Content

Published:

This is an archived release.

Fall in exchange rate led to debt growth

In the 1st quarter of 2015, moderate values were registered of new debt securities issued by Norwegian entities. Nevertheless, Norwegian entities’ outstanding bond and commercial paper debt rose by 8 per cent compared with the 1st quarter of 2014 due to a fall in the exchange rate.

| Bonds issued in Norway | Short-term paper issued in Norway | Debt securities abroad | ||||

|---|---|---|---|---|---|---|

| Number | Amount | Number | Amount | Number | Amount | |

| March 2015 | 90 | 47 606 | 120 | 35 615 | 124 | 67 757 |

| February 2015 | 70 | 32 510 | 84 | 17 147 | 101 | 89 554 |

| January 2015 | 67 | 29 518 | 80 | 24 437 | 95 | 68 900 |

| December 2014 | 66 | 20 310 | 84 | 26 462 | 57 | 20 221 |

| November 2014 | 91 | 26 634 | 97 | 17 782 | 76 | 75 737 |

| October 2014 | 70 | 32 236 | 85 | 15 205 | 111 | 67 786 |

| September 2014 | 104 | 32 266 | 107 | 35 821 | 118 | 83 458 |

| August 2014 | 66 | 22 598 | 104 | 21 049 | 74 | 32 893 |

| July 2014 | 42 | 16 972 | 56 | 8 240 | 75 | 31 287 |

| June 2014 | 101 | 43 198 | 97 | 34 758 | 82 | 38 995 |

| May 2014 | 102 | 48 461 | 87 | 19 052 | 104 | 52 774 |

| April 2014 | 77 | 30 687 | 88 | 16 777 | 107 | 63 632 |

| March 2014 | 104 | 57 363 | 81 | 31 017 | 141 | 79 478 |

Marginal growth in domestic security debt

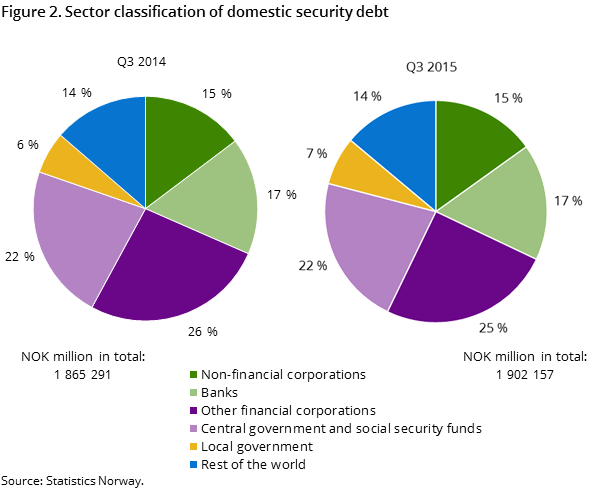

The nominal value of outstanding bond and commercial paper debts referring to issues in Norway amounted to NOK 1 901 billion at the end of March 2015. This is a growth of just 0.2 per cent compared to the end of March 2014. The growth of these debts is due to a depreciation of NOK, as 7 per cent of the debts are raised in other currencies. The largest share of the debts, 41 per cent, referred to financial corporations. The second largest share of the debts, 31 per cent, referred to the general government. The average market value of the domestic bond debt was 2.4 per cent higher than the face value, while the market value of the domestic commercial paper debt was 0.2 per cent lower than the face value.

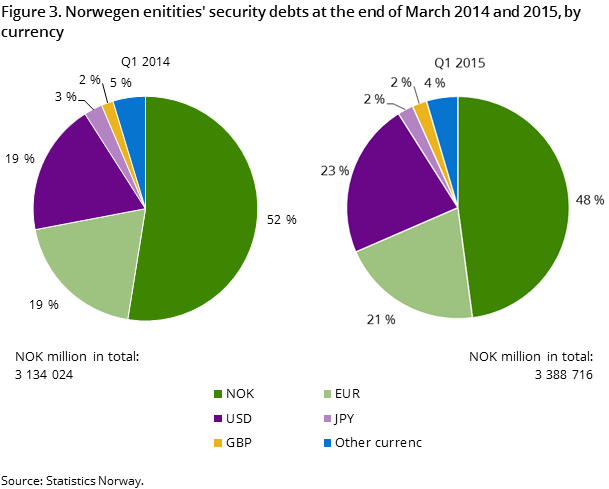

Sharp increase in Norwegian entities’ outstanding debts in currencies other than NOK

Eighty-six per cent of the outstanding bond and commercial paper debt from issues in Norway referred to Norwegian borrowers at the end of March 2015. At the same time, Norwegian entities’ outstanding bond and commercial paper debts abroad amounted to NOK 1 747 billion; an increase of 19 per cent compared with the end of March last year. As a result of this, Norwegian entities’ outstanding bond and commercial paper debts in Norway and abroad amounted to NOK 3 389 billion at the end of March 2015. While a major part of bond and short-term security debts in Norway is raised in NOK, Norwegian entities’ debts abroad are raised in other currencies. A depreciation of NOK had a particular impact on Norwegian entities’ debts in USD, EUR, GBP and JPY from March 2014 to March 2015. This led to 8 per cent growth in Norwegian entities’ outstanding bond and commercial paper debts in Norway and abroad in the same period.

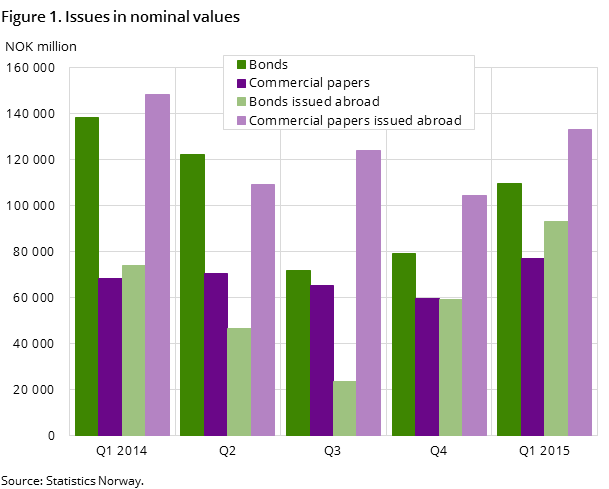

Moderate volumes of new bonds and commercial papers in 1st quarter of 2015

In Norway, 227 issues of bonds and 284 issues of commercial papers valued at NOK 187 billion were registered in the 1st quarter of 2015. The major part of the volume of issues in Norway, NOK 110 billion, referred to bonds.

Compared to the 4th quarter of 2013, the number and amount of issues in Norway were reduced by 11 per cent and 10 per cent respectively. In the same period, Norwegian entities also issued 320 bonds and commercial papers abroad, valued at NOK 226 billion. Compared to the 1st quarter of 2014, the number of these issues was reduced by 25 per cent, while the value of these issues rose by 2 per cent.

Reduction in issues by “Rest of the world” in Norway

The share of the volume of issues for “Rest of the world” in Norway was reduced from 13 per cent in the 1st quarter of 2014 to just four per cent in the 1st quarter of 2015. In the same period, non-financial corporations’ share of the volume of issues in Norway was reduced from 15 per cent to 11 per cent, while the general government and financial corporations’ share rose from 44 per cent and 29 per cent respectively to 51 per cent and 34 per cent respectively.

The major part of the volume of issues by Norwegian entities abroad, a total of 79 per cent, referred to financial corporations.

The statistics is now published as Securities.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42