Content

Published:

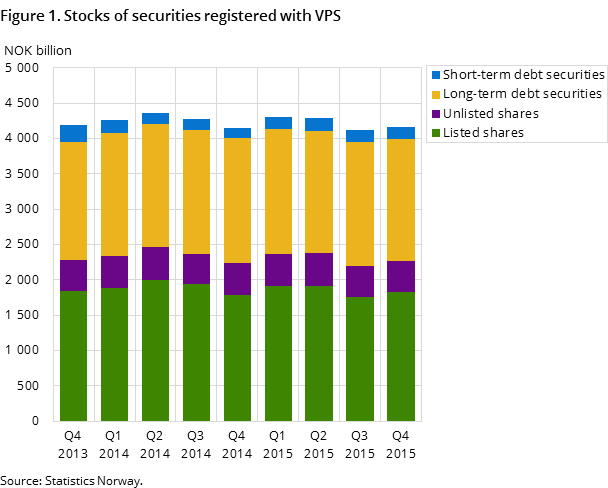

Increase in share values

The market value of quoted shares registered with the Norwegian Central Securities Depository (VPS) increased by NOK 76 billion in the fourth quarter of 2015. This corresponds to an increase of 4.3 per cent.

| 1st quarter 2015 | 2nd quarter 2015 | 3rd quarter 2015 | 4th quarter 2015 | |

|---|---|---|---|---|

| Stocks (market value) | ||||

| Shares (listed) | 1 912.3 | 1 912.6 | 1 751.7 | 1 827.2 |

| Shares (unlisted) | 449.4 | 470.0 | 443.3 | 432.8 |

| Long-term debt securities | 1 776.6 | 1 728.8 | 1 756.0 | 1 735.2 |

| Short-term debt securities | 165.6 | 173.9 | 166.9 | 170.4 |

| Equity certificates | 28.9 | 30.1 | 28.0 | 31.3 |

| Dividends/coupon payments | ||||

| Shares (listed) | 6.5 | 44.0 | 7.3 | 13.4 |

| Shares (unlisted) | 1.3 | 5.7 | 1.3 | 0.4 |

| Long-term debt securities | 11.5 | 24.8 | 9.0 | 10.1 |

| Short-term debt securities | 0.3 | 0.3 | 0.3 | 0.3 |

| Equity certificates | 0.2 | 1.2 | .. | .. |

The market value of the quoted shares was NOK 1 827 billion at the end of the fourth quarter. The increase in share prices on Oslo Stock Exchange in October and November more than compensated for the drop in stock prices observed in December. This in turn meant that stock prices had an overall increase during the fourth quarter of 2015. While Oslo Stock Exchange All-Share Index (OSEAX), which shows the price development of quoted shares, fell by 3.1 per cent during December, OSEAX had an aggregated increase of 4.2 per cent from the end of the third quarter to the end of the fourth quarter in 2015.

Meanwhile, the value of the unquoted shares registered with the Norwegian Central Securities Depository (VPS) saw a NOK 11 billion decrease this quarter. This corresponds to a 2.4 per cent reduction in the total market value of all unquoted shares. The decrease is principally related to a merger with a quoted company. This led to values being transferred from non-quoted shares to quoted shares.

Foreigners and non-financial enterprises buy securities

The fourth quarter of 2015 saw total net purchases of securities of NOK 1.6 billion. Foreigners and non-financial enterprises net purchased securities for NOK 8 billion. The public sector and households also bought securities during the period, while financial enterprises net sold securities worth NOK 11 billion.

Foreigners net purchased shares and long-term debt securities worth NOK 3.1 billion and NOK 8.3 billion respectively. During the same period, foreigners net sold NOK 6.6 billion worth of short-term deb securities.

The non-financial enterprises bought all types of securities during the fourth quarter, despite a substantial part of the trading being made up of debt securities. With net purchases of short-term debt securities worth NOK 1.6 billion, government-owned public companies made up the most active party of purchasers among the non-financial enterprises.

The central government net bought securities worth NOK 2.9 billion during this quarter. Long-term debt securities made up NOK 1.8 billion of these purchases.

The financial enterprises’ net trading was mainly in debt securities. Financial enterprises net sold NOK 20.5 billion worth of long-term debt securities and net purchased NOK 8.4 billion worth of short-term debt securities.

Decrease in the outstanding amounts of long-term debt securities

The market value of the total outstanding amounts of long-term debt securities registered with VPS was NOK 1 735 billion at the end of the third quarter; corresponding to a decrease of 1.6 per cent compared to the previous quarter. The market value of the total outstanding amounts of short-term debt securities, which have an original term to maturity of one year or less, increased by 2.1 per cent compared with the previous quarter, and was NOK 170 billion at the end of the quarter.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42