Content

Published:

This is an archived release.

Equity ratio increases

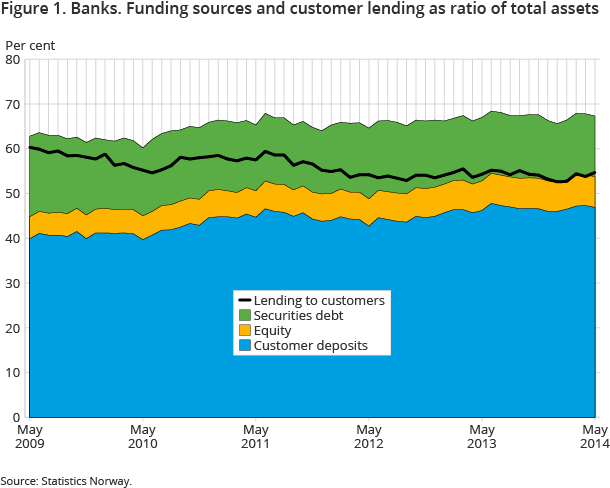

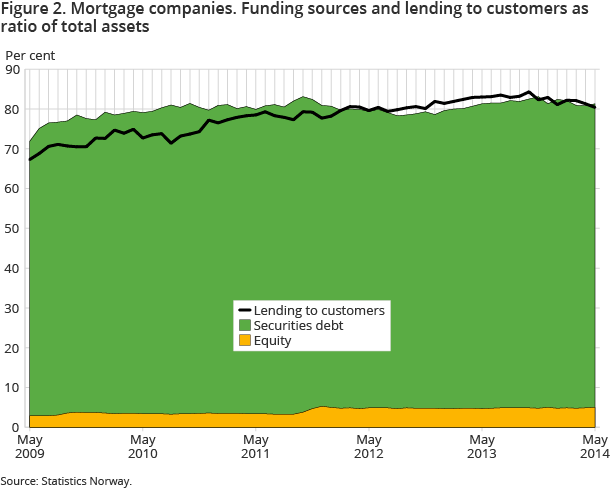

Between end of May 2009 and end of May 2014, banks' equity-to-assets ratio increased with 2.0 percentage points, to 6.9 per cent. During the same period, the mortgage companies’ equity-to-assets ratio increased with 2.2 percentage points.

| May 2013 | May 2014 | May 2013 - May 2014 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 047 533 | 4 292 015 | 6.0 |

| Deposits | 2 705 951 | 2 892 056 | 6.9 |

| Loans | 2 919 317 | 3 143 403 | 7.7 |

| Mortgage companies | |||

| Bank total assets | 1 726 230 | 1 782 275 | 3 |

| Loans | 1 491 795 | 1 499 197 | 0.5 |

At the end of May 2014, the banks’ equity was NOK 296 billion, of which NOK 203 billion was retained earnings. The increase in equity ratio since end of May 2009 stems primarily from retained earnings. The increased equity ratio should be viewed in the context of the new capital- and liquidity standards which have been introduced for the financial institutions.

Mortgage companies’ equity was nearly NOK 90 billion at the end of May this year, of which NOK 62 billion was paid-in equity. Since May 2009, the paid-in equity has increased more than the retained earnings. During the period, the banks established several specialised mortgage companies with the permit to issue covered bonds , and large amounts of mortgage loan portfolios were transferred to these companies. The new mortgage companies are the main reason for the increase in the paid-in equity.

Funding from customer deposits still increasing

Norwegian banks has a number of funding sources , and a large part comes from customer deposits. Customer deposits amounted to NOK 2 014 billion at the end of May this year, an increase of NOK 144 billion from the end of May last year. During the last five years, the customers’ deposits-to-assets ratio increased from 39.9 per cent to 46.9 per cent. In the last twelve months up to end-May 2014, the increase in the ratio was 0.7 percentage points. Customer deposits are considered to be a stable long term funding for banks. Even if some customers will make withdraws on their deposits, the probability that many customers withdraws their deposits at the same time is generally small. However, cash flows between the customers and the Government, and also the holiday pay to the employees, lead to monthly fluctuations in the customer deposits. In May 2014, there was a decrease of NOK 22 billion, or 1.1 per cent in the customer deposits.

Falling bond ratio in banks, increasing bond ratio in mortgage companies

Banks’ debt securities, which consists of long term bonds and short term bonds, were NOK 578 billion, or 13.5 per cent of total assets at the end of May 2014. In the period from the end of May 2009 to the end of May 2014 the ratio has fallen by 4.5 percentage points, the last twelve month by 0.7 percentage points. Both the ratio for long term bonds and short term bonds fell in the last five years, long term bonds by 4.1 percentage points and the short term bonds by 0.4 percentage points.

Mortgage companies debt securities was NOK 1 360 billion at the end of May 2014, an increase of NOK 644 billion since the end of May 2009. In this five year period, the securities debts-to assets ratio increased from 69.0 per cent to 76.3 per cent. During the last twelve months, there was a decrease in the ratio of 0.3 percentage points, while the equity-to-assets ratio increased with 0.3 percentage points. Covered bonds was NOK 875 billion at the end of May 2014, an increase of NOK 543 billion, or 163.6 per cent, since the end of May 2009.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42