Content

Published:

Updated:

This is an archived release.

Growth in debts due to considerable bonds

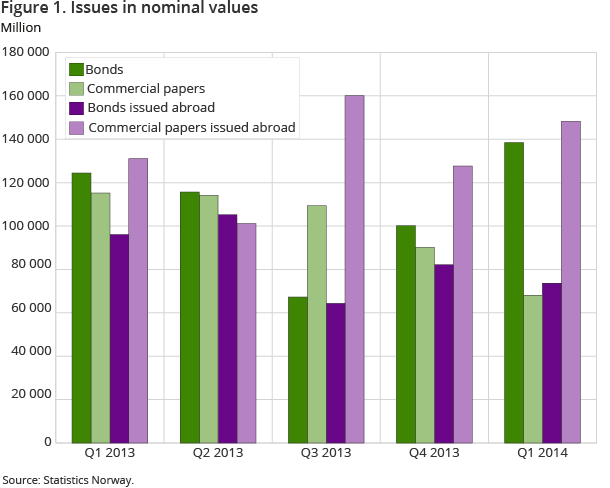

In the 1st quarter of 2014, relatively moderate values of new commercial papers and large values of new bonds were registered in Norway. Considerable issues by Norwegian entities abroad in the same period led to a 4 per cent growth in Norwegian entities’ outstanding debt abroad.

| Bonds issued in Norway | Short-term paper issued in Norway | Debt securities abroad | ||||

|---|---|---|---|---|---|---|

| Number | Amount | Number | Amount | Number | Amount | |

| Corrected 6 June 2014. | ||||||

| March 2014 | 104 | 57 363 | 81 | 31 017 | 141 | 79 478 |

| February 2014 | 92 | 34 959 | 89 | 16 696 | 139 | 60 375 |

| January 2014 | 111 | 46 107 | 100 | 20 434 | 147 | 82 042 |

| December 2013 | 111 | 30 493 | 72 | 54 458 | 63 | 25 324 |

| November 2013 | 104 | 35 713 | 86 | 16 566 | 111 | 111 814 |

| October 2013 | 87 | 33 895 | 82 | 19 157 | 138 | 72 682 |

| September 2013 | 106 | 32 113 | 94 | 78 539 | 157 | 92 262 |

| August 2013 | 56 | 18 380 | 84 | 17 900 | 153 | 67 888 |

| July 2013 | 36 | 16 758 | 49 | 12 902 | 138 | 64 318 |

| June 2013 | 100 | 31 009 | 99 | 70 343 | 134 | 61 418 |

| May 2013 | 98 | 46 839 | 90 | 21 047 | 97 | 87 116 |

| April 2013 | 88 | 37 800 | 74 | 22 744 | 119 | 57 770 |

| March 2013 | 94 | 34 025 | 110 | 80 025 | 124 | 73 116 |

In Norway, 307 issues of bonds and 270 issues of commercial papers valued at NOK 207 billion were registered during the 1st quarter of 2014. Thirteen per cent of the value referred to issues by “Rest of the world”, compared to 8 per cent in the 1st quarter of 2013.

The volumes of issues of bonds were more than twice the volumes of issues of commercial papers. Compared to the 1st quarter of 2013, the number of issues in Norway was at the same level, while the amount of issues was reduced by 14 per cent. In the same period, Norwegian entities also issued 427 bonds and commercial papers abroad, valued at NOK 222 billion. Compared to the 1st quarter of 2013, the number of issues rose by 9 per cent, while the amount of issues was reduced by 2 per cent.

Decrease in issues by the general government and increase in other issues

A major part of the volume of issues in Norway still refers to the general government, but this was reduced from 59 per cent in the 1st quarter of 2013 to 44 per cent in the 1st quarter of 2014. This reduction is due to a decrease in amounts caused by rollovers/swap arrangements in which new treasury bills have replaced old treasury bills at the time of maturity. The second largest part of the issues, making up 29 per cent, referred to financial corporations. The corresponding figure for the 1st quarter of 2013 was 20 per cent. Fourteen per cent of the issues referred to non-financial corporations. The major part of the volume of issues by Norwegian entities abroad; totalling 86 per cent, referred to financial corporations.

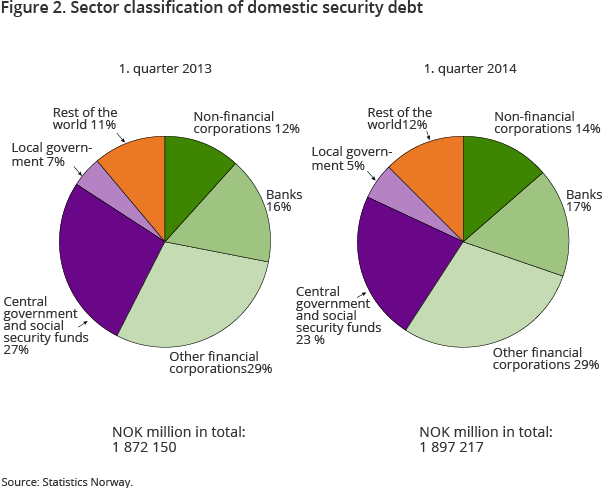

Growth in Norwegian entities’ outstanding debts in currencies other than NOK

The nominal value of outstanding bond and short-term security debts referring to issues in Norway amounted to NOK 1 897 billion at the end of March 2014. This is an increase of approximately 1 per cent compared to the end of March 2013. The largest part of the debts; 46 per cent, referred to financial corporations. The second largest part of the debts; 28 per cent, referred to the general government. The average market value of the domestic bond debt was 2 per cent1 higher than the nominal value, while the market value of the domestic commercial paper debt was 0.4 per cent lower than the nominal value.

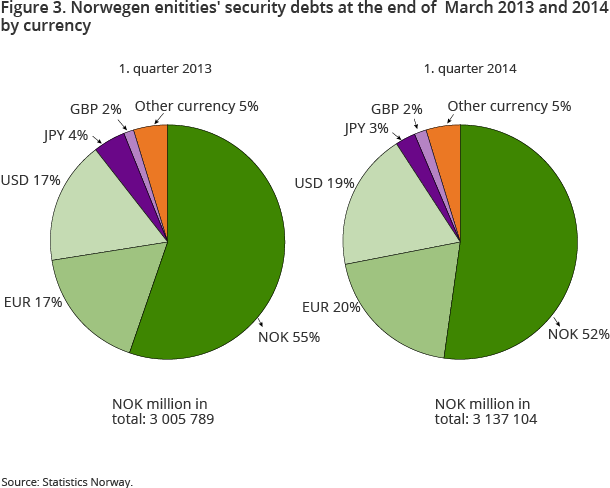

Eighty-eight per cent of the outstanding bond and short-term security debt from issues in Norway referred to Norwegian borrowers at the end of March 2014. At the same time, Norwegian entities’ outstanding bond and short-term security debts abroad amounted to NOK 1 477 billion. Thus, Norwegian entities’ outstanding bond and short-term security debts in Norway and abroad amounted to NOK 3 137 billion at the end of March 2014. This is an increase of 4 per cent compared with the end of March 2013.

A major part of such debt in Norway is raised in NOK, while a major part of Norwegian entities’ bond and short-term security debts abroad is raised in EUR, USD, GBP or JPY, or other currencies to some extent. At the end of March 2014, 48 per cent of Norwegian entities’ bond and commercial paper debts were raised in currencies other than NOK. The corresponding part of such debt at the end of March last year was 45 per cent.

A total of 38 per cent of Norwegian entities’ bond and commercial paper debts in Norway and 32 per cent of their bond and commercial paper debts abroad fall due within a period of two years.

1 The figure was corrected, 6 June 2014.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42