Still weak figures in manufacturing

Published:

Norwegian industrial managers report a further downturn in the total production volume in the third quarter of the year. There is low numbers of new orders and major uncertainty related to the coronary pandemic. The general outlook for the four quarter of 2020 is characterized by pessimism among the majority of industry leaders, but a lesser extent than in the previous quarter.

- Full set of figures

- Business tendency survey for manufacturing, mining and quarrying

The business tendency survey for the third quarter of 2020 shows a decline in total output compared to the second of 2020. There are in particular the producers of capital goods that report lower production, but also producers of and intermediate goods report a decline in production volume compared to the previous quarter. Producers of consumer goods, on the other hand, report a higher production volume in this quarter.

The total industry employment also shows a decline in the third quarter of 2020. The decline is related to the comprehensive measures against the spread of infection that were implemented this spring. Lower employment is reported for both capital goods and intermediate goods, while producers of consumer goods report higher employment in this quarter.

Figure 1. Production and employment for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Total volume of production | Average employment | |

| Q1-2011 | 50 | 55.35 | 53.88 |

| Q2-2011 | 50 | 55.91 | 54.72 |

| Q3-2011 | 50 | 55.06 | 54.23 |

| Q4-2011 | 50 | 54.21 | 53.61 |

| Q1-2012 | 50 | 53.22 | 53.64 |

| Q2-2012 | 50 | 52.47 | 54.09 |

| Q3-2012 | 50 | 52.04 | 54.27 |

| Q4-2012 | 50 | 51.02 | 53.14 |

| Q1-2013 | 50 | 49.74 | 52.29 |

| Q2-2013 | 50 | 50.83 | 52.39 |

| Q3-2013 | 50 | 52.69 | 51.59 |

| Q4-2013 | 50 | 54.00 | 50.58 |

| Q1-2014 | 50 | 54.43 | 49.87 |

| Q2-2014 | 50 | 52.97 | 49.55 |

| Q3-2014 | 50 | 51.34 | 49.84 |

| Q4-2014 | 50 | 50.44 | 49.04 |

| Q1-2015 | 50 | 48.11 | 45.13 |

| Q2-2015 | 50 | 46.21 | 41.01 |

| Q3-2015 | 50 | 46.82 | 39.11 |

| Q4-2015 | 50 | 47.49 | 39.39 |

| Q1-2016 | 50 | 48.62 | 41.07 |

| Q2-2016 | 50 | 49.08 | 42.19 |

| Q3-2016 | 50 | 47.36 | 41.98 |

| Q4-2016 | 50 | 47.57 | 42.60 |

| Q1-2017 | 50 | 49.68 | 44.90 |

| Q2-2017 | 50 | 50.01 | 47.46 |

| Q3-2017 | 50 | 50.37 | 49.80 |

| Q4-2017 | 50 | 51.32 | 50.56 |

| Q1-2018 | 50 | 52.38 | 50.31 |

| Q2-2018 | 50 | 54.17 | 51.12 |

| Q3-2018 | 50 | 55.50 | 52.68 |

| Q4-2018 | 50 | 56.02 | 54.29 |

| Q1-2019 | 50 | 55.69 | 55.24 |

| Q2-2019 | 50 | 54.93 | 54.84 |

| Q3-2019 | 50 | 53.06 | 52.13 |

| Q4-2019 | 50 | 49.77 | 48.78 |

| Q1-2020 | 50 | 45.67 | 44.83 |

| Q2-2020 | 50 | 44.80 | 42.92 |

| Q3-2020 | 50 | 46.96 | 44.81 |

Reduced orders and unchanged total stock of order

The total stock of orders in manufacturing is in the third quarter about at the same level as in the previous quarter. There was also a clear downturn in new orders from both the domestic and the export market. There is in particularly producers of capital goods who report a decrease in new orders in both the domestic and export markets. Suppliers to the oil and gas sector contributed most to the fall. This affects particularly the manufacture of machinery and equipment and manufacture of building of ships, boats and oil platforms. There are also reports of a decline in new orders for producer of consumer goods and intermediate goods from both the domestic and export markets, but the decline is more moderate for these producers.

The decline in new orders among producers of capital goods is partly related to the fact that there have been few new oil and gas projects on the Norwegian shelf in the last quarter. The low oil price has also contributed to an order drought for the supplier industry from the global oil market. The economic downturn among Norway's most important trading partners has contributed to lower demand for Norwegian export companies. Most producers of intermediate goods mainly sell their products to the export markets and they are thereby particularly affected by the fall in new orders from the export markets.

Figure 2. New orders received for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | New orders received from home markets | New orders received from export markets | |

| Q1-2011 | 50 | 57.30 | 53.46 |

| Q2-2011 | 50 | 56.91 | 50.61 |

| Q3-2011 | 50 | 54.89 | 48.16 |

| Q4-2011 | 50 | 55.02 | 47.26 |

| Q1-2012 | 50 | 55.13 | 48.07 |

| Q2-2012 | 50 | 52.57 | 48.85 |

| Q3-2012 | 50 | 49.80 | 46.57 |

| Q4-2012 | 50 | 49.07 | 44.63 |

| Q1-2013 | 50 | 48.19 | 45.00 |

| Q2-2013 | 50 | 48.87 | 47.97 |

| Q3-2013 | 50 | 50.65 | 52.41 |

| Q4-2013 | 50 | 50.75 | 54.97 |

| Q1-2014 | 50 | 50.08 | 54.85 |

| Q2-2014 | 50 | 49.86 | 53.02 |

| Q3-2014 | 50 | 48.23 | 49.56 |

| Q4-2014 | 50 | 46.30 | 46.16 |

| Q1-2015 | 50 | 44.44 | 43.54 |

| Q2-2015 | 50 | 43.08 | 42.17 |

| Q3-2015 | 50 | 43.16 | 43.33 |

| Q4-2015 | 50 | 44.36 | 44.09 |

| Q1-2016 | 50 | 45.88 | 43.27 |

| Q2-2016 | 50 | 46.84 | 42.68 |

| Q3-2016 | 50 | 47.47 | 43.72 |

| Q4-2016 | 50 | 49.23 | 45.88 |

| Q1-2017 | 50 | 50.29 | 47.93 |

| Q2-2017 | 50 | 49.92 | 49.39 |

| Q3-2017 | 50 | 51.50 | 50.27 |

| Q4-2017 | 50 | 53.74 | 51.93 |

| Q1-2018 | 50 | 53.91 | 54.24 |

| Q2-2018 | 50 | 53.37 | 55.56 |

| Q3-2018 | 50 | 53.61 | 55.21 |

| Q4-2018 | 50 | 54.22 | 53.89 |

| Q1-2019 | 50 | 54.80 | 52.89 |

| Q2-2019 | 50 | 54.18 | 51.57 |

| Q3-2019 | 50 | 51.47 | 49.65 |

| Q4-2019 | 50 | 46.80 | 46.80 |

| Q1-2020 | 50 | 42.25 | 44.98 |

| Q2-2020 | 50 | 41.62 | 45.01 |

| Q3-2020 | 50 | 44.37 | 46.33 |

There is still growth in the price level both in the home and export market for overall manufacturing. Producers of consumer goods and intermediate goods, in particular, report increased prices for sales to the domestic market. Prices in the domestic market for capital goods were unchanged compared with the second quarter of 2020. Price growth in the export market is reported for both intermediate goods and consumer goods, while prices declines are reported for the producers of capital goods.

Figure 3. Prices on products for manufacturing. Changes from previous quarter. Smoothed seasonally adjusted

| Turning point value | Prices on products at home markets | Prices on products at export markets | |

| Q1-2011 | 50 | 55.80 | 52.84 |

| Q2-2011 | 50 | 54.83 | 49.98 |

| Q3-2011 | 50 | 52.59 | 46.56 |

| Q4-2011 | 50 | 51.99 | 44.99 |

| Q1-2012 | 50 | 51.87 | 45.54 |

| Q2-2012 | 50 | 51.44 | 46.21 |

| Q3-2012 | 50 | 51.90 | 45.44 |

| Q4-2012 | 50 | 51.77 | 44.44 |

| Q1-2013 | 50 | 51.08 | 45.04 |

| Q2-2013 | 50 | 52.20 | 47.17 |

| Q3-2013 | 50 | 53.14 | 50.00 |

| Q4-2013 | 50 | 53.61 | 53.05 |

| Q1-2014 | 50 | 54.37 | 53.30 |

| Q2-2014 | 50 | 54.18 | 51.54 |

| Q3-2014 | 50 | 53.37 | 50.82 |

| Q4-2014 | 50 | 53.05 | 51.71 |

| Q1-2015 | 50 | 51.06 | 50.62 |

| Q2-2015 | 50 | 48.67 | 49.44 |

| Q3-2015 | 50 | 48.27 | 49.77 |

| Q4-2015 | 50 | 48.75 | 49.02 |

| Q1-2016 | 50 | 49.61 | 47.87 |

| Q2-2016 | 50 | 50.33 | 47.80 |

| Q3-2016 | 50 | 50.04 | 47.87 |

| Q4-2016 | 50 | 49.58 | 47.91 |

| Q1-2017 | 50 | 50.28 | 49.59 |

| Q2-2017 | 50 | 51.73 | 51.08 |

| Q3-2017 | 50 | 53.23 | 52.29 |

| Q4-2017 | 50 | 54.34 | 53.30 |

| Q1-2018 | 50 | 55.49 | 55.17 |

| Q2-2018 | 50 | 56.29 | 56.12 |

| Q3-2018 | 50 | 56.41 | 55.22 |

| Q4-2018 | 50 | 56.19 | 53.53 |

| Q1-2019 | 50 | 55.55 | 52.04 |

| Q2-2019 | 50 | 54.38 | 51.44 |

| Q3-2019 | 50 | 54.10 | 51.89 |

| Q4-2019 | 50 | 54.68 | 53.30 |

| Q1-2020 | 50 | 54.43 | 53.24 |

| Q2-2020 | 50 | 54.13 | 52.32 |

| Q3-2020 | 50 | 54.17 | 51.66 |

Expecting further decline in the fourth quarter of 2020

The general outlook for the fourth quarter of 2020 is still affected by the Norwegian and global measures against the coronavirus pandemic. However, this pessimism is not as strong as it was in the third quarter of the previous survey. There are still a large proportion of industry leaders who report that the pandemic is the reason for the pessimism expressed in the index for the general outlook for the coming quarter. The general assessment is most negative among producers of capital goods and intermediate goods, while producers of consumer goods have a positive view of the outlook for the next quarter.

The industry leaders report that future investment plans are adjusted downwards and new orders from both the domestic and the export market are expected to decrease. The same applies to employment, which is expected to decline significantly in the fourth quarter of 2020 for manufacturing as a whole.

Figure 4. General judgement of the outlook in next quarter for manufacturing

| Turning point value | Smoothed seasonally adjusted | |

| Q1-2011 | 50 | 60.13 |

| Q2-2011 | 50 | 57.55 |

| Q3-2011 | 50 | 56.03 |

| Q4-2011 | 50 | 56.04 |

| Q1-2012 | 50 | 56.38 |

| Q2-2012 | 50 | 56.20 |

| Q3-2012 | 50 | 55.53 |

| Q4-2012 | 50 | 55.12 |

| Q1-2013 | 50 | 55.16 |

| Q2-2013 | 50 | 55.01 |

| Q3-2013 | 50 | 54.79 |

| Q4-2013 | 50 | 54.68 |

| Q1-2014 | 50 | 54.16 |

| Q2-2014 | 50 | 53.39 |

| Q3-2014 | 50 | 51.60 |

| Q4-2014 | 50 | 48.49 |

| Q1-2015 | 50 | 45.38 |

| Q2-2015 | 50 | 43.51 |

| Q3-2015 | 50 | 42.89 |

| Q4-2015 | 50 | 44.16 |

| Q1-2016 | 50 | 46.91 |

| Q2-2016 | 50 | 50.51 |

| Q3-2016 | 50 | 52.97 |

| Q4-2016 | 50 | 53.61 |

| Q1-2017 | 50 | 53.94 |

| Q2-2017 | 50 | 54.92 |

| Q3-2017 | 50 | 56.98 |

| Q4-2017 | 50 | 58.93 |

| Q1-2018 | 50 | 59.49 |

| Q2-2018 | 50 | 58.86 |

| Q3-2018 | 50 | 59.32 |

| Q4-2018 | 50 | 59.33 |

| Q1-2019 | 50 | 60.12 |

| Q2-2019 | 50 | 57.16 |

| Q3-2019 | 50 | 51.14 |

| Q4-2019 | 50 | 44.24 |

| Q1-2020 | 50 | 40.48 |

| Q2-2020 | 50 | 42.99 |

| Q3-2020 | 50 | 47.21 |

The industrial confidence indicator is positive

The industrial confidence indicator in the third quarter was 1.7, (seasonally-adjusted up from -9.6 in the previous quarter. This is the first time since the third quarter of 2019 that this indicator has been positive, but it is still below the historical average of 2.9.

The industrial confidence indicator is positive for both the majority of producers of intermediate goods and consumer goods, while it is still negative for producers of capital goods.

Values above zero indicate that total output will grow in the forthcoming quarter, while values below zero indicate that total output will fall. International comparisons of the industrial confidence indicator are available from Eurostat (EU), The Swedish National Institute of Economic Research and Statistics Denmark.

1 Industrial confidence indicator is the arithmetic average of the answers (balances) to the questions on production expectations, total stock of orders and inventories of own products (the latter with inverted sign).

Figure 5. Industrial confidence indicator¹

| Seasonally adjusted | Average 1990-2020 | |

| Q1-2011 | 9.1 | 2.9 |

| Q2-2011 | 8.5 | 2.9 |

| Q3-2011 | 5.7 | 2.9 |

| Q4-2011 | 6.0 | 2.9 |

| Q1-2012 | 9.0 | 2.9 |

| Q2-2012 | 6.4 | 2.9 |

| Q3-2012 | 0.8 | 2.9 |

| Q4-2012 | 4.9 | 2.9 |

| Q1-2013 | 1.4 | 2.9 |

| Q2-2013 | 1.0 | 2.9 |

| Q3-2013 | 6.3 | 2.9 |

| Q4-2013 | 8.0 | 2.9 |

| Q1-2014 | 6.5 | 2.9 |

| Q2-2014 | 6.1 | 2.9 |

| Q3-2014 | 1.9 | 2.9 |

| Q4-2014 | -1.7 | 2.9 |

| Q1-2015 | -3.6 | 2.9 |

| Q2-2015 | -9.3 | 2.9 |

| Q3-2015 | -6.4 | 2.9 |

| Q4-2015 | -8.2 | 2.9 |

| Q1-2016 | -6.6 | 2.9 |

| Q2-2016 | -3.0 | 2.9 |

| Q3-2016 | -3.6 | 2.9 |

| Q4-2016 | -0.5 | 2.9 |

| Q1-2017 | 1.6 | 2.9 |

| Q2-2017 | 2.5 | 2.9 |

| Q3-2017 | 3.8 | 2.9 |

| Q4-2017 | 6.5 | 2.9 |

| Q1-2018 | 6.9 | 2.9 |

| Q2-2018 | 8.8 | 2.9 |

| Q3-2018 | 9.2 | 2.9 |

| Q4-2018 | 8.9 | 2.9 |

| Q1-2019 | 7.9 | 2.9 |

| Q2-2019 | 5.8 | 2.9 |

| Q3-2019 | 0.8 | 2.9 |

| Q4-2019 | 0.0 | 2.9 |

| Q1-2020 | -17.0 | 2.9 |

| Q2-2020 | -9.6 | 2.9 |

| Q3-2020 | 1.7 | 2.9 |

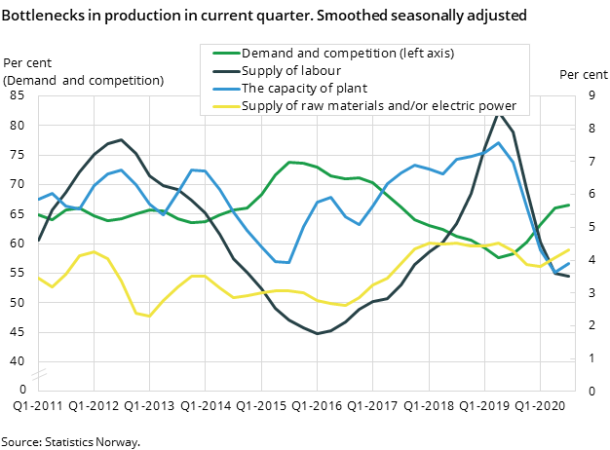

Weak demand and strong competition are limiting the production

An increasing share of managers is reporting that weak demand and strong competition were limiting factors for production increased in the third quarter of 2020. At the same time there is a low percentage of leaders who report that the capacity of plant and supply of the lack of qualified labour is a challenge.

The average capacity utilisation for Norwegian manufacturing is slightly higher than the previous quarter, and was calculated to 76.6 per cent at the end of the third quarter of 2020. The capacity utilisation is now significantly lower than in 2019, and is well below the historical average of 80.0 per cent. International comparisons of average capacity utilisation are available from Eurostat (EU).

Figure 7. Capacity utilisation in per cent for manufacturing

| Smoothed seasonally adjusted | Average 1990-2020 | |

| Q1-2011 | 79.5 | 80.04 |

| Q2-2011 | 79.8 | 80.04 |

| Q3-2011 | 79.6 | 80.04 |

| Q4-2011 | 79.6 | 80.04 |

| Q1-2012 | 79.7 | 80.04 |

| Q2-2012 | 79.7 | 80.04 |

| Q3-2012 | 79.8 | 80.04 |

| Q4-2012 | 79.8 | 80.04 |

| Q1-2013 | 79.4 | 80.04 |

| Q2-2013 | 79.3 | 80.04 |

| Q3-2013 | 79.5 | 80.04 |

| Q4-2013 | 80.0 | 80.04 |

| Q1-2014 | 80.4 | 80.04 |

| Q2-2014 | 80.5 | 80.04 |

| Q3-2014 | 80.1 | 80.04 |

| Q4-2014 | 79.3 | 80.04 |

| Q1-2015 | 78.4 | 80.04 |

| Q2-2015 | 77.4 | 80.04 |

| Q3-2015 | 76.7 | 80.04 |

| Q4-2015 | 76.9 | 80.04 |

| Q1-2016 | 77.1 | 80.04 |

| Q2-2016 | 77.2 | 80.04 |

| Q3-2016 | 77.0 | 80.04 |

| Q4-2016 | 76.9 | 80.04 |

| Q1-2017 | 77.1 | 80.04 |

| Q2-2017 | 77.6 | 80.04 |

| Q3-2017 | 77.8 | 80.04 |

| Q4-2017 | 77.8 | 80.04 |

| Q1-2018 | 78.3 | 80.04 |

| Q2-2018 | 78.8 | 80.04 |

| Q3-2018 | 79.3 | 80.04 |

| Q4-2018 | 79.5 | 80.04 |

| Q1-2019 | 79.6 | 80.04 |

| Q2-2019 | 79.6 | 80.04 |

| Q3-2019 | 79.2 | 80.04 |

| Q4-2019 | 78.1 | 80.04 |

| Q1-2020 | 76.7 | 80.04 |

| Q2-2020 | 76.1 | 80.04 |

| Q3-2020 | 76.6 | 80.04 |

Timelines

The survey data was collected in the period from 4 September to 20 October 2020.

Contact

-

Edvard Andreassen

-

Ståle Mæland

-

Statistics Norway's Information Centre