Content

Published:

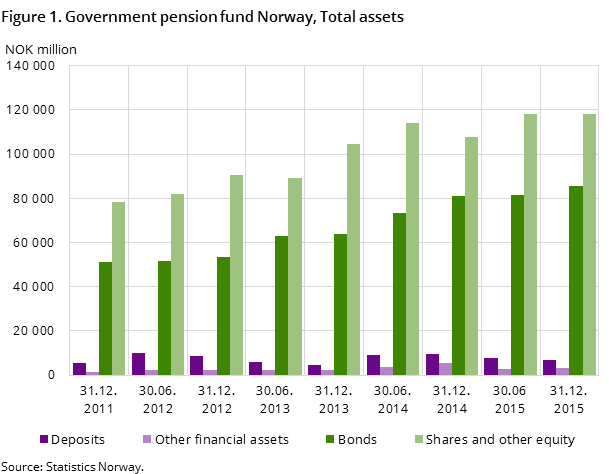

Increase in Government Pension Fund Norway

The balance sheet for Government Pension Fund Norway shows an increase of almost 7 per cent in the fund’s net assets.

| 2nd half year 2015 | 2nd half year 2015 | 2nd half year 2005 | 2nd half year 2005 | |

|---|---|---|---|---|

| Million kroner | Percentage of total assets | Million kroner | Percentage of total assets | |

| Deposits in total | 7 003 | 3.3 | 1 245 | 0.7 |

| Commercial papers | 0 | 0.0 | 4 536 | 2.4 |

| Bonds | 85 711 | 40.1 | 34 268 | 17.9 |

| Shares and other equity | 118 047 | 55.2 | 50 575 | 26.4 |

| Loans | 0 | 0.0 | 96 625 | 50.5 |

| Other financial assets | 3 060 | 1.4 | 4 102 | 2.1 |

| Non-financial assets | 0 | 0.0 | 0 | 0.0 |

| Total assets | 213 821 | 100.0 | 191 348 | 100.0 |

At the end of 2015, the total assets were valued at NOK 214 billion, Shares and other equity accounted for 55.2 per cent of the total portfolio and bonds accounted for 40.1 per cent. The shares have increased by 9.6 per cent, to a total value of NOK 118 billion and the bonds have increased by 5.9 per cent, to a total value of NOK 86 billion at the end of 2015. The fund also had deposits worth NOK 7 billion and other financial assets worth NOK 3 billion at the end of 2015.

Last publicationOpen and readClose

These statistics were originally published to offer the public access to short-term statistics that show the development of the Government pension fund - Norway's financial position at the end of June and end of December each year. Quarterly figures are now available from Folketrygdfondet, so Statistics Norway will no longer publish figures.

Government Pension Fund NorwayOpen and readClose

Through the Government Pension Fund Act, the Storting has made the Ministry of Finance responsible for the management of the Government Pension Fund Norway (GPFN). Operational management of the Fund is carried out by Folketrygdfondet. The capital base of the GPFN originates primarily from surpluses in the national insurance scheme between the introduction of the national insurance scheme in 1967 and the late 1970s. The objective for the management of the Fund is to maximise financial returns measured in Norwegian kroner, given a moderate level of risk. The main part of the assets of the GPFN is invested in the Norwegian equity and fixed income markets.

Contact

-

Eivind Andreas Sirnæs Egge

E-mail: eivind.egge@ssb.no

tel.: (+47) 91 69 05 03