Content

Published:

This is an archived release.

Decreased debt growth

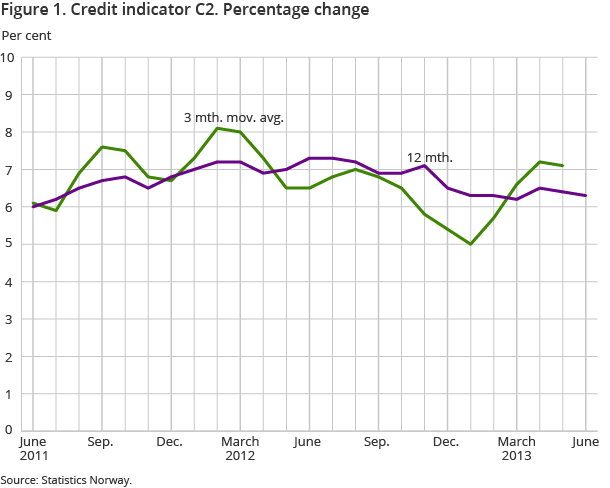

The twelve-month growth in the credit indicator C2 was 6.3 per cent to end-June, marginally down from 6.4 per cent the previous month.

| January 2013 | February 2013 | March 2013 | April 2013 | May 2013 | June 2013 | |

|---|---|---|---|---|---|---|

| 1Annualised figure | ||||||

| 12-month growth, total | 6.3 | 6.3 | 6.2 | 6.5 | 6.4 | 6.3 |

| 3-month moving average, total1 | 5.0 | 5.7 | 6.6 | 7.2 | 7.1 | .. |

| 12-month growth, households | 7.2 | 7.2 | 7.4 | 7.7 | 7.4 | 7.3 |

| 12-month growth, non-financial corporations | 4.4 | 4.2 | 3.9 | 4.0 | 4.2 | 4.3 |

The general public’s gross domestic debt C2 amounted to NOK 4 250 billion at end-June, up from NOK 4 216 billion the previous month.

Lower debt growth for households

Households’ gross domestic debt totalled NOK 2 459 billion at end-June, up from NOK 2 441 billion the previous month. The twelve-month growth was 7.3 per cent to end-June, marginally down from 7.4 per cent to end-May.

Increased debt growth for non-financial corporations

Non-financial corporations’ gross domestic debt amounted to NOK 1 429 billion at end-June, up from NOK 1 413 billion at end-May. The twelve-month growth was 4.3 per cent to end-June, up from 4.2 per cent the month before.

Decreased debt growth for municipal government

Municipal government’s gross domestic debt totalled NOK 362 billion at end-June, up from NOK 361 billion the month before. The twelve-month growth was 8.1 per cent to end-June, down from 8.8 per cent the previous month.

Growth rates affected by portfolio shifts

Of the general public’s gross domestic debt, nearly half consisted of bank loans at end-June. This amounted to NOK 2 046 billion. The twelve-month growth in bank loans was 2.2 per cent to end-June, up from 1.8 per cent the previous month. Mortgage companies’ loans amounted to NOK 1 407 billion at end-June, up from NOK 1 402 billion at end-May. The twelve-month growth in mortgage company loans was 7.2 per cent to end-June, down from 7.9 per cent the month before.

The growth rates are affected by transfers of loans from banks to mortgage companies. The growth rate for banks and mortgage companies in total was 4.2 per cent to end-June, unchanged from the previous month.

High activity in the bond market

The twelve-month growth rate in bond debt was 33.2 per cent to end-June, up from 29.8 per cent to end-May. The twelve-month growth rate in certificate debt was -2.2 per cent to end-June, down from 11.2 per cent the previous month.

The statistics is now published as Credit indicator.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42