Content

Published:

This is an archived release.

Upward revision of tax revenues

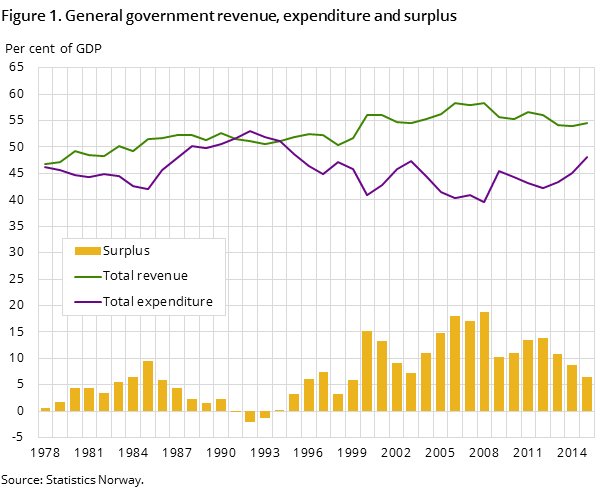

General government surplus for 2015 is now estimated at NOK 201 billion, up NOK 15 billion from the previous estimate.

| 2011 | 2012 | 2013 | 2014 | 2015 | |

|---|---|---|---|---|---|

| General government revenue | 1 580 595 | 1 664 677 | 1 662 578 | 1 693 351 | 1 698 382 |

| General government expenditure | 1 205 122 | 1 254 127 | 1 331 246 | 1 418 071 | 1 497 540 |

| Net lending/borrowing (-) | 375 474 | 410 551 | 331 332 | 275 280 | 200 842 |

| Central government net lending/borrowing | 394 979 | 427 676 | 354 512 | 298 453 | 214 100 |

| Local government net lending/borrowing | -19 505 | -17 126 | -23 180 | -23 173 | -13 259 |

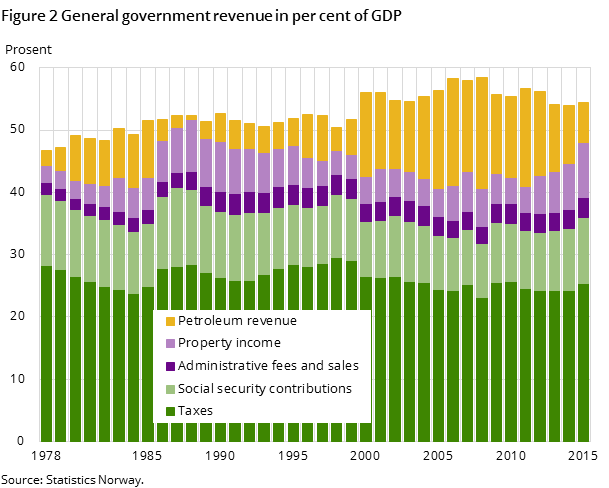

The statistics have been updated based on new accounting information and tax estimates. Ordinary income tax has been significantly revised upwards due to a doubling of household dividends from 2014 to 2015. The increased dividends result in higher tax revenues in both central and local government. Despite this upward revision of taxes, the 2015 surplus is still significantly lower than in the preceding years, owing to the substantial fall in petroleum revenues combined with a steady growth in government expenditure.

For more comprehensive information on last year’s development, please refer to the February 2016 publication.

This page has been discontinued, see General government revenue and expenditure, Quarterly.

Contact

-

Eivind Andreas Sirnæs Egge

E-mail: eivind.egge@ssb.no

tel.: (+47) 91 69 05 03

-

Frode Borgås

E-mail: frode.borgas@ssb.no

tel.: (+47) 40 90 26 52

-

Aina Johansen

E-mail: aina.johansen@ssb.no

tel.: (+47) 40 90 26 66