Content

Published:

This is an archived release.

Declining loans to industry

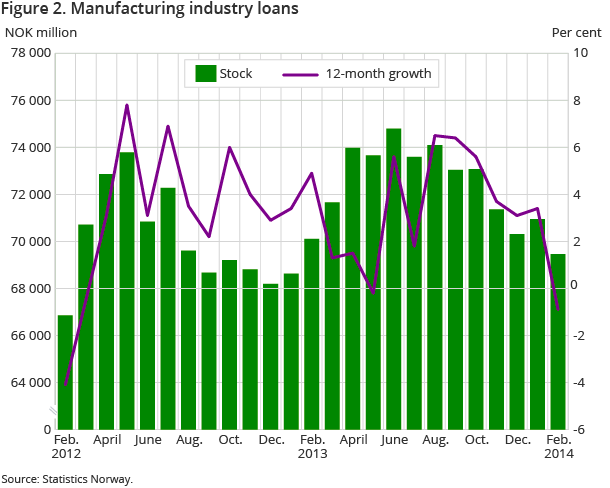

Loans to the manufacturing industry fell by 0.9 per cent from the end of February last year to the end of February this year. The total twelve-month growth for all loans was 1.5 per cent.

| February 2013 | February 2014 | February 2013 - February 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 3 968 384 | 4 330 153 | 9.1 |

| Deposits | 2 664 977 | 2 905 663 | 9.0 |

| Loans | 2 794 450 | 3 094 821 | 10.7 |

| Mortgage companies | |||

| Bank total assets | 1 731 225 | 1 769 401 | 2 |

| Loans | 1 481 575 | 1 517 077 | 2.4 |

Loans from banks, mortgage companies, state lending institutions and finance companies to the manufacturing industry amounted to NOK 69 billion at end-February. This is a decrease of NOK 1.5 billion compared to end-January this year and a decline of NOK 0.6 billion compared to end-February 2013.

The growth in lending to industry was, however, positive in all periods after May 2013 and until end-January this year. Loans to enterprises in the manufacturing industry were 4,9 per cent of total industry loans at end-February.

Moderate growth for total loans

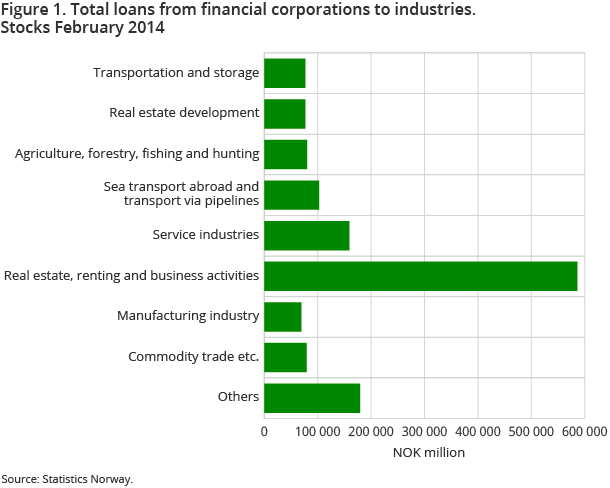

Total industry loans from banks, mortgage companies, state lending institutions and finance companies amounted to nearly NOK 1 410 billion at end- February this year, unchanged from the previous month. Total industry loans increased by NOK 20.5 billion, or 1.5 per cent compared to end-February last year. From end-January 2013 until end-January 2014, the twelve-month growth rate was 1.9 per cent.

By end-February 2014 the industry loans share was 31.8 per cent of total industry loans from financial institutions, unchanged from the previous month. The percentage has remained to be stable and varied between 30.9 and 32.6 percent of total lending from February 2013 to February 2014.

Decline in loans to service industries

Loans from financial institutions to professional and financial services, business services and other service activities amounted to NOK 159 billion at end-February, unchanged from the month before. The twelve-month growth rate for this industry group was -0.8 per cent until end-February. The decrease stems primarily from lower borrowing within industry for professional and financial services.

Loans to real estate, renting and business activities amounted to NOK 586 billion at end-February this year, up NOK 1.1 billion from the month before. During the last twelve-month period, the growth for these loans was 4.4 per cent by end-February 2014. Loans to real estate, renting and business activities made up the largest share of industry loans and accounted for 41.6 per cent of total industry loans.

Loans for sea transport abroad and transport via pipelines fell most

Loans from financial institutions to the international shipping and pipeline transport industry amounted to NOK 103 billion at end-February, down from NOK 107 billion at end-January. The twelve-month growth rate was negative in all periods after September 2012, and was -14.7 per cent until end-February.

At end-February this year, 63 per cent of loans to sea transport abroad and transport via pipelines were issued in foreign currency. Exchange rate fluctuations, thus, affect the value of these loans due to all amounts in the balance sheet being converted into Norwegian kroner. Changes in shipping loans must therefore be viewed in the context of volatility in exchange rates during the same period.

As a share of total industry loans, the shipping industry was the third largest industry at end-February, with a share of 7,3 per cent of total industry loans at end-February.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42