Content

Published:

This is an archived release.

Net financial assets reach new heights

At the end of 2012, general government net financial assets totalled NOK 4 871 billion. This is an increase of NOK 527 billion from 2011.

| 2011 | 2012 | |||

|---|---|---|---|---|

| Stocks per 31.Dec | Transactions | Other change | Stocks per 31.Dec | |

| Assets | ||||

| Currency and Deposits | 169 101 | 62 590 | -313 | 231 378 |

| Bonds | 1 416 598 | 155 323 | -38 993 | 1 532 928 |

| Loans | 574 560 | 32 569 | -2 407 | 604 722 |

| Shares and other equity | 2 815 692 | 229 722 | 155 074 | 3 200 488 |

| Other accounts receivable | 302 335 | 4 161 | -3 743 | 302 753 |

| TOTAL ASSETS | 5 278 284 | 484 365 | 109 618 | 5 872 268 |

| Liabilities | ||||

| Bonds | 466 884 | 56 100 | -1 499 | 521 485 |

| Loans | 329 547 | 8 797 | -1 230 | 337 114 |

| Oher accounts payable | 137 139 | 5 050 | 142 | 142 331 |

| TOTAL LIABILITIES | 933 569 | 69 947 | -2 588 | 1 000 929 |

| Net financial assets | 4 344 715 | 4 871 339 | ||

| Net lending | 414 419 | |||

| Net revaluations | 112 205 | |||

General government’s financial assets amounted to NOK 5 872 billion in 2012; an increase of NOK 594 billion from the previous year. At the same time, debt increased by NOK 67 billion to NOK 1 001 billion. Of general government total financial assets, shares and other equity constituted 55 per cent, while long-term bonds and loans made up 26 and 10 per cent respectively. Of total financial debt, the increase was mostly in issued long-term bonds, which increased to 31 per cent of the debt portfolio. However, loans remained the largest liability item making up 34 per cent of the total debt.

Central government net financial assets surpassed NOK 5 000 billion

Central government’s return on its investment in shares was strongly positive in 2012. Revaluations, due to higher share prices and foreign exchange profits, amounted to NOK 156 billion. Combined with net purchases of shares and other equity amounting to NOK 230 billion, central government’s portfolio of shares and equity rose to NOK 3 136 billion at the end of 2012. This constitutes nearly 56 per cent of central government’s financial assets. In 2002, the corresponding figure was 38 per cent. The increase was mostly due to the decision to increase the portion of the Government Pension Fund Global invested in shares. Central government also benefitted from increased value on investments in shares in corporations such as Statoil ASA and Telenor ASA.

Central government investments in long-term bonds amounted to NOK 1 521 billion at the end of 2012. This constituted 27 per cent of total assets. Total assets amounted to NOK 5 630 billion, while total debt was NOK 607 billion.

Deficit for local government

Local government has had substantial deficits in all previous years. In 2012, the deficit, measured by net financial investments, amounted to NOK 17 billion. This was financed by incurring increased debt in long-term bonds, loans and other accounts payable, of which the latter consists mainly of short-term debt.

At the end of 2012, local government net financial debt amounted to more than NOK 150 billion, of which financial assets amounted to NOK 263 billion and total debt was NOK 415 billion.

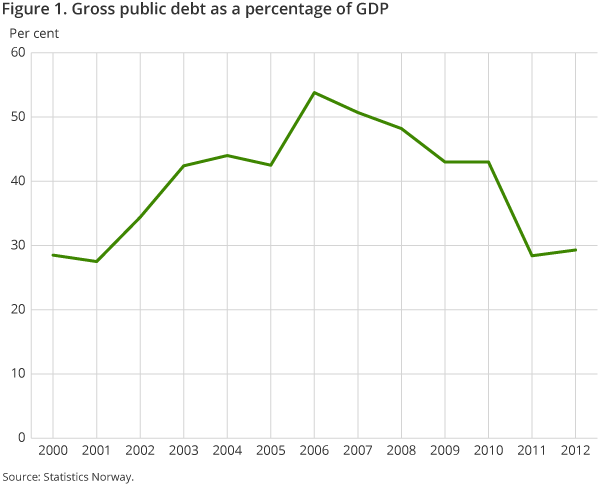

General government’s gross debt 29.4 per cent of GDP

One of the main criteria of the Maastricht Treaty is that a country’s gross public debt should not exceed 60 per cent of its gross domestic product (GDP). Gross public debt, as defined in the Maastricht Treaty, is often used in international comparisons. It includes gross debt from bonds, loans, certificates, commercial papers and treasury bills, measured at nominal value and consolidated for debt between different units within general government.

At the end of 2012, general government gross debt was NOK 853 billion or 29.4 per cent of GDP. The gross debt fell substantially from 2010, when it was 43 per cent of GDP, to 2011 when it was 28.4 per cent. The reduction was mostly due to reduced repurchase agreements utilised in the administration of the Government Pension Fund Global.

Local government debt and interest expense Open and readClose

Municipalities and county authorities have increased their debt in recent years. At the end of 2005, the debt amounted to NOK 227 billion. At the end of 2012 this had increased to NOK 415 billion. However, not all of the debt affects the local government budgets, as a large portion of the debt is related to tasks which do not, or only partly, incur increased interest expenses. Some of the interest expense is routed onward to households, such as housing loans from Husbanken (The Norwegian State Housing Bank). Others are tied to compensation agreements for schools and churches, where central government covers the interest expense. Further interest expense is closely related to services that are financed through fees from the public. This is often the case with regards to water, sewage and waste management. Local government also has bank deposits and other assets, for instance from unused loans, which reduces the net interest expense. In the National budget for 2013, it is estimated that if the aforementioned is taken into consideration, only a third of the local government debt will affect the local government budgets through interest expenses. Two thirds of the interest expense is thus paid indirectly by others, through municipalities receiving corresponding interest income, compensation from central government or fees from its inhabitants.

Liabilities connected to the Government Pension Fund GlobalOpen and readClose

Repurchase agreements and re-sale agreements in securities are frequently used instruments in the administration of the Government Pension Fund Global. The fund sells a portfolio of securities accompanied by a repurchase agreement. However, in the accounts, the portfolio remains on the asset side of the fund’s balance sheet, as does the cash received for the sale. The corresponding sales value is then entered as a loan from the buyer on the liability side of the balance sheet. The reverse situation is called a re-sale agreement or a reversed repo.

The European System of Accounts (ESA) requires repurchase agreements to be included in the balance category loans. This means that liabilities associated with repos in the Government Pension Fund Global are included in the official estimation of Norway’s gross debt. As repurchase agreements inflate both sides of the balance sheet, the gross debt, calculated according to ESA, presents a misleading picture of the financial situation of the general government in Norway.

Planned changes in the national accounts statisticsOpen and readClose

New revised figures for national accounts and related statistics will be published in November and December 2014. Statistics Norway complies with international guidelines in its preparation of national accounts and statistics on foreign affairs. New international guidelines have now been issued for these statistics. Statistics Norway is currently in the process of implementing the changes, in addition to new source data for some of the statistics.

This page has been discontinued, see General government, financial assets and liabilities, Quarterly.

Additional information

Contact

-

Jostein Birkelund

E-mail: jostein.birkelund@ssb.no

tel.: (+47) 40 90 26 55

-

Achraf Bougroug

E-mail: achraf.bougroug@ssb.no

tel.: (+47) 40 90 26 15

-

Frode Borgås

E-mail: frode.borgas@ssb.no

tel.: (+47) 40 90 26 52