Content

Published:

This is an archived release.

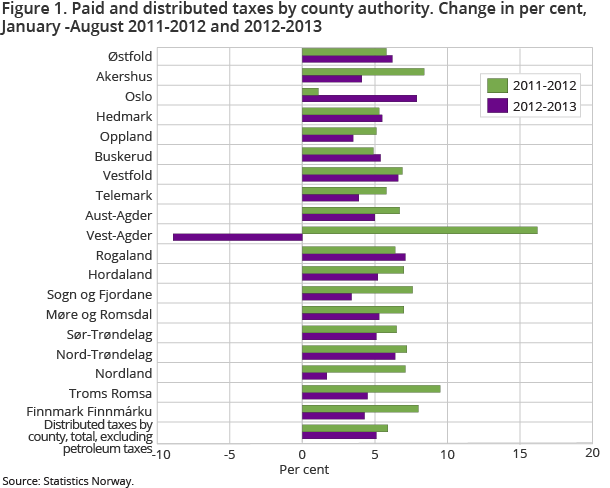

Low increase in tax payments

So far this year, NOK 589.7 billion has been paid in taxes in Norway. NOK 374.4 billion of this was paid through the advance tax arrangement and NOK 150.2 billion was from taxes on petroleum extraction. This is an increase of 3.9 per cent compared to the same period last year.

| Distributed taxes. Accumulated figures so far this year | Change in per cent compared to same period previous year | |||

|---|---|---|---|---|

| August 2012 | August 2013 | August 2012 | August 2013 | |

| Total | 567 771 | 589 728 | 9.0 | 3.9 |

| Ordinary taxes to central government | 19 948 | 20 542 | 33.0 | 3.0 |

| Ordinary taxes on extraction of petroleum | 56 641 | 56 325 | 17.9 | -0.6 |

| Special income tax on extraction of petroleum | 93 430 | 93 833 | 18.6 | 0.4 |

| Tax equalization tax to central government | 143 128 | 147 385 | 2.3 | 3.0 |

| Ordinary taxes to county authority (incl. Oslo) | 16 033 | 17 092 | 6.7 | 6.6 |

| Ordinary taxes to municipalities | 75 354 | 80 597 | 5.4 | 7.0 |

| Member contributions to the National Insurance Scheme | 66 251 | 69 647 | 6.9 | 5.1 |

| Employer contributions to the National Insurance Scheme | 94 333 | 101 657 | 6.5 | 7.8 |

| Taxes on dividends to foreign shareholders | 2 653 | 2 651 | 30.6 | -0.1 |

NOK 36.2 billion was paid in taxes in August this year. The majority of the payments were from taxes on petroleum extraction, which accounted for NOK 30.9 billion of this. So far this year, there is only a 0.1 per cent increase in taxes on petroleum extraction from the same period last year, and this is also the reason for the low increase of 3.9 per cent in the overall tax payments.

Through the advance tax arrangement and non-personal taxpaying arrangement, excluding taxes on petroleum extraction, a total of NOK 439.6 billion has been paid. Compared to last year, this is an increase of 5.2 per cent, or NOK 21.9 billion. Contributions to the National Insurance Scheme accounted for NOK 171.3 billion of the payments through the advance tax arrangement, which is an increase of 6.7 per cent.

Contact

-

June Solås

E-mail: june.solas@ssb.no

tel.: (+47) 98 87 46 76

-

Bjørn Gran-Henriksen

E-mail: bjorn.gran-henriksen@ssb.no

tel.: (+47) 41 40 20 71