Content

Published:

This is an archived release.

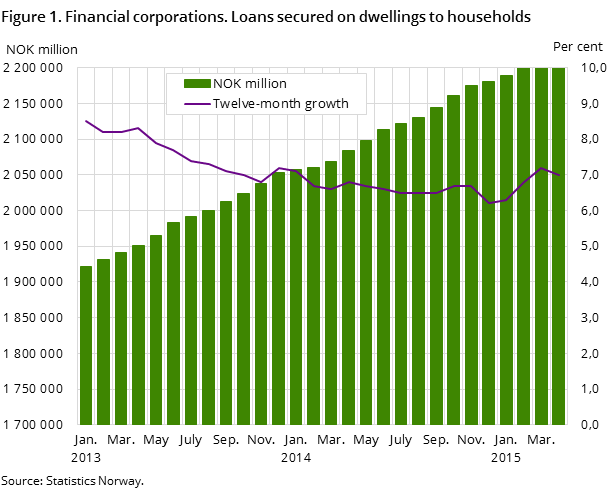

Decreased growth in housing loans

The twelve-month growth in housing loans from financial corporations to households was 7.0 per cent to end-April, down from 7.2 per cent to end-March. Compared to April last year, the twelve-month growth has declined by 0.2 percentage points.

| April 2014 | April 2015 | April 2014 - April 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 301 229 | 4 619 848 | 7.4 |

| Deposits | 2 945 921 | 3 056 103 | 3.7 |

| Loans | 3 177 080 | 3 408 096 | 7.3 |

| Mortgage companies | |||

| Bank total assets | 1 769 957 | 1 909 999 | 8 |

| Loans | 1 499 109 | 1 548 580 | 3.3 |

Loans secured on dwellings from financial corporations to households amounted to NOK 2 229 billion at the end of April; an increase of NOK 145 billion from April last year. A total of 84.5 per cent of households’ total loans from financial corporations were secured on dwellings at end-April.

Decreased growth in repayment loans

Loans secured on dwellings consist of two types of loans: repayment loans and credit lines. At the end of April, the repayment loans constituted a share of 80.1 per cent of all housing loans to households, and amounted to NOK 1 785 billion. This is an increase of NOK 11.5 billion from previous month and an increase of about NOK 150 billion from April last year. The twelve-month growth in the households repayment loans was 9.1 per cent to end-April; a decrease from 9.5 per cent the previous month.

Credit lines secured on dwellings from financial corporations to households amounted to NOK 444 billion at the end of April; a decline of NOK 177 billion from the previous month. The twelve-month growth in credit lines secured on dwellings to households was -0.9 per cent at end-April, and has been negative since June 2013.

Higher growth in housing loans from mortgage companies

Loans secured on dwellings from mortgage companies totalled NOK 1 122 billion at the end of April. This is an increase of NOK 12.8 billion compared to the previous month. The twelve-month growth in housing loans from mortgage companies to households was 4.3 per cent at end-April; an increase from 2.2 per cent to end-March.

Banks’ housing loans to households amounted to NOK 1 046 billion at the end of April. This is an increase of NOK 96.7 billion compared to April last year and corresponds to a twelve-month growth of 10.2 per cent.

Housing loans from state lending institutions to households totalled NOK 62 billion at the end of April. The twelve-month growth in these loans was 2.5 per cent; a decrease from 2.8 per cent the previous month.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42