Content

Published:

Strong increase in household wealth

Average net worth for Norwegian households was NOK 2 million in 2012. This was 8 per cent higher than the year before.

| 2012 | 2011 - 2012 | |||

|---|---|---|---|---|

| Average for households with different property holdings (NOK) | Part of household with different property code (per cent) | NOK million | Percentage change | |

| Estimated real capital | 2 782 600 | 81.9 | 5 119 020 | 10.6 |

| Estimated market value primary dwelling | 2 795 100 | 67.4 | 4 229 032 | 10.4 |

| Estimated market value secondary dwelling | 2 125 000 | 10.6 | 506 258 | 18.5 |

| Taxable gross financial capital | 813 900 | 98.9 | 1 806 939 | 5.5 |

| Bank deposits | 384 900 | 98.8 | 853 896 | 8.3 |

| Shares and other securities | 1 391 400 | 21.1 | 658 124 | 3.1 |

| Share of unit trusts, bond and money market funds | 130 700 | 31.7 | 93 133 | 7.8 |

| Foreign taxable wealth | 295 600 | 5.3 | 35 397 | 0.1 |

| Estimated gross wealth | 3 116 400 | 99.0 | 6 925 959 | 9.2 |

| Debt | 1 325 700 | 83.5 | 2 485 133 | 7.5 |

| Study debt | 185 400 | 23.4 | 97 550 | 6.1 |

| Estimated net wealth | 1 988 800 | 99.4 | 4 440 826 | 10.2 |

| Positive net wealth | 2 550 100 | 81.3 | 4 653 874 | 8.9 |

| Negative net wealth | -522 300 | 18.2 | -213 048 | -11.9 |

| Property taxes | 28 900 | 19.9 | 12 909 | 4.5 |

There was a substantial rise in non-financial wealth in 2012, the principal wealth holding of Norwegian households. The total value of primary and secondary dwellings rose by 10 per cent and 18 per cent respectively. The value of non-financial assets grew faster than both financial wealth and liabilities in 2012.

Highest net worth among younger pensioners

Households where the main income earner was aged 67 to 79 had the highest average net worth in 2012, at NOK 3.2 million. Even households headed by someone aged 55 to 66 had a mean net worth exceeding NOK 3 million. More than half of all households had a net worth of more than NOK 1 million in 2012.

Small reduction in inequality

The distribution of net worth is highly skewed. Households in the highest net worth decile held 49 per cent of total net worth in 2012, while 18 per cent of total net worth was held by households in the top 1 per cent of the wealth distribution. The wealth distribution has, nevertheless, become slightly less unequal in recent years. In 2010, the highest net worth decile held 51 per cent of total net worth.

Increase in liabilities

On average, all households had NOK 1.1 million in debt in 2012. This was an increase of 5.6 per cent from the previous year. Households with the highest income saw the strongest rise in debt in 2012, while households at the bottom of the income distribution saw a reduction in average debt.

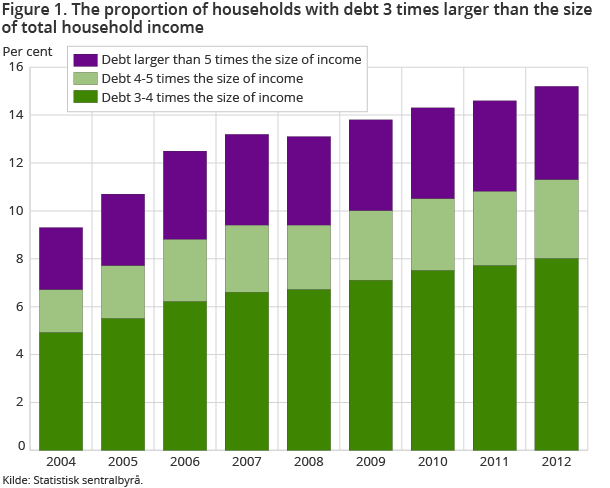

More people are facing a high debt as a proportion of household income. In 2012, 15.2 per cent of all households had a debt that was three times their income. This was up from 14.6 per cent in 2011.

Assessed market value of own dwelling Open and readClose

The values for private dwellings are based on a model developed by Statistics Norway where house prices are calculated for all dwellings based on the actual selling price of a majority of dwellings sold on the private market. Data from this model is currently used by the Directorate of Taxes when assessing tax values for the principal residence and other private dwellings. In the tax return, the principal dwelling is assessed at a value of 25 per cent of assessed market value, while other private dwellings are valued at 40 per cent of market value.In the wealth statistics, the full market price is applied. Further information on the wealth statistics can be found in the report: Wealth distribution in Norway .

The statistics is published with Income and wealth statistics for households.

Additional information

The statistics are based on register data, including all persons in private households. Persons in student households are not included. Registered cash income and debt and wealth registered in the tax assessment are included.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42