Content

Published:

This is an archived release.

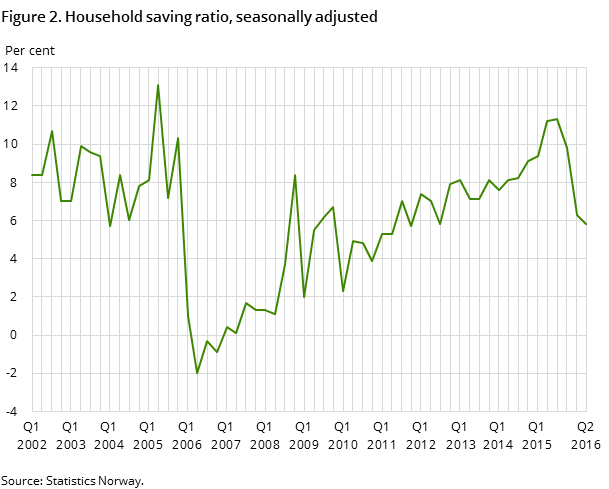

Lower household saving

According to seasonally-adjusted figures, disposable income in households and non-profit institutions serving households increased by NOK 3.6 billion from the previous quarter, while savings were reduced.

| 3rd quarter 2015 | 4th quarter 2015 | 1st quarter 2016 | 2nd quarter 2016 | |

|---|---|---|---|---|

| Compensation of employees | 366 681 | 367 929 | 366 443 | 366 154 |

| Disposable income | 356 408 | 360 619 | 353 010 | 356 680 |

| Total consumption | 336 064 | 341 936 | 347 423 | 352 359 |

| Saving, net | 42 803 | 37 112 | 23 658 | 21 718 |

| Savings ratio (per cent) | 11.3 | 9.8 | 6.4 | 5.8 |

| Real disposable income, growth | 0.5 | -0.3 | -5.1 | 2.0 |

Compensation of employees was at NOK 366 billion in the 2nd quarter 2016, almost unchanged from the previous quarter, according to preliminary and seasonally adjusted figures. An increase in property income and reduction in property expenses and an increase in pensions and benefits, mainly work-related benefits, from the public sector helped to draw up the disposable income. It was a seasonally adjusted increase in disposable income in the 2nd quarter 2016 of about NOK 3.6 billion, or 1 percent increase. Seasonally adjusted consumption increased by 1.4 percent, and savings decreased by NOK 2 billion to NOK 22 billion. The seasonally adjusted savings rate ended at 5.8 per cent.

Accumulated over the first two quarters in 2016, the disposable income in the corporate sector was higher compared with the first two quarters of 2015. It was mainly the non- financial enterprises that contributed positively, while the financial sector had a decrease in disposable income. The fixed capital formation of the enterprises declined and helped to reduce their net borrowing compared to last year.

In the general government, however, the expenditures for both consumption and the fixed capital formation increased. In addition, the income was slightly lower than in the same period in 2015, so that net lending has been reduced.

RevisionsOpen and readClose

Quarterly sector accounts are based on preliminary calculations. The uncertainty in the last quarter is the largest. New information is continuously being integrated into the figures, which could cause revisions in the previously released data. Quarterly sector accounts are also consolidated against the data from the quarterly national accounts data. When the last quarters of the unadjusted series are updated, seasonally-adjusted series may also be revised backwards.

Additional information

Contact

-

Pål Sletten

E-mail: pal.sletten@ssb.no

tel.: (+47) 99 29 06 84

-

Nils Amdal

E-mail: nils.amdal@ssb.no

tel.: (+47) 91 14 91 46