Content

Published:

This is an archived release.

Impact of bond loans increases

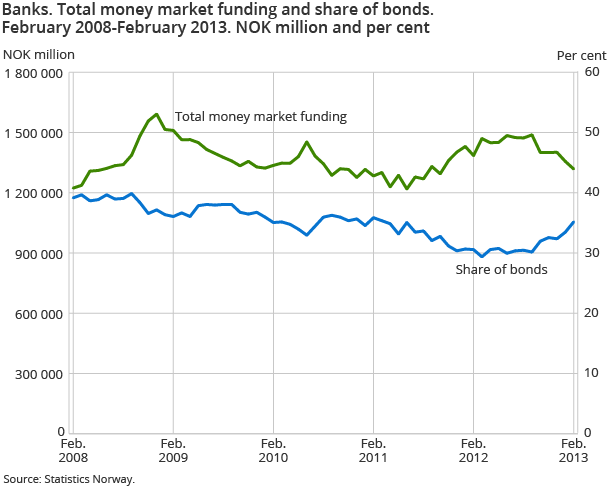

The banks' money market funding totalled NOK 1 319 billion at end-February 2013. Bond loans constituted 34.6 per cent of total money market funding. The share of bond loans increased by 4.2 percentage points from February 2012.

| February 2012 | February 2013 | February 2012 - February 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 3 912 761 | 3 968 384 | 1.4 |

| Deposits | 2 602 971 | 2 664 953 | 2.4 |

| Loans | 2 743 509 | 2 794 450 | 1.9 |

| Mortgage companies | |||

| Bank total assets | 1 617 514 | 1 731 225 | 7 |

| Loans | 1 350 183 | 1 481 575 | 9.7 |

Banks’ total money market funding fell by NOK 37.8 billion from the end of January to the end of February. Compared to February 2012, the funding fell by NOK 67.2 billion1.

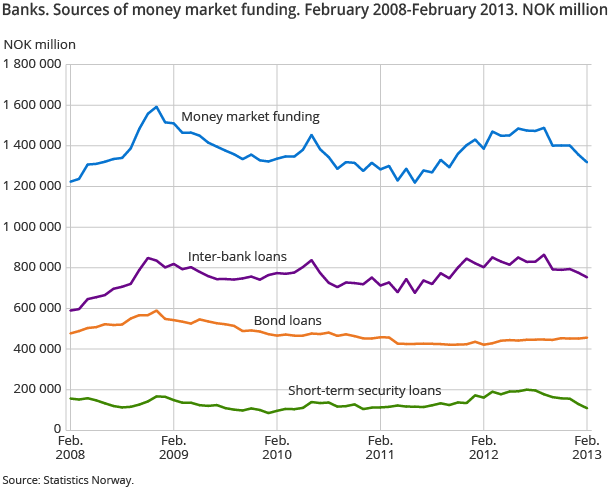

Norwegian banks finance their operations in the money market through different sources, such as inter-bank loans, bond loans and short-term security loans. F-loans from Norwegian Central Bank, loans from foreign central banks and customer deposits are other significant sources of bank funding.

Increase in the share of bond loans

At the end of February, the banks’ bond loans totalled NOK 456 billion. This is an increase of 4.7 billion, or 1.1 per cent, compared to the previous month and corresponds to a share of 34.6 per cent of banks’ total money market funding. This is the highest share since June 2011, when banks’ bond loans constituted 34.9 per cent of banks’ total money market funding.

At the end of February 2013, 58.2 per cent of banks' bond loans were issued in Norway. This percentage fell from 60.3 per cent in February 2012.

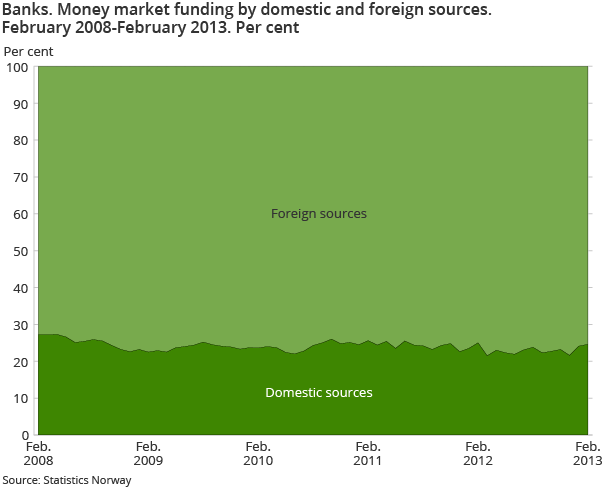

Still significant share of foreign market funding

At the end of February 2013, about 75 per cent of money market funding stemmed from foreign sources. At the end of February this equalled NOK 994 billion. The funding from foreign sources fell by NOK 35.4 billion compared to the previous month.

High share of inter-bank loans

Inter-bank loans constituted 57.1 per cent of banks' total money market funding at the end of February and amounted to NOK 753 billion. This was a decrease of NOK 22.3 billion compared to the previous month. Inter-bank loans share of banks' total money market financing has been between 54 per cent and 60 per cent since the end of 2009.

At the end of February, Norwegian banks’ inter-bank loans from foreign banks amounted to NOK 705 billion. This is equivalent to 53.5 per cent of banks' total money market funding. This share fluctuates from month to month, and can be affected by changes in foreign exchange rates.

Domestic inter-bank loans accounted for a modest NOK 48 billion at end-February, down from NOK 52 billion at end-January. Domestic inter-bank loans constituted 3.6 per cent of the total money market funding in February. This share has remained stable between 3 and 5 per cent in the past five years.

Declining short-term security loans

Banks' short-term security loans peaked at NOK 200 billion at end-July 2012. At the end of February 2013, short-term security loans amounted to NOK 109 billion, a decline of NOK 20.3 billion compared to the previous month. Most short-term security loans are placed abroad; NOK 98 billion at end-February.

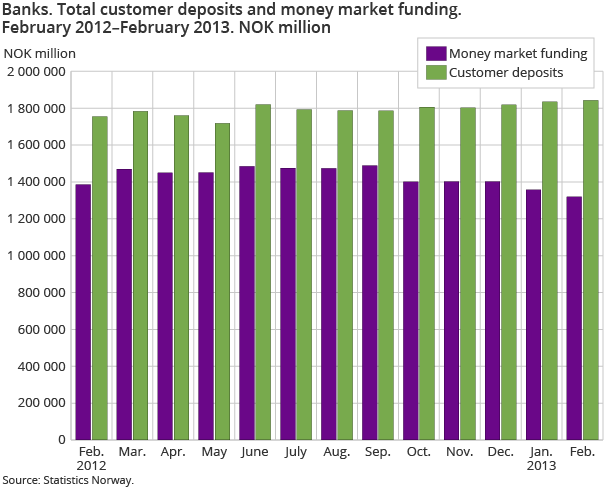

Increased customer deposits

In addition to money market funding, Norwegian banks finance their lending through customer deposits. At the end of February, total deposits from customers amounted to NOK 1 842 billion. This is an increase of NOK 8.2 billion compared to the previous month.

Decreased borrowing from central banks

Norwegian banks can also get funding from Norges Bank and foreign central banks. By the end of February, F-loans from Norges Bank and loans from foreign central banks amounted to NOK 85 billion. This is an increase from NOK 56 billion compared to the previous month. These loans amounted to barely NOK 34 billion at end-February last year.

1 The number has been corrected, 12.04.2013.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42