

The classification of Consumption expenditure groups in the National Accounts is based on the international classification COICOP - Classification of Individual Consumption by Purpose, published by the UN.

Classification of the functions of government

The classification of the functions of government by purpose applies to all types of general government expenses, such as government final consumption expenditure, gross fixed capital formation, subsidies, property rents (i.e. expenses), capital transfers and other transfers for use in government financial accounts and in the national accounts. This classification is based on the international classification COFOG - Classification of the Functions of Government, published by the UN.

Classification of the purpose of non-profit institutions serving households (NPISH)

This is a minor purpose classification which applies to expenses of NPISHs. It is based on the international classification COPNI - Classification of the Purposes of the Non-Profit Institutions Serving Households, published by the UN.

Name: National accounts

Topic: National accounts and business cycles

Division for National Accounts

National level

The monthly national accounts (MNA) are published about 40 days after the end of the given month.

The quarterly national accounts (QNA) are published about 40 days after the end of the given quarter. Quarterly figures are calculated as the sum of three months (from monthly national accounts).

The first estimates of the preliminary year is published about 40 days after the end of the year.

Published figures are reported to Eurostat, the International Monetary Fund (IMF) and the Organisation for Economic Co-operation and Development (OECD).

Not relevant

The national accounts (NA) statistics are designed to provide a consistent and comprehensive survey of the overall national economy. The national accounts give both a summarised description of the economy as a whole and a detailed description of transactions between different parts of the Norwegian economy, and between Norway and the rest of the world. The national accounts also provide information on capital stocks and employment.

The first Norwegian national accounts based on modern principles were published by Statistics Norway in 1952. Annual series national accounts were calculated back to 1865 during the 1950th.

Final annual national accounts figures are based on all available final economic statistics and therefore take time to produce. The purpose of the quarterly national accounts is to provide updated information about short-term developments in the Norwegian economy based on an overall, consistent accounting system. Statistics Norway has produced and released quarterly national accounts (QNA) on a regular basis from 1953 but were not published at fixed intervals from the 1970s to the beginning of the 1980s. A new model for a QNA system was developed at the beginning of the 1980s and has been used since 1985, with some modifications.

National accounts are used as a tool to compare the economic situation in different countries, and therefore it is important that the national accounts in various countries are based on a common template. Staff involved in elaborating national accounts in Statistics Norway participated actively in developing international recommendations and concepts regarding national accounts. The first international standard for national accounts, 1953 System of National Accounts (1953 SNA), was published by UN in 1953.

From time to time adaptations or changes are made to the common international recommendations for national accounts. This requires corresponding changes in the construction of the Norwegian national accounts. At different time intervals, new source statistics are produced and indicate that parts of the national accounts figures need to be revised. Since one objective of the national accounts is to provide a picture of the development over time which is as correct as possible, it is not possible to introduce such changes from one year to another. With different time intervals, it will therefore be necessary to carry out major revisions of the national accounts figures, so-called main revisions, in order to introduce adaptations due to new international recommendations or introduce new levels based on new statistical sources. As part of these main revisions the time series are also revised so that the revised national accounts can give a consistent picture of the economic development over time.

In recent decades, Statistics Norway has carried out main revisions published in 1995, 2002, 2006, 2011 and 2014. The main purpose of main revision published in November 2014, was to incorporate updated international recommendations in 2008 SNA andESA 2010. Changes due to this main revision are described, among else, in the article Main revision 2014. Planned changes in the national accounts statistics. The publication History of national accounts in Norway. From free research to statistics regulated by law also provides more information about the history of national accounts in Norway, including main revisions. In the future main revisions of the national accounts normally will be carried out every five years.

Since the QNA are completely harmonised with the annual national accounts, it is also necessary to revise the QNA figures once the annual national accounts figures have been revised.

The quarterly figures are mostly used for observation and analysis of the current economic cycle. The QNA figures also serve as a basis for making forecasts of the future economic development, the government’s work with the national budget and other economic planning. In addition, the QNA contribute with material for research and development. Annual and quarterly national accounts are a useful tool for analyses of the economic development and structures in Norway. The national accounts are also used to compare the economy in different countries.

The annual and quarterly national accounts therefore have a wide group of users, from school pupils and students to public and private institutions that actively use the statistics in their analyses and investigation of economic structure and development. Active users include the Research Department in Statistics Norway, the Ministry of Finance, Norges Bank, international organisations such as the IMF, the OECD, the World Bank, the UN and Eurostat, resident and non-resident financial sector analysts, and the media.

No external users have access to the statistics and analyses before they are published and accessible simultaneously for all users on ssb.no at 08.00 am. Prior to this, a minimum of three months' advance notice is given in the Statistics Release Calendar. This is one of Statistics Norway’s key principles for ensuring that all users are treated equally.

The monthly figures are the basis for quarterly figures, quarterly figures are calculated as the sum of three months. Quarterly figures will be updated when publishing the third month in the quarter. This means that there may be deviations between the monthly and quarterly figures in the two months before the new quarter is calculated. The deviations will mainly apply to seasonally adjusted figures. In addition, the monthly publication includes a table showing rolling numbers for three and three months. The three-month growth is calculated by comparing a three-month period with the previous three-month period. For example, the volume change in the rolling table for July is given by comparing the period May-July with February-April. Figures for March, June, September and December will correspond to growth for a quarter.

All historical figures are consistent with both preliminary and final annual national accounts figures in fixed and current prices

The Norwegian Balance of Payments (BOP) is an integrated part of the Norwegian system of national accounts, and the BOP figures are fully consistent with other preliminary and final quarterly and annual national accounts figures. Furthermore, quarterly and annual national accounts figures are fully consistent and compatible with the institutional sector accounts. The regional national accounts, and various satellite accounts (environment, tourism, health, non-profit institutions, education) are consistent with the above mentioned national accounts statistics. Previous published figures from the regional accounts and various satellite accounts are, however, not revised as a part of main revision of the national accounts, so figures for previous years may not necessarily be compatible with updated NA time series.

As mentioned in the chapter "Production: Data sources and sampling", the national accounts are based on various statistical sources. The source statistics may not use the same definitions or groupings as used in the national accounts. As a result, figures in the source statistics may be adapted or corrected before being used in the national accounts. Published figures in the source statistics of certain industries may therefore not correspond to published figures in the national accounts.

Not relevant

Regulation (EU) No 549/2013 (ESA 2010).

The European Parliament and of the council of 21 May 2013 on the European system of national and regional accounts in the European Union (text with EEA relevance).

The coverage of the national accounts is defined by international guidelines in the 2008 System of National Accounts (2008 SNA), published by the UN, the OECD, the IMF, the World Bank, and the Commission of the European Communities, and theEuropean System of National and Regional Accounts (ESA 2010).

The total national economy, and the distinction between the national economy and foreign countries, is defined in terms of resident units. A unit is defined as a resident unit of the country when it has a centre of economic interest in the economic territory of the country - i.e. when it is involved in economic activities on this territory for an extended period of time (one year or more).

Two basic types of information are recorded in the national accounts: flows and stocks. Flows refer to actions and effects of events that take place within a given period of time, for example the output of an industry in one year. Stocks refer to positions at a certain point of time, for example the value of capital stock or the number of employed persons.

The national accounts consist of two main sets of tables; supply and use tables (SUT), also described as the real accounts, and the institutional sector accounts. The real accounts are based on local kind-of-activity units (KAUs), while the institutional sector accounts are based on institutional units. Institutional units are economic entities that are capable of owning goods and assets, of incurring liabilities and of engaging in economic activities and transactions with other units in their own right. An institutional unit contains one or more local kind-of-activity units (local KAUs). The local KAUs are classified by type of activity. An activity is characterised by an input of products, a production process and an output of products. All local KAUs engaged in the same or similar kind-of-activity constitute an industry.

The SUT at current and constant prices gives a structured overview of the supply (output and import) and use (final consumption, gross fixed capital formation, changes in inventories, export and intermediate consumption) of products (goods and services) in the economy. For each industry the value added is calculated as the difference between output and intermediate consumption. The value added in an industry can also be decomposed into compensation of employees, consumption of fixed capital, other taxes on production (net of subsidies) and operating surplus. The real accounts also give information on fixed assets, as well as wages, hours worked, full-time equivalent persons and employed persons by industry. Monthly national accounts does not include figures for employment etc..

Furthermore, the real accounts provide the basis for the calculation of the Gross Domestic Product (GDP) and other central macroeconomic measures. The annual growth in volume and price are calculated for most variables.

The non-financial sector accounts are based on institutional units. Institutional units are capable of providing a full set of accounts. The non-financial sector accounts describe all economic transactions in the various sectors. The accounts also provide information on the stocks financial and non-financial capital. Financial sector accounts are also based on institutional units. The institutional units are grouped in institutional sectors on the basis of their principal economic functions, behavior and objectives. The non-financial sector accounts are consistent with the real accounts. The further description of the national accounts covers the part of the national accounts that is based on the annual SUT (the real accounts).

The coverage of the preliminary annual and quarterly real accounts is the same as the final annual SUT

The accounting structure in the system that produces monthly, quarterly and preliminary annual figures (MNA) is, however, more aggregated than in the system that produces the final annual SUT. While the SUT in the annual accounts consists of about 130 industry groups and 700 product groups, the SUT in the MNA consists of about 80 industry groups and 120 product groups. The MNA and QNA system produces tables with seasonal adjusted figures for industries' value added, household consumption for aggregated consumption groups and for central macroeconomic measures. However, only tables for final expenditure and gross domestic product are published on a monthly basis, while the QNA contain more details.

The calculations of the annual real accounts are based on statistics from several different sources, such as the structural business statistics for manufacturing and other industries, accounting statistics for general government and enterprises, statistics for wages and earnings, external trade statistics, household consumer surveys and employment statistics. Some parts of the national accounts are compiled more or less directly from the source statistics, while other parts are based on calculations and estimates.

Monthly information is used for compiling monthly national accounts, such as the production index of industrial production, the index for retail sales, consumer price index, building statistics, producer price indices and much more. For some service industries where we lack explicit production indicators, monthly information about jobs, working days and absence is obtained from the A-ordning. For investments where we only have quarterly information, such as oil investments, quarterly figures are conventionally distributed by month. In the months before we get the so-called oil census, the development is used in the planned investment figures reported together with those performed for a quarter. In connection with the work on the QNA, quarterly information is incorporated and an update of the previous months is made. Quarterly national accounts will appear as the sum of the three months in the quarter.

The source statistics used to calculate national accounts are with a few exceptions produced by Statistics Norway.

Having the reporting responsibility to Eurostat, the Division for National Accounts occasionally documents the calculations for the final annual national accounts, see Norwegian National Accounts - GNI Inventory for ESA95.

In addition, there are a number of reports giving more detailed documentation of calculation of figures for various specific industry groups or other parts of the national accounts (mostly in Norwegian only).

The documentation report for the Quarterly national accounts gives an overview of central sources and methods used for quarterly accounts compilation. This will be updated in the autumn of 2018 to include monthly national accounts.

Compilation of the final annual real accounts

The annual national accounts are mainly based on statistics collected by other divisions in Statistics Norway. To some extent data produced by external suppliers are also used.

The process of compiling the final annual national accounts starts with the calculation of independent supply and use estimates for all goods and services at current prices. To some extent, source data are extracted directly from the databases and converted into national accounts codes and format. Other parts of the economy are based on more complex calculations, by means of different statistical sources and/or assessments.

The source data are critically evaluated and compared with alternative sources (for some parts of the economy). In some areas, the statistics have to be adjusted in order to satisfy the requirements of the national accounts. In areas where the statistics are incomplete, evaluations are essential. In the process of estimating national accounts data, estimated national accounts figures are critically evaluated and controlled in several steps.

Finally, supply and use for each of these goods and services are balanced using supplementary information and quality assessments of the various statistical sources. This results in integrated supply and use tables at current prices.

The figure below gives an outline of the calculation system for final annual national accounts figures. First, detailed figures are calculated and balanced in current prices. Then the system calculates figures in constant prices, based on the detailed current price figures and corresponding price indices. The deflation (current values being divided by price indices) takes place at the most detailed product level: A price index is allocated to each detailed product. The individual products are as price homogeneous as possible. Constant price figures in the annual national accounts are calculated using the price level of the previous year, which means that the base year is changed every

year.

The deflation approach has in fact two dimensions, (i) differentiated by main categories of supply and use (deflating output, imports, exports and implicitly for domestic use), and (ii) differentiated through valuation (deflating current values at basic prices by price indices and implicitly determining the other value components, including adjustments against values at purchaser prices). The method used to calculate constant figures is called double deflation, i.e. a separate deflation of output and intermediate consumption is carried out in order to arrive at value added at constant prices as a balancing item, based on a detailed input-output framework (supply and use tables).

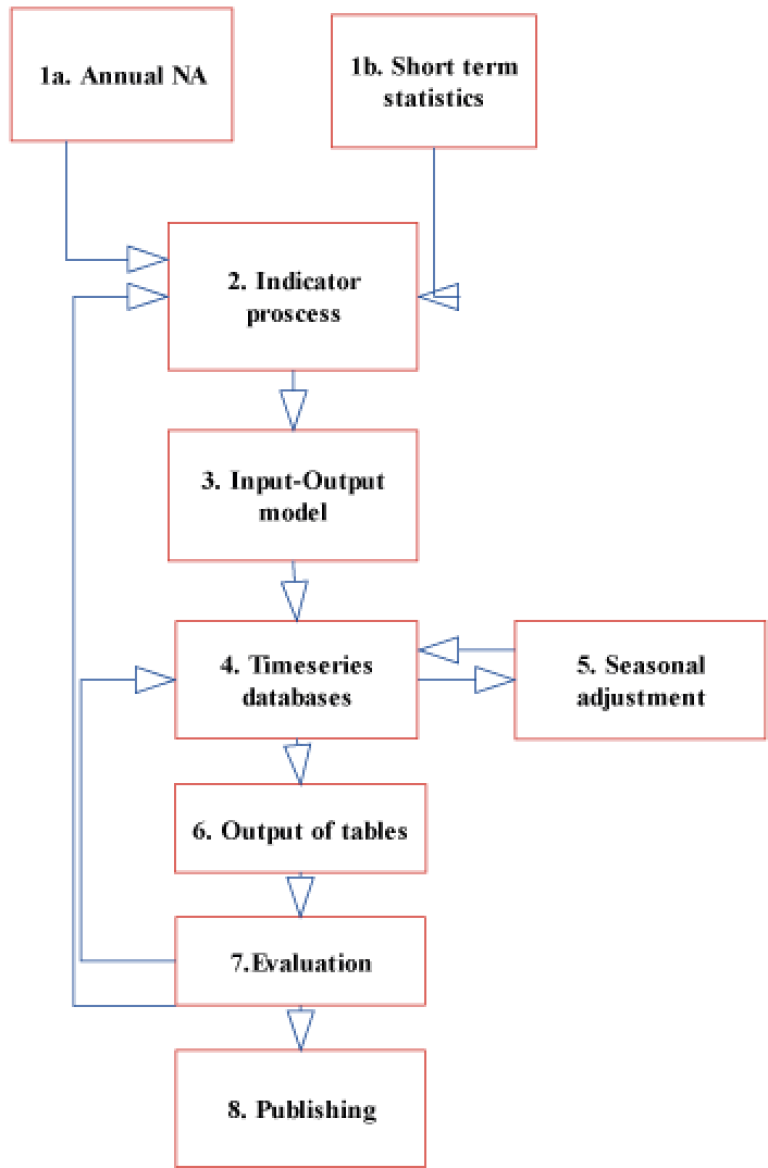

Figure 1. The calculation system for final annual NA figures (Click)

For a more detailed documentation, see Norwegian National Accounts - GNI Inventory for ESA95.

Compilation of the MNA and QNA

The majority of the short-term statistics produced by Statistics Norway are transferred to the MNA system by use of a direct link to the relevant databases. The information in the data sources about growth is used more or less directly in the MNA system. Some other input data series in the MNA system, however, are based more or less on calculations and estimations, using various types of information from Statistics Norway and other sources. Quarterly figures are calculated as the sum of three months

The national accounts data for a specific month, quarter or year are revised in accordance with an ordinary publication and revision cycle. The quarterly figures within a specific year t become final 21 months later after the end of the year t. In addition, periodical main revisions generate revised figures.

In the process of calculating MNA or QNA figures for a specific month or quarter, the short-term statistics source data are critically evaluated and compared with alternative sources (for some parts of the economy). In some cases, the information in the source statistics must be adjusted in order to satisfy the requirements of the quarterly national accounts. In the process to estimate MNA data estimated MNA figures are critically evaluated and controlled in many steps.

Monthly process

The figure below gives an overview of the Norwegian MNA and QNA estimation process. The figure shows that the MNA system is based on two main pillars: a) The SUT for the (final) annual national accounts and b) short-term statistics.

Figure 2. The computing system in the Norwegian MNA/QNA

The main principle in the MNA system is that the national accounts figures for the current quarter are computed based on the development of short-term indicators and the current-price figures from the base year. The base year (t-2) is the latest calculated final version of the annual national accounts. The method is the same for most common variables: The value in the base year is given the same growth rate (percentage change) as in the appropriate indicator, or a grouping of different relevant indicators.

A simple projection method, based on the development in previous periods, is used if an indicator does not cover the whole period from the base year to the current quarter.

The indicator compilations are made in the indicator process (box 2 in the figure).

However, the indicator process alone does not give a complete harmonised account at current and constant prices. To calculate values for variables that are not calculated in the indicator compilations, and to harmonise the accounts, we use an input-output model (box 3 in the figure).

The input-output model includes a commodity-flow balance, a price input-output system and a set of equations for summaries and definitions. It now comprises over 12 000 equations in total. The input-output coefficients are calculated from the SUT in the base year. The variables calculated in the indicator compilations are transferred to the input-output model as exogenous variables. To calculate balanced accounts at current prices we need price indices on all supply and use categories. These are computed in the model by weighting together product price indices with the input-output coefficients as weights. Each product gets three different price indices, one for resident output delivered to the home market (to resident users), a second for import and a third for export.

The price index for an industry’s total output is then calculated as a weighted average of the price indices for the home and export market using the input-output coefficients as weights. The price indices of intermediate consumption, final consumption expenditure and gross fixed capital formation are calculated in a similar way, using the import and home market price indices and the input-output coefficients.

The model also calculates variables which are not covered by short-term statistics or other information and therefore not calculated in the indicator process. These calculations are based on simple assumptions. For instance, intermediate consumption for most industries at constant prices (the total except FISIM) is assumed to be a fixed proportion of total output for the relevant industry. The distribution of intermediate consumption (except FISIM) on different products at constant prices is also assumed to be the same as in the base year. The industries’ use of FISIM as intermediate consumption is supposed to equal the growth in total output of FISIM services. Output in the retail and wholesale trade activities in constant prices is assumed to follow the development of the use of the various goods in constant prices, such as household consumption, intermediate consumption and gross fixed capital formation of the various specific goods (that means supposed fixed margins).

Changes in stock of separate products are (for most products) calculated as the difference between the total supply and use of the product. As in the annual NA, the changes in stock may be adjusted if that seems reasonable after an evaluation of the figures.

The results are stored in the time series database (box 4 in the figure), which, among other things, provides the basis for different sets of tables (box 6). At the moment there are two different sets of tables (with seasonal unadjusted figures), sets for internal checks and analyses of data and more aggregated sets of data for publishing.

Process 1-4 describes how the quarterly seasonally unadjusted figures are estimated. The unadjusted figures are seasonally adjusted (box 5) using a seasonal adjustment program.

The method adopted to compile the MNA is highly mechanical. This applies to the update of variables in the national accounts based on short-term statistics as well as the balancing of commodities, the computation of indirect taxes and factor incomes and the overall balancing of the GDP and main aggregates. Technically, the data systems are programmed in FAME and TROLL (the latter is used for the input-output model only).

Checks and/or the evaluation of data are, however, performed in several steps. The MNA system offers a unique opportunity to compare different types of input data. The evaluation of the different sources is done in close contact with the relevant statistics divisions in Statistics Norway. A more thorough evaluation is being done when processing and publishing quarterly figures, while the monthly process is more automated and less profound. Therefore, only final expenditure and gross domestic product are published on a monthly basis while the quarterly accounts offer more details.

Quarterly figures are calculated as the total of three months at quarterly releases. Quarterly figures will be updated only when publishing the third month in the quarter. This means that there may be a mismatch between the monthly and quarterly figures in the interim months. This applies mainly to seasonally adjusted numbers. That is, when you get a new observation (new month), it will normally affect the seasonally adjusted figures back in time. We do not update the QNA numbers that have also been sent to international organizations before the next quarters release. At the same time, we show figures for three-month growth. This is calculated by comparing a three-month period with the previous three-month period. For example, the volume change in July is given by comparing the period May-July with February-April. Figures for March, June, September and December will correspond to growth for a quarter. This means that users may get a continuous update of the quarterly figures by looking at the monthly publication.

Annual process and alignment

The MNA system is updated with a new base year every year (i.e. the latest final version of the annual accounts). The database for the annual accounts (box 1a), as well as the base data and coefficients in the harmonisation model (box 3) are updated. At the same time, it is possible to implement new indicators, carry out changes in the input series and in the model, etc. Such changes are not carried out in an ordinary monthly or quarterly process.

The recalculation of the monthly accounts is carried out by distributing the annual figures between the months using the original monthly figures as keys. The recalculated monthly accounts will then add up to the annual accounts at constant and current prices.

The harmonisation is based on the principle that the differences between the monthly changes to the original and harmonised series shall be as small as possible. The monthly accounts should add up to the figures in the annual accounts.

When the base year is updated the MNA for that year is aligned automatically.

Reference year

All figures are published at current prices and (for most sizes) constant prices (i.e. the accounts also specify volume and price changes). Constant-price estimates in the national accounts are calculated based on the previous year's prices; i.e. the base year is changed every year. Subsequently, data on volume changes are constructed in terms of growth rates and corresponding implicit data on changes in prices. In parallel, time series of volume figures are constructed by using prices from a reference year. The constant-price estimates are consistent with the data on changes in volume in the series of growth rates. Since the chaining is carried out separately for all items, the table components do not, however, necessarily add up to the totals of the same table.

The publication Quarterly national accounts gives more information about sources, methods and the processes used to calculate quaterly NA figures. This will be updated in the autumn of 2018 to include monthly national accounts.

The methods and routines used to produce seasonally adjusted figures are described in the chapter About seasonal adjustment.

§ 2-6 of the Statistics Act states that data under no circumstances shall be published in such a way that they may be traced back to the supplier. This means that the general rule is not to publish data if there are fewer than three enterprises in an industry. In practice, this means that for some detailed industry categories, figures must be aggregated up to a more aggregated industry group before they can be published.

Consistent monthly time series will exist back to 2016. Consistent quarterly time series will exist back to 1978 and annual time series back to 1970. Annual NA figures for the years 1865-1970 are based on the previous standards used for the national accounts and are not compatible with the up to date figures after the latest main revision of the NA.

Quarterly figures are calculated as the sum of three months. Quarterly figures will be updated only when publishing the third month in the quarter. This means that there may be mismatch between the monthly and quarterly figures in the interim months, see the description of the monthly process above.

Monthly figures, and thus quarterly figures, are aligned with the final annual national accounts figures, both in fixed and current prices. The other parts of the national accounts, such as income and capital accounts, and foreign accounts are also consistent and consistent with MNA.

The national accounts are based on various statistical sources. The sources are either survey data from establishments, enterprises or households, or data from registers. National accounts statistics reflect the inaccuracy in the statistical sources and the methods of compilation. Weaknesses and inaccuracy in the statistical sources are normally described in the documentation of the relevant sources.

Since the national accounts are an integrated system with balancing methods and consistency checks, the national accounts may reduce some of the inaccuracies in the statistical sources. On the other hand, national accounts require the compilation of statistics in areas where the sources are unsatisfactory, and the inaccuracy in such areas may therefore be significant. Some of the figures in the national accounts are estimated as residuals, and the uncertainty may be substantial in these areas. Examples are the compilation of changes in inventories and operating surplus by activity.

The EU Commission and Eurostat have completed a quality evaluation of the national accounts in all EEA countries. The conclusion was that "The Norwegian national accounts are of a high quality, soundly based on reliable and exhaustive sources, integrated in a system with a detailed product breakdown". (Report on the sources and methods used in compiling GNP in Norway, Eurostat/B1/CPNB/237/EN, 9 December 1997, Luxembourg.)

The International Monetary Fund (IMF) completed an evaluation of central parts of Norwegian macroeconomic statistics in autumn 2002, including the Norwegian national accounts. In the report IMF (2003), the Norwegian macroeconomic statistics, including the national accounts, got positive reviews: "In summary, Norway's macroeconomic statistics are of generally high quality." About the national accounts, the IMF also expressed that: "The source data for both the annual and the quarterly national accounts are generally sound and timely, and sufficiently portray reality."

The production of several of the sources that are used in the national accounts takes a considerable amount of time. Consequently, preliminary figures are more inaccurate than final figures.

In 2003, Statistics Norway carried out a project to evaluate the quality of the Norwegian QNA. The task of the project was to describe and evaluate the different processes in the system, and set up a plan for further work to improve quality. A project report was released in April 2004 (in Norwegian only). The report lists a variety of measures to increase quality, such as changes in the organisation of the QNA process, technical changes in the data system, an increase and improvement of the documentation related to the QNA system etc.

Another way of measuring the general quality of the QNA figures is to compare the preliminary annual figures from the first version of the annual accounts (by adding up the quarters in the QNA) with the final version. This was done in 2004. The article (in Norwegian only) looks at the growth rates of the main aggregates: GDP, GDP for mainland Norway, household consumption, government consumption, gross fixed capital formation, exports, imports and compensation of employees. For most variables, the study covers the years 1972-2002, while for some variables it covers the years 1993-2002. The study concludes that the preliminary figures generally had underestimated the growth rate in relation to the final figures, but that the overall picture did not differ too much.

The national accounts data for a specific month, quarter or year are revised in accordance with an ordinary publication and revision cycle. The monthly and quarterly figures within a specific year t have the status final 21 months after the end of the year. See Administrative information, Frequency and timeliness. In addition, periodical main revisions give revised figures. See Background and purpose. The table below shows the publication cycle for yearly and quarterly national accounts figures. In addition to what is stated in the table, monthly data will be published about 40 days after the end of the month. In May, year t (which coincides with the QNR for the first quarter), all months, also in year t-1, can be revised. After May year t, only the monthly figures for the current year are subject to revision.

| Publication cycle for quarterly and yearly national accounts figures | ||||

| Release date in: | 1st quarter year t | 2nd quarter year t | 3rd quarter year t | 4th quarter year t |

| May, year t | First preliminary version | Revised 3 for year t-1 | Revised 2 for year t-1 | Revised 1 for year t-1 |

| August, year t | Revised 1 Revised 5 for year t-1 Final for year t-2 | First preliminary version Revised 4 for year t-1 Final for year t-2 | Revised 3 for year t-1 Final for year t-2 | Revised 2 for year t-1 Final for year t-2 |

| November, year t | Revised 2 | Revised 1 | First preliminary version | Revised 3 for year t-1 |

| February, year t | Revised 3 for year t-1 | Revised 2 for year t-1 | Revised 1 | First preliminary version for year t-1 |

Goods sent abroad for processing and merchanting in the Norwegian national accounts. Notater (2015/02)

Process tables in the Norwegian national accounts. Notater (2015/03)

Improved treatment of insurance in the Norwegian national accounts. Notater (2015/04)

Changes in inventories in the Norwegian National Accounts - Accounting data as a source for changes in inventories. Notater (2017/13)

Quarterly national accounts - methods and sources of the quarterly national accounts compilations for Norway December 2013. Notater (2014/02)

Revised national accounts figures 1970-2010

History of national accounts in Norway - from free research to statistics regulated by law. Notater (113)

Norwegian National Accounts - GNI Inventory for ESA95

Norwegian methodology for supply and use tables and input-output tables. Notater (2009/8)

What is seasonal adjustment?

Monthly and quarterly time series are often characterised by considerable seasonal variations, which might complicate inter-period comparability. Such time series are therefore subjected to a process of seasonal adjustment in order to remove the effects of seasonal fluctuations. Once data have been adjusted for seasonal effects by X-12-ARIMA or some other seasonal adjustment tool, a clearer picture of the time series emerge.

For more information on seasonal adjustment, please refer to Statistics Norway’s: metadata on methods: seasonal adjustment.

Because of climatic conditions, public holidays and holidays in July and December, the intensity of the production varies throughout the year. The same applies to household consumption and other parts of the economy.