Content

Published:

Growth in debt affected by the exchange rate

The outstanding debts from bonds issued in Norway rose by 6 per cent in 2014. A sharp fall in the exchange rate affected this debt growth significantly as some of the loans are denominated in foreign currency. Fifty per cent of the debt is well secured, while 42 per cent is unsecured.

| Issues in nominal value | Bond debts at nominal value | Bond debts at market value | |

|---|---|---|---|

| 1Source: The Norwegian Central Securities Depository | |||

| 2014 | 411 792 | 1 728 373 | 1 772 811 |

| 2013 | 407 424 | 1 637 902 | 1 665 173 |

| 2011 | 294 671 | 1 514 609 | 1 541 616 |

| 2010 | 261 973 | 1 290 110 | 1 283 251 |

| 2009 | 492 186 | 1 220 447 | 1 211 973 |

| 2008 | 286 037 | 933 816 | 883 242 |

| 2007 | 225 691 | 775 403 | 779 124 |

| 2006 | 253 450 | 732 784 | 746 813 |

| 2005 | 151 880 | 594 369 | 624 208 |

| 2004 | 126 901 | 535 230 | 566 076 |

| 2003 | 124 407 | 520 294 | 544 583 |

The face value of the outstanding debts from bonds issued in Norway at the end of 2014 amounted to NOK 1 728.4 billion. NOK 127 billion of this debt referred to loans denominated in foreign currency. This is 30 per cent more than the bond debt that was denominated in foreign currency at the end of 2013. Two thirds of this debt growth is caused by a fall in the exchange rate. A major part of the loans denominated in foreign currency refers to bonds issued by ‘the rest of the world’. The fall in the exchange rate led to a 1.2 per cent growth in total debts from bonds issued in Norway. The rest of the debt growth is caused by larger issues than redemptions.

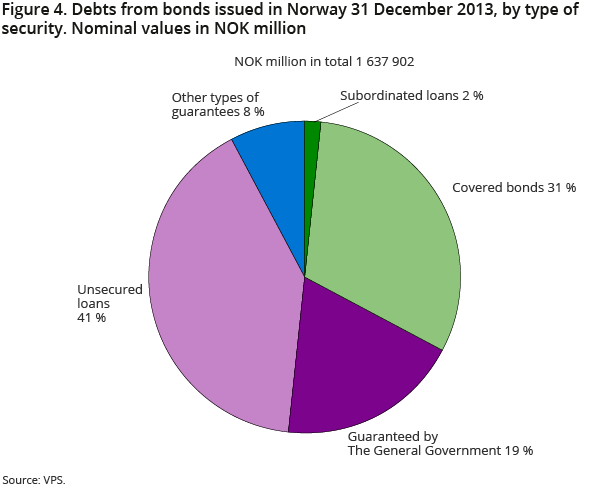

Various types of security

The debts from bonds issued in Norway have various types of security. Forty two per cent of the debts at the end of 2014 referred to unsecured loans. Two per cent and 21 per cent of the debts referred to subordinated loans and bonds guaranteed by general government respectively. Twenty-seven per cent of the debts referred to covered bonds. The rest of the bond debts have various other types of security.

General government received more debt – financial corporations received less

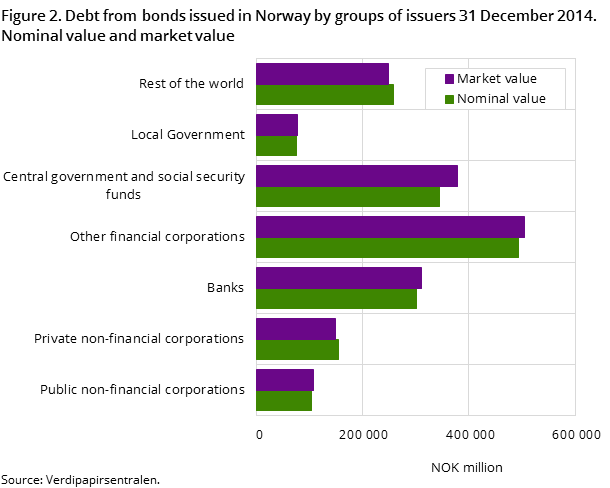

Twenty-nine per cent and 24 per cent of the bond debt at the end of 2014 referred to financial corporations other than banks and the general government respectively. The bond debt that referred to other financial corporations was reduced by 7 per cent in 2014, while bond debt that referred to the general government rose by a total of 20 per cent. Banks’ share of the bond debt at the end of 2014 was 17 per cent. The rest of the world’s share of the debt increased from 14 per cent at the end of 2013 to 15 per cent at the end of 2014.

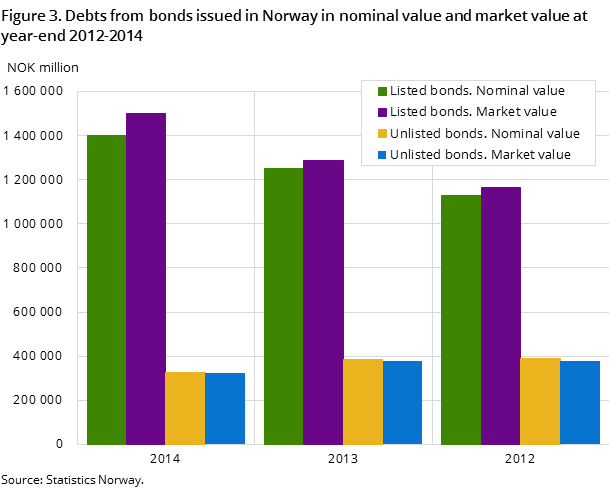

Continuous growth in market values

While the market value of the domestic bond debt was lower than the nominal value in the period 2008-2010, the situation has been the opposite since 2011. The market value of the domestic bond debt has had a continuous growth, and was on average 2.6 per cent higher than the face value at the end of 2014. This value refers to both listed and unlisted bonds, which may be priced differently. At the end of 2014, the market value of the listed bond debt was on average 6.9 per cent higher than the face value, while the market value of the unlisted bond debt was one per cent lower than the face value.

The market values were generally lower than the face values of bonds issued by private non-financial corporations and ‘the rest of the world’. For other bonds, the market values were generally higher than the nominal values. The market value was especially high for bonds issued by the central government and social security finds, with an average of 9 per cent over the face value.

Moderate volumes of issues in 2014

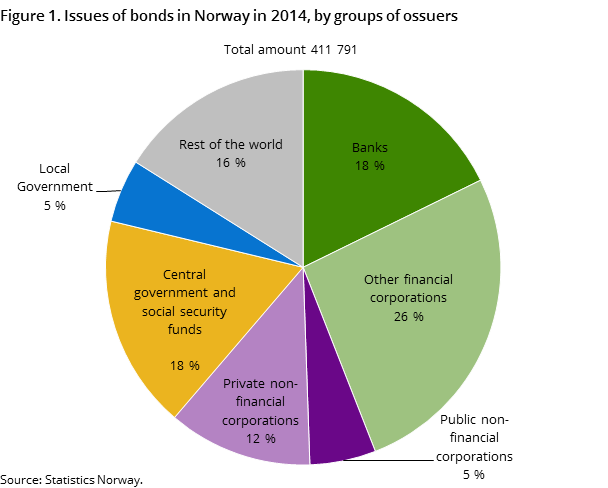

In 2014, bonds were issued for NOK 412 billion in Norway. Compared with 2013, the value of the issues of bonds rose by one per cent. In the same period, repayments of bonds were registered for a total of NOK 340 billion.

Mortgage companies still dominate the domestic bond market

By groups of issuers, mortgage companies dominated the market with NOK 102.9 billion in 2014. The second largest amount of bond issues in 2014, NOK 73.0 billion, referred to banks. The third largest amount of issues, NOK 72.0 billion, referred to central government and social security funds. As previously, a considerable share of the issues, NOK 66.2 billion, referred to ‘the rest of the world’.

Table: Bonds issued in Norway per 31 December 2014. Sorted by ISIN (xls-file)

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42