Content

Published:

This is an archived release.

Oil and natural gas pulled PPI down

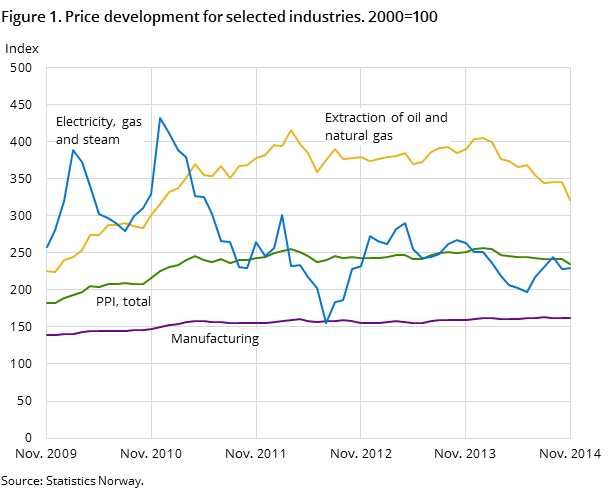

The producer price index for oil and gas, manufacturing, mining and electricity (PPI) decreased by 2.8 per cent from October to November 2014, mainly due to lower prices in crude oil, natural gas and petroleum products.

| Per cent | Index | Weights1 | ||

|---|---|---|---|---|

| November 2014 / October 2014 | November 2014 / November 2013 | November 2014 | ||

| 1The weights are updated annually, and are valid for the entire year. | ||||

| Industrial Classification | ||||

| Extraction, mining, manufacturing and electricity | -2.8 | -6.6 | 234.7 | 1 000.0 |

| Extraction and related services | -5.8 | -14.1 | 335.1 | 479.1 |

| Mining and quarrying | -3.4 | 2.0 | 167.0 | 11.5 |

| Manufacturing | -0.4 | 1.3 | 161.5 | 463.0 |

| Food, beverages and tobacco | 1.0 | 4.8 | 158.5 | 98.8 |

| Refined petroleum, chemicals, pharmaceuticals | -3.1 | -7.4 | 206.1 | 135.4 |

| Basic metals | 2.5 | 18.6 | 185.4 | 36.8 |

| Machinery and equipment | 0.3 | 3.7 | 156.9 | 42.0 |

| Electricity, gas and steam | 0.7 | -12.9 | 229.8 | 46.4 |

The PPI was 234.7 (with 2000=100) in November, which is 2.8 per cent down from October. A reduction in the total index can be explained by a price fall within extraction of oil and natural gas as well as lower prices in refined petroleum products.

Price falls in crude oil and natural gas

The price on crude oil, Brent Blend measured in Norwegian kroner, fell by 6.7 per cent from October to November. The prices of natural gas decreased in the same period. This led to a price reduction within ‘extraction of oil and natural gas’. The price of crude oil has been falling since June 2014, mainly due to market oversupply caused by the extraction of shale oil in the United States. The price decline in natural gas may partly be explained by the agreement between Russia and Ukraine, ensuring Ukraine will be supplied with gas throughout the winter and stable supplies of gas to the rest of Europe.

The import-weighted exchange rate index from the Norwegian Central Bank shows that the Norwegian currency has depreciated by 1.94 per cent compared with Norwegian trading partners from October to November 2014. The weakening in the Norwegian currency may help to explain why prices fell more in the export market than in the domestic market.

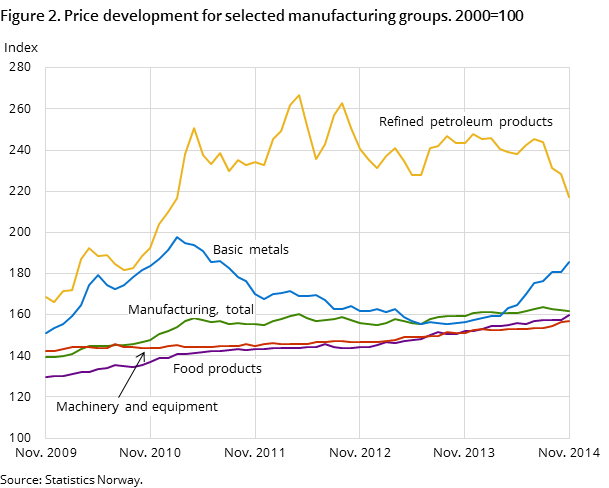

Weak price fall within manufacturing

Within manufacturing, prices fell by 0.4 per cent, mainly due to a reduction in prices of refined petroleum products of nearly 5 per cent.

A price rise within ‘food, beverages and tobacco’ as well as basic metals, by 1.0 and 2.5 per cent respectively, contributed to dampen the total decline in the PPI from October to November.

Twelve month rate – PPI down 6.6 per cent

The PPI decreased by 6.6 per cent from November 2013 to November 2014. This was mainly due to a decline in the index of ‘extraction of oil and natural gas’. Lower prices within ‘refined petroleum products’ and electricity were also important contributors to the decrease in the overall index during the twelve-month period.

Additional information

Contact

-

Producer price index

E-mail: produsentpris@ssb.no

tel.: (+47) 21 09 40 00

-

Elisabeth Mælum

E-mail: elisabeth.maelum@ssb.no

tel.: (+47) 97 01 28 49

-

Morten Madshus

E-mail: morten.madshus@ssb.no

tel.: (+47) 40 90 26 94

-

Monika Græsli Engebretsen

E-mail: monika.graesli.engebretsen@ssb.no

tel.: (+47) 40 90 23 71

-

Håvard Georg Jensen

E-mail: havard.jensen@ssb.no

tel.: (+47) 40 90 26 86