Content

Published:

This is an archived release.

Significant increase in financial assets

By the end of 2014, general government financial assets amounted to NOK 8 666 billion, which corresponds to an increase of NOK 1 324 billion, or 18 per cent, compared to the previous year.

| 2013 | 2014 | |||

|---|---|---|---|---|

| Stocks per 31.Dec | Transactions | Other change | Stocks per 31.Dec | |

| Assets | ||||

| Currency and Deposits | 191 274 | 36 079 | 750 | 228 103 |

| Bonds | 1 943 883 | 76 330 | 392 616 | 2 412 829 |

| Loans | 683 447 | -57 400 | 9 106 | 635 153 |

| Shares and other equity | 4 161 319 | 161 138 | 689 019 | 5 011 476 |

| Insurance technical reserves | 52 561 | 1 488 | 8 408 | 62 457 |

| Other accounts receivable | 309 519 | 11 590 | -5 531 | 315 578 |

| TOTAL ASSETS | 7 342 003 | 229 225 | 1 094 368 | 8 665 596 |

| Liabilities | ||||

| Bonds | 502 816 | 8 568 | 8 215 | 519 599 |

| Loans | 428 150 | -67 692 | 3 907 | 364 365 |

| Oher accounts payable | 142 319 | 1 971 | 0 | 144 290 |

| TOTAL LIABILITIES | 1 073 285 | -57 153 | 12 122 | 1 028 254 |

| Net financial assets | 6 268 718 | 7 637 342 | ||

| Net lending | 286 378 | |||

| Net revaluations | 1 082 246 | |||

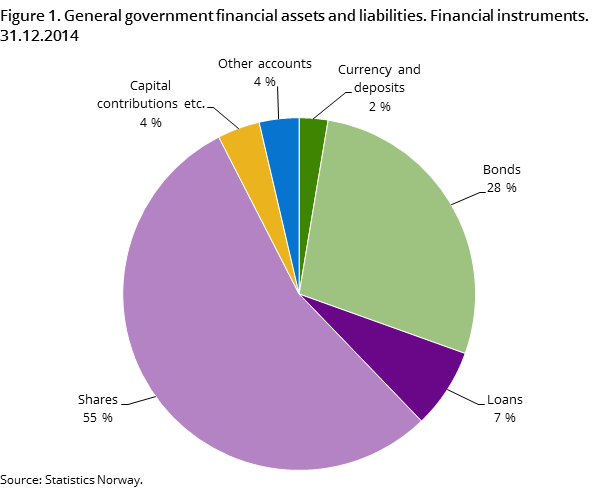

Of the total financial assets in general government, 55 per cent were invested in shares and equities. Investments in bonds and loans amounted to 28 per cent and 7 per cent respectively. The total general government debt amounted to NOK 1 028 billion. This is a decrease of 4 per cent compared with 2013.

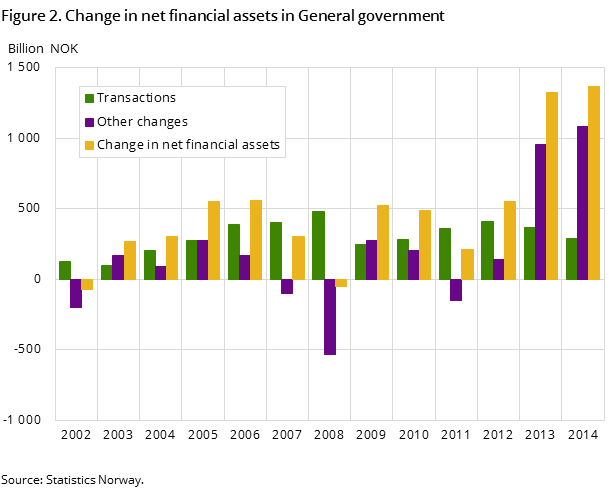

Revaluations make large contribution to increase in financial assets

Although revenues from petroleum-related activities have declined over the past few years they still contribute to a significant surplus in central government. Based on an operation surplus of NOK 310 billion, the central government acquired bonds, securities and equities worth NOK 223 billion and redeemed NOK 87 billion worth of debt. However, the largest contribution to central government’s net assets is not related to the operation surplus; revaluations in terms of capital gains and gains from depreciation of the Norwegian krone account for NOK 1 084 billion, or 83 per cent, of the total increase in central government financial assets in 2014.

Reduction of central government debt

In 2014 there has been a decrease in central government debt of NOK 76 billion. The reduction in total debt is related to the termination of financial crisis measures that the central government introduced in early 2009 to ensure liquidity to Norwegian banks. The reduction in government debt is also due to a continuous decrease in repurchase agreements utilised in the administration of Government Pension Fund Global. These economic events are illustrated by a decrease in debt securities and loans. At the end of 2014, general government gross debt was NOK 832 billion or 26,4 per cent of GDP.

Increased debt in local government

Recent years have been characterised by a large operating deficit in the local government. Accumulated, these deficits add up to more than NOK 100 billion over the last 5 years. As a result, the total debt in local government amounts to NOK 485 billion; an increase of NOK 124 billion, or 34 per cent, compared to 2010. However, part of this debt has little or no impact on the current expenditures. Part of the debt is reallocated to the households and business sector. Furthermore, a portion of the debt is loans where interest expenditures are compensated by the central government.

Liabilities connected to the Government Pension Fund GlobalOpen and readClose

Liabilities connected to the Government Pension Fund Global Repurchase agreements and re-sale agreements in securities are frequently used instruments in the administration of the Government Pension Fund Global. The fund sells a portfolio of securities accompanied by a repurchase agreement. However, in the accounts, the portfolio remains on the asset side of the fund’s balance sheet, as does the cash received for the sale. The corresponding sales value is then entered as a loan from the buyer on the liability side of the balance sheet. The reverse situation is called a re-sale agreement or a reversed repo.

This page has been discontinued, see General government, financial assets and liabilities, Quarterly.

Additional information

Contact

-

Jostein Birkelund

E-mail: jostein.birkelund@ssb.no

tel.: (+47) 40 90 26 55

-

Achraf Bougroug

E-mail: achraf.bougroug@ssb.no

tel.: (+47) 40 90 26 15

-

Frode Borgås

E-mail: frode.borgas@ssb.no

tel.: (+47) 40 90 26 52