Content

Published:

This is an archived release.

Higher interest rates on deposits

Interest rates on deposits in banks increased by 0.04 percentage points in the third quarter of 2013, while the interest on loans secured on dwellings in banks and mortgage companies declined slightly.

| 3rd quarter 2013 | 2nd quarter 2013 | |

|---|---|---|

| 1Due to changes in specifications applied from 3rd quarter 2013, the time series are not directly comparable to previous periods. | ||

| Interest rates including commissions on loans | ||

| Banks | 4.78 | 4.72 |

| Mortgage comanies | 3.74 | 3.76 |

| State lending institutions | 2.49 | 2.47 |

| Life insurance companies | 3.71 | 3.83 |

| Financial corporations, total | 4.19 | 4.17 |

| The Norwegian Public Service Pension Fund | 2.25 | 2.25 |

| Interest rates on deposits | ||

| Banks | 2.22 | 2.18 |

| Margins | ||

| Banks and mortgage companies. Loans margin | 2.61 | 2.62 |

| Banks. Interest rate margin | 2.56 | 2.54 |

| Banks. Deposits margin | -0.49 | -0.49 |

The deposit margin in banks was unchanged in the third quarter of 2013 after a decrease of 0.11 percentage points in the previous quarter. The lending margin on loans fell by 0.06 and 0.04 respectively in the third quarter of 2013, after an increase of 0.40 and 0.50 in the second quarter of 2013. The interest rate on lending between the banks; NIBOR , increased by 0.04 percentage points in the third quarter of 2013.

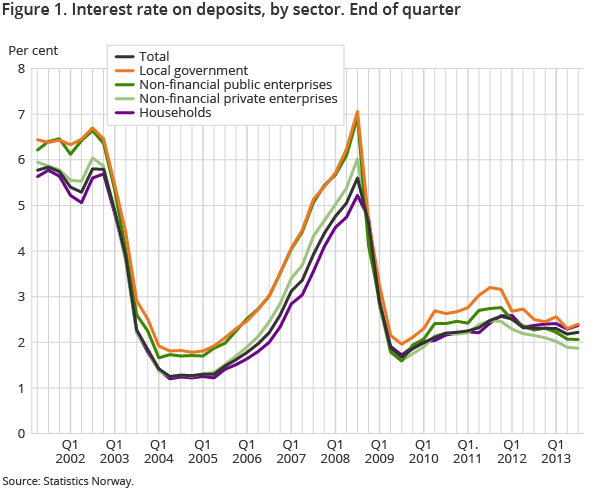

Higher interest rates on deposits

The average interest rate on deposits in banks increased by 0.04 percentage points in the third quarter of 2013, after falling by 0.12 percentage points in the second quarter of 2013. The interest on deposits from the local government increased by 0.10 percentage points, while interest on deposits from households increased by 0.08 percentage points. The local government had the highest average interest on deposits at the end of the third quarter of 2013, of 2.40 per cent, while households had the second highest average interest on deposits, of 2.37 per cent. The interest on deposits from non-financial private enterprises and non-financial public enterprises was nearly unchanged, with 2.06 and 1.87 per cent respectively.

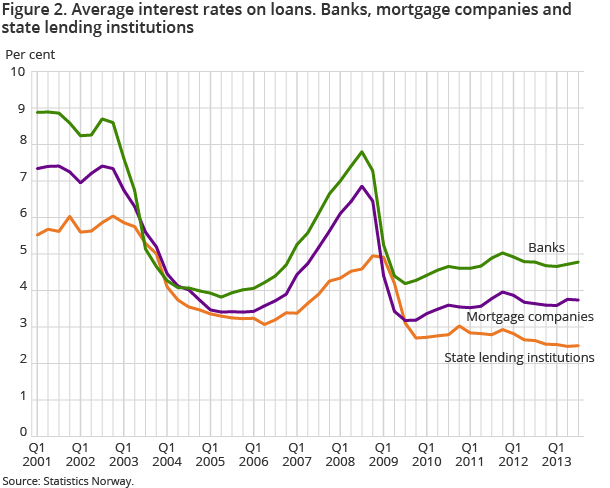

Slightly lower interest rates on mortgage lending

The average interest rate on repayment loans secured in dwellings from banks and mortgage companies fell by 0.02 percentage points to 4.16 per cent from the end of the second quarter to the end of the third quarter of 2013. The average interest rate on credit lines secured on dwellings from banks and mortgage companies was unchanged at 4.10 per cent.

The interest rate on loans from the state lending institutions, excluding zero-interest loans, fell by 0.04 percentage points in the third quarter of 2013 to 2.90 per cent. This is 0.22 percentage points lower than the same period last year. The interest on mortgage loans from the Norwegian Public Service Pension Fund was unchanged at 2.25 per cent in the last six quarters.

The average interest rate on all loans from banks and mortgage companies is temporarily calculated to 4.34 per cent for the third quarter of 2013; an increase of 0.03 percentage points from the second quarter of 2013. The interest rate on loans was 0.04 percentage points higher at the end of the third quarter 2013 than the same period last year. Banks and mortgage companies’ interest rates on loans to households increased by 0.05 percentage points in the third quarter of 2013, while the interest rate on loans to private-owned non-financial corporations fell by 0.02 percentage points.

Changes in the interest rate statistics

In September 2013, a major change was introduced in the reporting of loans to the interest rate statistics. Part of this change entails excluding loans with low interest rates as a consequence of loss/default from the calculation of interest on loans. This change alone may lead to higher average interest rates on loans. A change in the calculation method by reporting entities of overdrafts, capital facilities and consumer credit also means higher average interest rates on loans, especially on this type of loan. Due to the changes, interest rates from September 2013 are not directly comparable with previous periods. There is more uncertainty in the input data than usual in this quarter, which may result in revisions in the average interest rates on loans in future publications.

About the statistics Open and readClose

At the end of the third quarter of 2013, the interest rate statistics included data from 137 banks, 27 mortgage companies, 6 life insurance companies, 3 state lending institutions and the Norwegian Public Service Pension Fund. The share of loans from banks, mortgage companies, state lending institutions and life insurance companies was 52, 39, 8 and 1 per cent of total loans respectively (excluding the Norwegian Public Service Pension Fund).

The interest rates on loans from the state lending institutions are determined on the basis of the interest rates on treasury bills and government bonds.

The statistics is now published as Interest rates in banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42