Content

Published:

This is an archived release.

Higher profitability

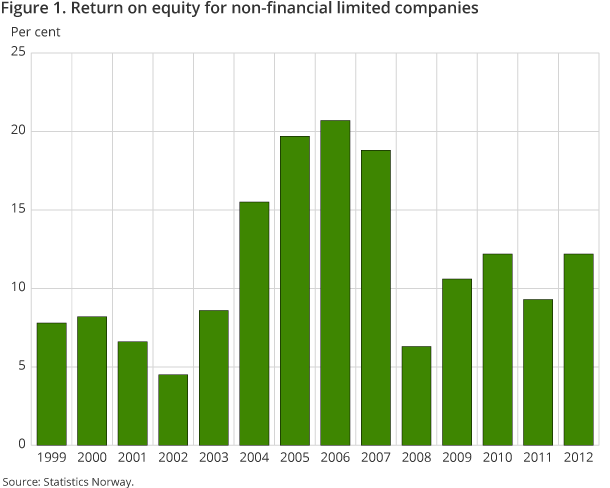

Profitability for non-financial limited companies rose in 2012 but was still lower than in the peak years of the mid-2000s.

| NOK million | Per cent | ||

|---|---|---|---|

| 2012 | 2011 | 2011 - 2012 | |

| Income statement | |||

| Operating income | 4 826 281 | 4 662 503 | 3.5 |

| Operating profit | 677 432 | 619 628 | 9.3 |

| Operating profit before tax | 836 985 | 714 462 | 17.1 |

| Net profit | 491 646 | 358 325 | 37.2 |

| Balance sheet | |||

| Fixed assets | 6 915 223 | 6 604 059 | 4.7 |

| Current assets | 2 694 058 | 2 772 700 | -2.8 |

| Equity | 3 981 606 | 3 883 398 | 2.5 |

| Liabilities | 5 627 675 | 5 493 361 | 2.4 |

| Per cent | Percentage points | ||

| Key figures | |||

| Operating profit margin | 14.0 | 13.3 | 0.7 |

| Return on total assets | 10.1 | 9.2 | 0.9 |

| Return on equity | 12.3 | 9.3 | 3.0 |

| Equity ratio | 41.4 | 41.4 | 0.0 |

Non-financial limited companies had higher operating profits in 2012 than in 2011. The operating profit margin as a percentage increased from 13.3 to 14.0. Coupled with an increase in net financial items, this resulted in a rise in net profit in 2012 compared to the previous year. Returns on equity consequently went up from 9.3 per cent in 2011 to 12.3 per cent in 2012, which was nevertheless lower than in the mid-2000s, when return on equity was approximately 20 per cent.

Highest profitability in petroleum activities and ocean transport

Profitability was highest in petroleum activities and ocean transport, where return on equity was 16.2 per cent in 2012. The corresponding figure for mainland Norway was 10.9 per cent. Returns on equity rose in mainland Norway but fell in petroleum activities and ocean transport. However, petroleum activities and ocean transport contributed 65 per cent of the operating profit and 52 per cent of the profits before tax in 2012.

New institutional sector classificationOpen and readClose

A new institutional sector classification was introduced in 2012. This had an impact on enterprises in portfolio investments, which were moved from the non-financial limited companies.

Find more figures

Find detailed figures from Accounting statistics for non-financial limited companies

Contact

-

Mihret Shimay

E-mail: mihret.shimay@ssb.no

tel.: (+47) 94 84 03 94

-

Hieu Minh Tran

E-mail: hieu.tran@ssb.no

tel.: (+47) 46 67 66 50