Content

Published:

This is an archived release.

Lower growth rate in housing loans

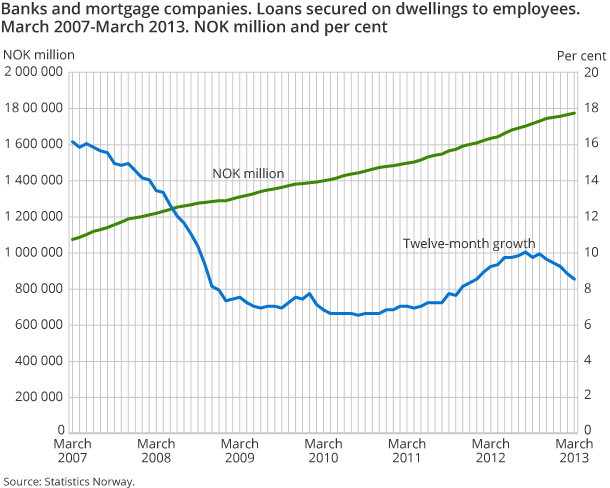

During the past twelve months to the end of March 2013, loans secured on dwellings from banks and mortgage companies to employees grew by 8.5 per cent. This is a drop in the twelve-month growth rate of 0.3 percentage points compared to the end of February 2012.

| March 2012 | March 2013 | March 2012 - March 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 029 597 | 3 924 729 | -2.6 |

| Deposits | 2 697 757 | 2 617 474 | -3.0 |

| Loans | 2 643 024 | 2 734 187 | 3.4 |

| Mortgage companies | |||

| Bank total assets | 1 633 430 | 1 724 993 | 6 |

| Loans | 1 376 145 | 1 478 802 | 7.5 |

Between March 2007 and March 2013, the twelve-month growth in housing loans reached its lowest point at the end of August 2010, when it was 6.5 per cent. Thereafter, there was a gradual growth in housing loans until a peak of 10 per cent at the end of August 2012. Since August 2012, the growth has fallen to 8.5 per cent at the end of March 2013.

Loans secured on dwellings from Norwegian banks and mortgage companies to Norwegian employees, social security recipients, students etc. amounted to NOK 1 774 billion at the end of March 2013. This is an increase of 0.5 per cent, or NOK 8.2 billion compared to the previous month.

Total loans to employees etc. from Norwegian banks, mortgage companies and finance companies amounted to NOK 1 959 billion at the end of March 2013. Loans secured on dwellings amounted to 91 per cent of the employees’ total loans from these three financial sectors.

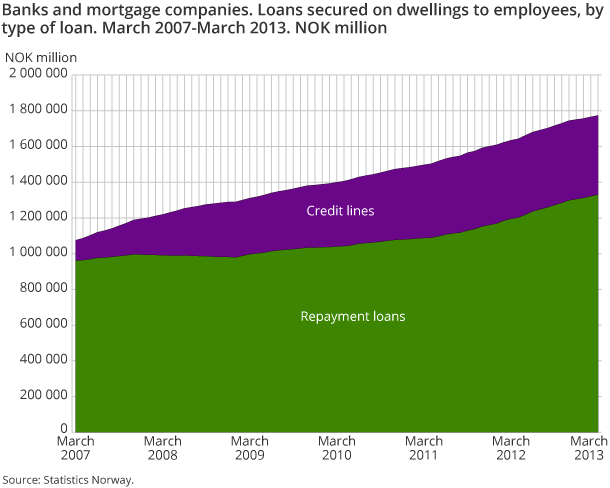

Repayment loans increase more than credit lines

Employees’ housing loans consist of repayment loans secured on dwellings and credit lines secured on dwellings . At the end of March 2013, 75 per cent of the employees’ housing loans from Norwegian banks and mortgage companies were repayment loans secured on dwellings.

Repayment loans secured on dwellings from Norwegian banks and mortgage companies to employees amounted to NOK 1 330 billion at the end of March 2013. This implies an increase of about NOK 135 billion, or 11.3 per cent, compared to the end of March 2012.

Credit lines secured on dwellings from Norwegian banks and mortgage companies to employees amounted to NOK 444 billion at the end of March 2013. This is an increase of about NOK 4 billion compared to the end of March 2012, and implies a twelve-month growth of 0.9 per cent.

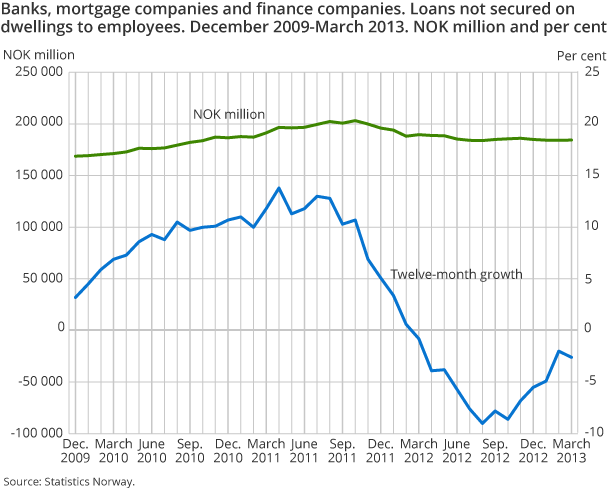

Decline in loans not secured on dwellings

Employees’ loans not secured on dwellings partly consist of credit card debt, consumer credit, overdraft facilities on deposits and car loans with collateral in the purchased item. The interest rate for these loans is normally higher than for loans secured on dwellings. From December 2009 to October 2011, employees’ loans not secured on dwellings from Norwegian banks, mortgage companies and finance companies increased from NOK 169 billion to NOK 203 billion. After October 2011, employees’ loans not secured on dwellings gradually fell, and totalled NOK 184 billion at the end of March 2013. From March 2012 to March 2013 these loans decreased by NOK 5.2 billion, or 2.7 per cent.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42