Content

Published:

This is an archived release.

Growth in debts despite decrease in issues

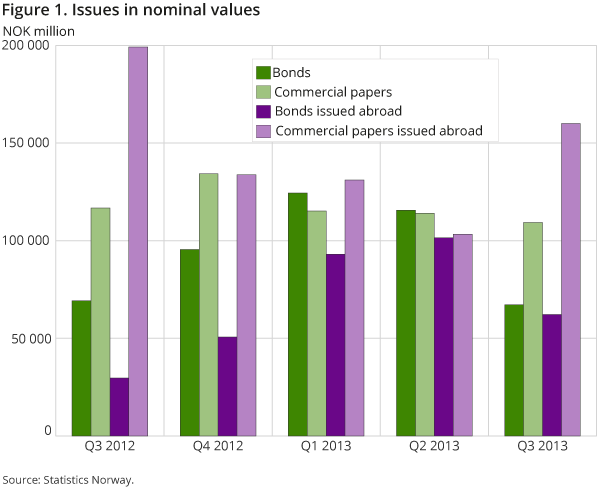

The values of issues of bonds and commercial papers in Norway were moderate in the 3rd quarter of 2013 compared with the 3rd quarter of last year. Otherwise, a growth in Norwegian entities’ outstanding debt was registered in the same period, mainly due to issues abroad.

| Bonds issued in Norway | Short-term paper issued in Norway | Debt securities abroad | ||||

|---|---|---|---|---|---|---|

| Number | Amount | Number | Amount | Number | Amount | |

| September 2013 | 106 | 32 113 | 94 | 78 539 | 156 | 92 221 |

| August 2013 | 56 | 18 380 | 84 | 17 900 | 147 | 66 304 |

| July 2013 | 36 | 16 758 | 49 | 12 902 | 136 | 63 803 |

| June 2013 | 100 | 31 009 | 99 | 70 343 | 134 | 61 418 |

| May 2013 | 98 | 46 839 | 90 | 21 047 | 95 | 86 663 |

| April 2013 | 88 | 37 800 | 74 | 22 744 | 115 | 56 820 |

| March 2013 | 94 | 34 025 | 110 | 80 025 | 121 | 72 296 |

| February 2013 | 101 | 31 673 | 86 | 17 104 | 131 | 62 881 |

| January 2013 | 103 | 58 726 | 85 | 18 047 | 134 | 88 900 |

| December 2012 | 91 | 24 998 | 70 | 91 828 | 84 | 37 738 |

| November 2012 | 123 | 38 545 | 103 | 21 179 | 101 | 90 567 |

| October 2012 | 75 | 31 907 | 87 | 21 228 | 109 | 56 235 |

| September 2012 | 108 | 34 867 | 114 | 85 780 | 101 | 48 989 |

In Norway, 198 issues of bonds and 227 issues of commercial papers valued at NOK 177 billion were registered during the 3rd quarter of 2013. Compared to the 3rd quarter of 2012, the number and amount of issues were reduced by 23 per cent. Ninety-six per cent of the issues in the 3rd quarter of 2013, NOK 169 billion, referred to issues by Norwegian entities. In the same period, Norwegian entities also issued 439 bonds and commercial papers abroad, valued at NOK 222 billion. Compared to the 3rd quarter of 2012, the number of issues rose by 3 per cent, while the value of such issues was reduced by the same percentage.

Increase in issues by the general government and decrease in other issues

Sixty-seven per cent of the volume of issues in Norway in the 3rd quarter of 2013, NOK 118 billion, referred to the general government. This is an increase of 5 per cent compared to their share of issues in the 3rd quarter last year. The second largest part of the issues; 17 per cent, or NOK 31 billion, referred to financial corporations. This is a decrease of a total of 25 per cent compared to the corresponding share of issues in the 3rd quarter of 2012. NOK 21 billion, or 12 per cent, referred to non-financial corporations; a decrease of 11 per cent compared to the corresponding share of issues in the 3rd quarter last year.

The major part of the volume of issues by Norwegian entities abroad, 85 per cent (NOK 189 billion), referred to financial corporations.

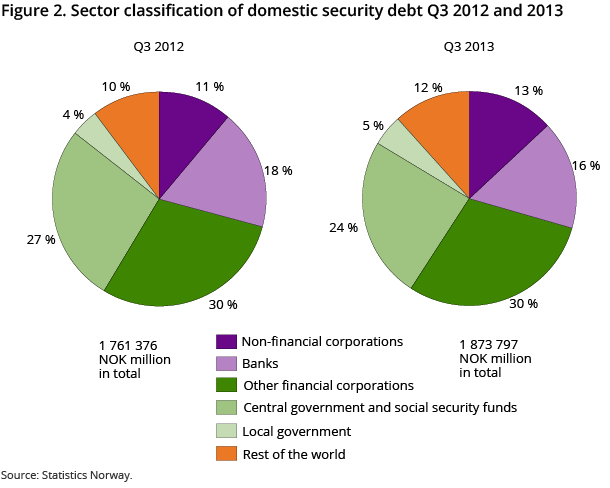

Continued growth in Norwegian entities’ outstanding debts

The nominal value of outstanding bond and short-term security debts referring to issues in Norway amounted to NOK 1 874 billion at the end of September 2013. This is an increase of 6 per cent compared to the end of September 2012. The largest part of the debts, 46 per cent, or NOK 861 billion, referred to financial corporations. The second largest part of the debts, 29 per cent, or NOK 547 billion, referred to the general government. The average market value of the domestic bond debt was 1.75 per cent higher than the nominal value, while the market value of the domestic commercial paper debt was 0.5 per cent lower than the nominal value.

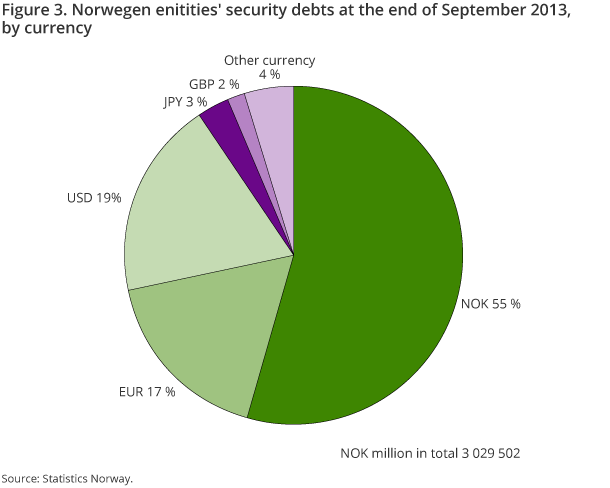

Eighty-eight per cent, or NOK 1 657 billion, of the outstanding bond and short-term security debt from issues in Norway referred to Norwegian borrowers at the end of September 2013. At the same time, Norwegian entities’ outstanding bond and short-term security debts abroad amounted to NOK 1 373 billion. As a result of this, Norwegian entities’ outstanding bond and short-term security debts in Norway and abroad amounted to NOK 3 030 billion at the end of September 2013. This is an increase of 4 per cent compared with the end of September last year.

A major part of such debt in Norway is raised in NOK, while a major part of Norwegian entities’ bond and short-term security debts abroad is raised in EUR, USD, GBP or JPY, or other currencies to some extent. A total of 43 per cent of Norwegian entities’ bond and commercial paper debts in Norway and 29 per cent of their bond and commercial paper debts abroad fall due within a period of two years.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42