Strong balance of income and current transfers

Published:

Balance of income and current transfers were measured at almost NOK 39 billion in the 1st quarter of 2020. This is the highest ever measured in a quarter. Investment income is contributing with net income of NOK 46 billion while net current transfers is cutting the balance of income and current transfers with about NOK 7 billion.

- Full set of figures

- International accounts

- Series archive

- Balance of payments (archive)

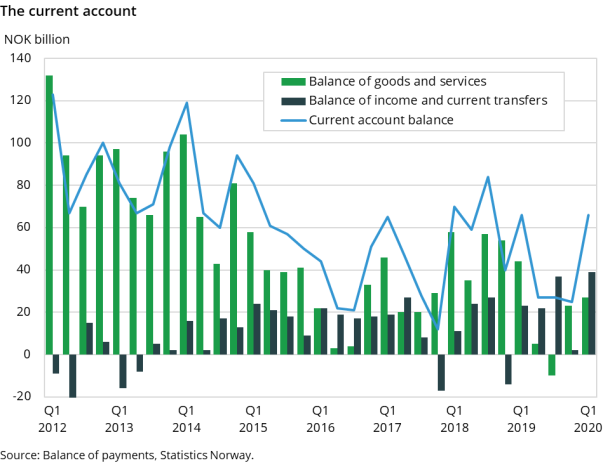

Preliminary figures for the 1st quarter of 2020 shows that Covid 19 had little impact on Norway's economic relations with foreign countries, although the pandemic disease had a marked impact on the travel figures in the balance of payments. The 1st quarter of the year shows a fall of 5.5 billion and 1.7 billion on imports and exports, respectively. This is a sharp fall considering that the effect is mainly due to the virus outbreak in Norway in the beginning of March. But there are other factors that have had a greater effect on the development of expenses and income in the balance of payments account.

Export and imports

Exports of goods and services in the 1st quarter of 2020 ended at NOK 320 billion. This is almost NOK 16 billion less than in the same quarter in 2019, and NOK 27 billion less than the last quarter. The income from crude oil and natural gas accounts for 35 percent of the total export value, even though income of crude oil and natural gas was NOK 22 billion less than it was in the 1st quarter of 2019. The major decline in income in the industry for crude oil and natural gas was solely due to a sharp reduction in oil and gas prices. Figures from national accounts shows a volume growth of crude oil and natural gas of almost 6 percent in the 1st quarter of 2020 from the same quarter in 2019, while the prices fell by more than 20 percent. The exports of services contribute NOK 7 billion to the total exports.

The preliminary figures of total import in the 1st quarter of 2020 are NOK 293 billion, which is about NOK 1 billion more than in the same quarter in 2019. We see a steady rise in most items of goods and services, but, as already mentioned, the imports of travel go down sharply in the 1st quarter of 2020, and this slows the growth of imports.

For more information about exports and imports, including price and volume considerations and seasonal adjustments, please see the quarterly national accounts.

The balance of income and current transfers

The balance of income and current transfers is historical high, with a surplus of almost NOK 39 billion in the 1st quarter of 2020. As the Government Pension Fund Global has grown large, the importance of income from the Fund has made itself well visible on the total income and current transfers balance. At the same time the fluctuations from quarter to quarter is substantial. Payments of dividends from companies are often linked to fixed quarters. In addition, the exchange rate fluctuations affect the magnitude of the flows since income and expenses are measured in Norwegian kroner. In the 1st quarter of 2020 the Norwegian krone has weakened somewhat against foreign currencies, particularly at the end of the quarter. This has made the income higher as it is measured in Norwegian kroner. Compared to the 1st quarter of 2019, total income was NOK 13 billion higher in the 1st quarter of 2020. At the same time, the expenses were NOK 3 billion lower. The high growth in income is primarily due to higher income to the Government Pension Fund Global.

The financial account

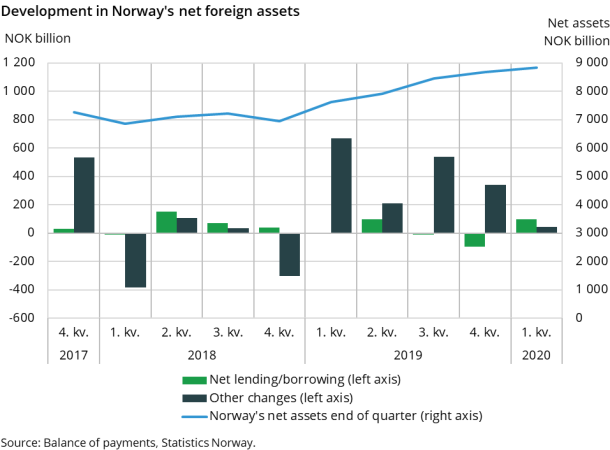

At the end of the 1st quarter of 2020, Norway’s net foreign assets amounted to NOK 8,828 billion. This was an increase of NOK 140 billion from the previous quarter.

Financial transactions

Net lending contributed the most to the rise of net foreign assets in the first quarter of the year, amounting to NOK 99 billion. During this quarter, Norwegians invested NOK 337 billion abroad, primarily driven by investments in debt securities, which are classified under Portfolio investment.

At the same time, Norwegians incurred liabilities of NOK 238 billion against the rest of the world. There was a rise in other accounts payable, and Norwegian banks increased their deposits from abroad.

Other changes

The Norwegian krone depreciated against foreign currencies during the first quarter of the year, leading to a positive effect on other changes due to exchange rate changes. At the same time, the global stock markets saw a considerable downturn, giving an opposite effect on other changes through negative market price changes. In total, other changes contributed positively to net foreign assets.

Contact

-

Håvard Sjølie

-

Linda Wietfeldt

-

Mats Kristoffersen

-

Statistics Norway's Information Centre