Content

Published:

This is an archived release.

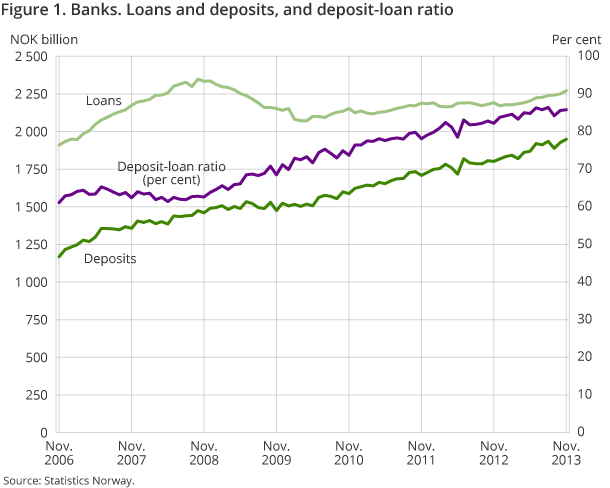

Increased deposit-loan ratio

From end-November 2008 to November 2013, the Norwegian banks’ deposit-loan ratio increased from 62.6 per cent to 85.8 per cent. Bank deposits have become a more significant source of credit finance during this 5-year period.

| November 2012 | November 2013 | November 2012 - November 2013 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 040 154 | 4 184 840 | 3.6 |

| Deposits | 2 671 155 | 2 803 115 | 4.9 |

| Loans | 2 794 987 | 3 001 762 | 7.4 |

| Mortgage companies | |||

| Bank total assets | 1 740 178 | 1 757 881 | 1 |

| Loans | 1 464 272 | 1 507 323 | 2.9 |

At end-November 2013, the banks’ customer deposits amounted to NOK 1 949 billion. This is an increase of NOK 147 billion, or 8.2 per cent, compared to the corresponding period in the previous year. Increased deposits from the household sector contributed to the increasing deposit-loan ratio . However, this increasing ratio is influenced by the transfer of loan portfolios from banks to mortgage companies. The portfolio transfer is an effect of the introduction of covered bonds issued by mortgage companies.

Slight increase in deposit-loan ratio for household sector

At end-November 2013, the deposit-loan ratio for the household sector was 85.8 per cent, which is an increase of 1.5 percentage points from end-November 2012. The deposit-loan ratio achieved its peak in June 2013 at 90.4 per cent, and subsequently falling in the following months. This was partly due to the increase in lending to the household sector, from NOK 1 044 billion at end-November 2012 to NOK 1 095 billion at end-November 2013.

For the period November 2012 to November 2013, deposits from the households increased from NOK 880 billion to NOK 939 billion. This represents a 6.7 per cent growth throughout the past 12 months.

Variation in deposit-loan ratio for corporations

The deposit-loan ratio for banks has fluctuated from 56.0 per cent at end-March 2013 to 62.0 per cent at end-November 2013. This variation is due to a decrease in the deposits from non-financial corporations in February and March 2013. During the past 12 months, the deposits rose from NOK 623 billion to NOK 694 billion, which represents a 12-month growth of 11.3 per cent. The loans to corporations have increased at a steady pace throughout the year, from NOK 1 088 billion at end-November 2012 to NOK 1 119 billion at end-November 2013.

Loan portfolio movements

Transfers of loans secured on dwellings from banks to mortgage companies issuing covered bonds contribute to an increased deposit-loan ratio in banks. The deposit-loan ratio in Norwegian banks rose by 23.2 percentage points from November 2008 to November 2013.

The banks’ customer deposits as a share of total loans to customers from banks and mortgage companies issuing covered bonds were 58.1 per cent at end-November 2013.

Exchange rate fluctuations will influence the dataOpen and readClose

As a large part of Norwegian banks’ funding is denominated in foreign currency, exchange rate fluctuations will influence our data.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42