Still difficult for petroleum-related manufacturing

Published:

Norwegian industrial managers report a production decline compared with the first quarter of 2017, still driven by suppliers to petroleum related manufacturing. The general expectations for the third quarter of 2017 are positive among most of the industry leaders.

- Full set of figures

- Business tendency survey for manufacturing, mining and quarrying

The business tendency survey for the second quarter of 2017 shows a decline in total production compared with the first quarter of 2017. Manufacturers of capital goods contribute in particular to the decline, where the low activity among suppliers to the oil and gas sector continues to contribute to the decline. This particularly affects industries such as:

- Machinery and equipment

- Building of ships, boats and oil platforms

- Repair and installation of machinery

Producers of intermediate goods reported a growth in production in the last quarter. There was an increase in industries such basic chemicals and the industry grouping rubber, plastic and mineral products. At the same time, there was lower production within consumer goods, especially in furniture and other manufacturing.

The overall employment declined in the second quarter of 2017. The decline comes from capital goods and consumer goods, while intermediate goods shows an increase. Lower employment is most significant among producers of capital goods, which are in particularly affected by the reduced investment activity in the petroleum related industry.

Figure 1. Production and employment for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Total volume of production | Average employment | |

| Q1-2008 | 50 | 56.44 | 54.20 |

| Q2-2008 | 50 | 53.67 | 51.35 |

| Q3-2008 | 50 | 47.83 | 46.42 |

| Q4-2008 | 50 | 40.96 | 40.33 |

| Q1-2009 | 50 | 37.62 | 36.18 |

| Q2-2009 | 50 | 39.78 | 36.65 |

| Q3-2009 | 50 | 44.58 | 39.40 |

| Q4-2009 | 50 | 47.89 | 42.41 |

| Q1-2010 | 50 | 50.03 | 44.54 |

| Q2-2010 | 50 | 51.34 | 45.43 |

| Q3-2010 | 50 | 52.02 | 47.00 |

| Q4-2010 | 50 | 53.24 | 50.45 |

| Q1-2011 | 50 | 55.36 | 53.88 |

| Q2-2011 | 50 | 55.92 | 54.72 |

| Q3-2011 | 50 | 55.06 | 54.23 |

| Q4-2011 | 50 | 54.16 | 53.61 |

| Q1-2012 | 50 | 53.15 | 53.63 |

| Q2-2012 | 50 | 52.47 | 54.09 |

| Q3-2012 | 50 | 52.04 | 54.28 |

| Q4-2012 | 50 | 50.97 | 53.14 |

| Q1-2013 | 50 | 49.76 | 52.28 |

| Q2-2013 | 50 | 50.92 | 52.39 |

| Q3-2013 | 50 | 52.65 | 51.61 |

| Q4-2013 | 50 | 53.87 | 50.60 |

| Q1-2014 | 50 | 54.46 | 49.84 |

| Q2-2014 | 50 | 53.17 | 49.53 |

| Q3-2014 | 50 | 51.28 | 49.88 |

| Q4-2014 | 50 | 50.24 | 49.10 |

| Q1-2015 | 50 | 48.12 | 45.08 |

| Q2-2015 | 50 | 46.52 | 40.97 |

| Q3-2015 | 50 | 46.75 | 39.14 |

| Q4-2015 | 50 | 47.38 | 39.49 |

| Q1-2016 | 50 | 48.12 | 40.99 |

| Q2-2016 | 50 | 48.41 | 42.10 |

| Q3-2016 | 50 | 47.61 | 42.12 |

| Q4-2016 | 50 | 47.64 | 42.84 |

| Q1-2017 | 50 | 48.66 | 44.95 |

| Q2-2017 | 50 | 49.03 | 46.79 |

No change in new orders from the domestic market

The total stock of orders remained unchanged in the second quarter compared with the first quarter of 2017. There were also virtually no change in the number of new orders from the domestic market during this quarter. In the export market the numbers of new orders fell.

Producers of capital goods saw a decline in new orders from both markets during this quarter. For manufacturers of intermediate goods there was an increase of new orders from both markets and an increase in the stock of orders. For manufacturers of consumer goods there was a decrease in new orders from the home market, while the export market increased. The total stock of orders remained more or less unchanged.

Figure 2. New orders received for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | New orders received from home markets | New orders received from export markets | |

| Q1-2008 | 50 | 52.80 | 50.10 |

| Q2-2008 | 50 | 49.38 | 46.48 |

| Q3-2008 | 50 | 42.58 | 42.72 |

| Q4-2008 | 50 | 34.48 | 28.81 |

| Q1-2009 | 50 | 32.46 | 28.00 |

| Q2-2009 | 50 | 37.37 | 38.02 |

| Q3-2009 | 50 | 42.34 | 41.09 |

| Q4-2009 | 50 | 44.47 | 43.87 |

| Q1-2010 | 50 | 46.91 | 47.56 |

| Q2-2010 | 50 | 50.78 | 51.76 |

| Q3-2010 | 50 | 53.52 | 53.42 |

| Q4-2010 | 50 | 55.38 | 54.19 |

| Q1-2011 | 50 | 57.30 | 53.25 |

| Q2-2011 | 50 | 56.91 | 50.35 |

| Q3-2011 | 50 | 54.90 | 48.04 |

| Q4-2011 | 50 | 54.92 | 47.23 |

| Q1-2012 | 50 | 54.88 | 48.03 |

| Q2-2012 | 50 | 52.41 | 48.86 |

| Q3-2012 | 50 | 49.89 | 46.57 |

| Q4-2012 | 50 | 49.26 | 44.67 |

| Q1-2013 | 50 | 48.27 | 45.04 |

| Q2-2013 | 50 | 48.83 | 47.94 |

| Q3-2013 | 50 | 50.63 | 52.37 |

| Q4-2013 | 50 | 50.81 | 54.97 |

| Q1-2014 | 50 | 50.08 | 54.82 |

| Q2-2014 | 50 | 49.84 | 53.03 |

| Q3-2014 | 50 | 48.22 | 49.59 |

| Q4-2014 | 50 | 46.29 | 46.15 |

| Q1-2015 | 50 | 44.44 | 43.49 |

| Q2-2015 | 50 | 43.19 | 42.23 |

| Q3-2015 | 50 | 43.23 | 43.34 |

| Q4-2015 | 50 | 44.39 | 44.03 |

| Q1-2016 | 50 | 45.88 | 43.57 |

| Q2-2016 | 50 | 46.80 | 43.26 |

| Q3-2016 | 50 | 47.38 | 43.82 |

| Q4-2016 | 50 | 49.23 | 45.57 |

| Q1-2017 | 50 | 50.37 | 48.06 |

| Q2-2017 | 50 | 49.51 | 49.22 |

Overall, prices went up for both export and domestic market. Producers of capital goods saw a decline in prices in both markets, while producers of intermediate goods and consumers goods had an increase in both markets.

Figure 3. Prices on products for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Prices on products at home markets | Prices on products at export markets | |

| Q1-2008 | 50 | 61.95 | 54.05 |

| Q2-2008 | 50 | 60.85 | 54.97 |

| Q3-2008 | 50 | 56.22 | 54.45 |

| Q4-2008 | 50 | 50.09 | 50.29 |

| Q1-2009 | 50 | 44.77 | 45.16 |

| Q2-2009 | 50 | 44.35 | 43.94 |

| Q3-2009 | 50 | 46.02 | 44.06 |

| Q4-2009 | 50 | 46.22 | 43.85 |

| Q1-2010 | 50 | 46.72 | 45.53 |

| Q2-2010 | 50 | 49.05 | 49.27 |

| Q3-2010 | 50 | 51.35 | 51.54 |

| Q4-2010 | 50 | 53.53 | 52.67 |

| Q1-2011 | 50 | 55.82 | 52.85 |

| Q2-2011 | 50 | 54.85 | 49.99 |

| Q3-2011 | 50 | 52.63 | 46.54 |

| Q4-2011 | 50 | 52.03 | 44.96 |

| Q1-2012 | 50 | 51.91 | 45.58 |

| Q2-2012 | 50 | 51.41 | 46.24 |

| Q3-2012 | 50 | 51.86 | 45.41 |

| Q4-2012 | 50 | 51.80 | 44.37 |

| Q1-2013 | 50 | 51.16 | 45.11 |

| Q2-2013 | 50 | 52.12 | 47.22 |

| Q3-2013 | 50 | 53.07 | 49.93 |

| Q4-2013 | 50 | 53.67 | 52.94 |

| Q1-2014 | 50 | 54.45 | 53.36 |

| Q2-2014 | 50 | 54.26 | 51.88 |

| Q3-2014 | 50 | 53.55 | 51.24 |

| Q4-2014 | 50 | 53.18 | 51.95 |

| Q1-2015 | 50 | 51.05 | 50.27 |

| Q2-2015 | 50 | 48.74 | 48.61 |

| Q3-2015 | 50 | 48.16 | 49.15 |

| Q4-2015 | 50 | 48.52 | 48.93 |

| Q1-2016 | 50 | 49.51 | 48.13 |

| Q2-2016 | 50 | 50.17 | 47.90 |

| Q3-2016 | 50 | 49.87 | 47.69 |

| Q4-2016 | 50 | 49.79 | 47.70 |

| Q1-2017 | 50 | 50.56 | 49.79 |

| Q2-2017 | 50 | 51.57 | 51.92 |

Positive expectations for the third quarter of 2017

The general outlook for the third quarter of 2017 is positive. Business leaders reports that investment plans are adjusted upwards, while employment will see a further drop. New orders from both the domestic market and export market are expected to increase. The total stock of orders is expected to increase. Producers of capital goods, intermediate goods and consumer goods are all optimistic about the third quarter. For the producers of capital goods, this is the second quarter in a row that they are positive about the general outlook. The last time they were positive was in the first quarter of 2014.

Figure 4. General judgement of the outlook in next quarter for manufacturing.

| Turning point value | Smoothed seasonally adjusted | |

| Q1-2008 | 50 | 56.98 |

| Q2-2008 | 50 | 52.38 |

| Q3-2008 | 50 | 45.47 |

| Q4-2008 | 50 | 40.34 |

| Q1-2009 | 50 | 40.17 |

| Q2-2009 | 50 | 43.98 |

| Q3-2009 | 50 | 47.54 |

| Q4-2009 | 50 | 50.26 |

| Q1-2010 | 50 | 53.24 |

| Q2-2010 | 50 | 56.04 |

| Q3-2010 | 50 | 59.01 |

| Q4-2010 | 50 | 61.01 |

| Q1-2011 | 50 | 60.13 |

| Q2-2011 | 50 | 57.54 |

| Q3-2011 | 50 | 56.04 |

| Q4-2011 | 50 | 56.06 |

| Q1-2012 | 50 | 56.38 |

| Q2-2012 | 50 | 56.17 |

| Q3-2012 | 50 | 55.54 |

| Q4-2012 | 50 | 55.16 |

| Q1-2013 | 50 | 55.16 |

| Q2-2013 | 50 | 54.97 |

| Q3-2013 | 50 | 54.73 |

| Q4-2013 | 50 | 54.63 |

| Q1-2014 | 50 | 54.11 |

| Q2-2014 | 50 | 53.27 |

| Q3-2014 | 50 | 51.60 |

| Q4-2014 | 50 | 48.64 |

| Q1-2015 | 50 | 45.46 |

| Q2-2015 | 50 | 43.27 |

| Q3-2015 | 50 | 42.92 |

| Q4-2015 | 50 | 44.40 |

| Q1-2016 | 50 | 47.04 |

| Q2-2016 | 50 | 50.16 |

| Q3-2016 | 50 | 52.65 |

| Q4-2016 | 50 | 53.85 |

| Q1-2017 | 50 | 54.60 |

| Q2-2017 | 50 | 55.17 |

The industrial confidence indicator for the second quarter was 3.8 (seasonally-adjusted net figures), up from 1.5 in the previous quarter. This is the first time this indicator is above the historical average of 3.0 since the second quarter of 2014. Values above zero indicate that total output will grow, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

Figure 5. Industrial confidence indicator¹

| Seasonally adjusted | Average 1990-2017 | |

| Q1-2008 | 6.9 | 3.0 |

| Q2-2008 | -0.7 | 3.0 |

| Q3-2008 | -6.9 | 3.0 |

| Q4-2008 | -22.9 | 3.0 |

| Q1-2009 | -19.3 | 3.0 |

| Q2-2009 | -7.9 | 3.0 |

| Q3-2009 | -2.9 | 3.0 |

| Q4-2009 | 0.1 | 3.0 |

| Q1-2010 | 3.1 | 3.0 |

| Q2-2010 | 4.5 | 3.0 |

| Q3-2010 | 8.9 | 3.0 |

| Q4-2010 | 11.1 | 3.0 |

| Q1-2011 | 9.1 | 3.0 |

| Q2-2011 | 8.5 | 3.0 |

| Q3-2011 | 5.6 | 3.0 |

| Q4-2011 | 6.0 | 3.0 |

| Q1-2012 | 9.0 | 3.0 |

| Q2-2012 | 6.5 | 3.0 |

| Q3-2012 | 0.7 | 3.0 |

| Q4-2012 | 4.8 | 3.0 |

| Q1-2013 | 1.3 | 3.0 |

| Q2-2013 | 1.4 | 3.0 |

| Q3-2013 | 6.0 | 3.0 |

| Q4-2013 | 7.9 | 3.0 |

| Q1-2014 | 6.5 | 3.0 |

| Q2-2014 | 6.7 | 3.0 |

| Q3-2014 | 1.2 | 3.0 |

| Q4-2014 | -1.7 | 3.0 |

| Q1-2015 | -3.7 | 3.0 |

| Q2-2015 | -8.4 | 3.0 |

| Q3-2015 | -7.5 | 3.0 |

| Q4-2015 | -8.0 | 3.0 |

| Q1-2016 | -6.7 | 3.0 |

| Q2-2016 | -1.9 | 3.0 |

| Q3-2016 | -5.0 | 3.0 |

| Q4-2016 | -0.1 | 3.0 |

| Q1-2017 | 1.5 | 3.0 |

| Q2-2017 | 3.8 | 3.0 |

Increase in capacity utilisation

The average capacity utilisation for Norwegian manufacturing went up and was calculated to 77.7 per cent at the end of the second quarter of 2017, compared with 77.1 in the first quarter of 2017. This is below the historical average of 80.3 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

Figure 6. Capacity utilisation in per cent for manufacturing

| Smoothed seasonally adjusted | Average 1990-2017 | |

| Q1-2008 | 83.7 | 80.3 |

| Q2-2008 | 83.0 | 80.3 |

| Q3-2008 | 81.4 | 80.3 |

| Q4-2008 | 78.9 | 80.3 |

| Q1-2009 | 76.8 | 80.3 |

| Q2-2009 | 76.0 | 80.3 |

| Q3-2009 | 76.3 | 80.3 |

| Q4-2009 | 76.8 | 80.3 |

| Q1-2010 | 77.1 | 80.3 |

| Q2-2010 | 77.8 | 80.3 |

| Q3-2010 | 78.5 | 80.3 |

| Q4-2010 | 78.9 | 80.3 |

| Q1-2011 | 79.4 | 80.3 |

| Q2-2011 | 79.8 | 80.3 |

| Q3-2011 | 79.6 | 80.3 |

| Q4-2011 | 79.6 | 80.3 |

| Q1-2012 | 79.7 | 80.3 |

| Q2-2012 | 79.7 | 80.3 |

| Q3-2012 | 79.8 | 80.3 |

| Q4-2012 | 79.8 | 80.3 |

| Q1-2013 | 79.4 | 80.3 |

| Q2-2013 | 79.3 | 80.3 |

| Q3-2013 | 79.5 | 80.3 |

| Q4-2013 | 80.0 | 80.3 |

| Q1-2014 | 80.4 | 80.3 |

| Q2-2014 | 80.5 | 80.3 |

| Q3-2014 | 80.1 | 80.3 |

| Q4-2014 | 79.3 | 80.3 |

| Q1-2015 | 78.4 | 80.3 |

| Q2-2015 | 77.4 | 80.3 |

| Q3-2015 | 76.7 | 80.3 |

| Q4-2015 | 76.8 | 80.3 |

| Q1-2016 | 77.1 | 80.3 |

| Q2-2016 | 77.2 | 80.3 |

| Q3-2016 | 77.0 | 80.3 |

| Q4-2016 | 76.8 | 80.3 |

| Q1-2017 | 77.1 | 80.3 |

| Q2-2017 | 77.7 | 80.3 |

The average number of working months covered by the current stock of orders was 4.1 in the first quarter of 2017, compared to 4,0 in the previous quarter. This is above the historical average for the indicator of 3.8.

Figure 7. Number of working months covered by current stock of orders for manufacturing

| Smoothed seasonally adjusted | Average 1990-2017 | |

| Q1-2008 | 4.83 | 3.9 |

| Q2-2008 | 4.78 | 3.9 |

| Q3-2008 | 4.65 | 3.9 |

| Q4-2008 | 4.46 | 3.9 |

| Q1-2009 | 4.23 | 3.9 |

| Q2-2009 | 3.97 | 3.9 |

| Q3-2009 | 3.77 | 3.9 |

| Q4-2009 | 3.74 | 3.9 |

| Q1-2010 | 3.83 | 3.9 |

| Q2-2010 | 3.95 | 3.9 |

| Q3-2010 | 4.12 | 3.9 |

| Q4-2010 | 4.25 | 3.9 |

| Q1-2011 | 4.31 | 3.9 |

| Q2-2011 | 4.37 | 3.9 |

| Q3-2011 | 4.34 | 3.9 |

| Q4-2011 | 4.13 | 3.9 |

| Q1-2012 | 4.00 | 3.9 |

| Q2-2012 | 4.09 | 3.9 |

| Q3-2012 | 4.26 | 3.9 |

| Q4-2012 | 4.32 | 3.9 |

| Q1-2013 | 4.29 | 3.9 |

| Q2-2013 | 4.21 | 3.9 |

| Q3-2013 | 4.15 | 3.9 |

| Q4-2013 | 4.26 | 3.9 |

| Q1-2014 | 4.45 | 3.9 |

| Q2-2014 | 4.50 | 3.9 |

| Q3-2014 | 4.42 | 3.9 |

| Q4-2014 | 4.35 | 3.9 |

| Q1-2015 | 4.28 | 3.9 |

| Q2-2015 | 4.25 | 3.9 |

| Q3-2015 | 4.23 | 3.9 |

| Q4-2015 | 4.18 | 3.9 |

| Q1-2016 | 4.05 | 3.9 |

| Q2-2016 | 3.95 | 3.9 |

| Q3-2016 | 3.93 | 3.9 |

| Q4-2016 | 3.98 | 3.9 |

| Q1-2017 | 4.04 | 3.9 |

| Q2-2017 | 4.08 | 3.9 |

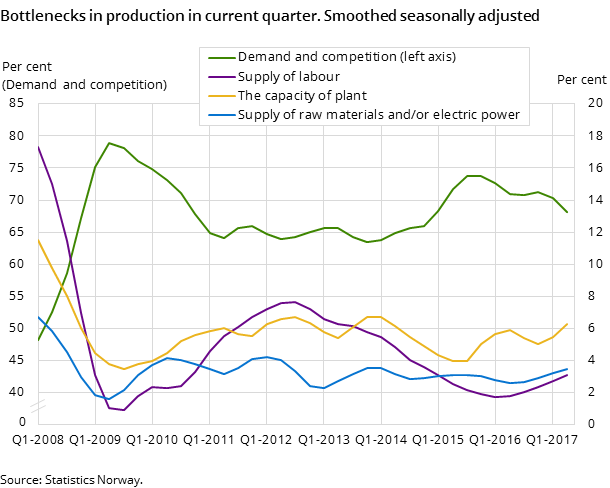

The resource shortage indicator went slightly up compared with the previous quarter. There is still little shortage of labour, good access to raw materials and electrical power, and few industry leaders are reporting full capacity utilisation.

Timeline

The survey data was collected in the period from 8 June 2017 to 21 July 2017.

Assessment of Q2 2017 and the short-term outlook¹

|

1 An overall evaluation of the present situation and expected short-term developments. 2 Very good: ++, Good: +, Stable: ~, Poor: -, Very poor: --, Good, but with certain negative indications: +(-), A situation where the + and - factors even out: +/-, Poor, but with certain positive indications: -(+) |

|

| Industry | Evaluation 2 |

| Food, beverages and tobacco | + |

| Wood and wood products | ++ |

| Paper and paper products | ++ |

| Basic chemicals | + |

| Non-ferrous metals | -(+) |

| Fabricated metal products | + |

| Computer and electrical equipment | -(+) |

| Machinery and equipment | - |

| Ships, boats and oil platforms | -- |

| Repair, installation of machinery | -(+) |

Contact

-

Edvard Andreassen

-

Nils-Arne Rye Krøtø

-

Jan Henrik Wang

-

Statistics Norway's Information Centre