Content

Published:

This is an archived release.

More money in the bank

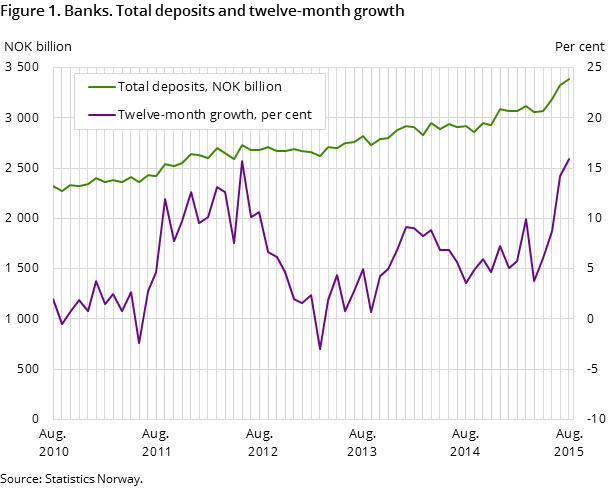

Total deposits in Norwegian banks amounted to NOK 3 385 billion at the end of August, up 16 per cent from end-August last year. The growth in deposits from Norwegian households was strongest among the domestic sectors.

| August 2014 | August 2015 | August 2014 - August 2015 | |

|---|---|---|---|

| Banks | |||

| Bank total assets | 4 275 366 | 5 001 485 | 17.0 |

| Deposits | 2 920 216 | 3 384 917 | 15.9 |

| Loans | 3 128 827 | 3 581 007 | 14.5 |

| Mortgage companies | |||

| Bank total assets | 1 788 141 | 1 983 056 | 11 |

| Loans | 1 482 377 | 1 568 091 | 5.8 |

Deposits from Norwegian households totalled NOK 1 077 billion at end-August, up from NOK 1 012 billion at end-August the previous year, which is an increase of 6.4 per cent. The households’ deposits constituted a share of 32 per cent of total deposits at end-August.

Bank deposits from domestic non-financial corporations amounted to NOK 624 billion at end-August, up from NOK 602 billion at end-August last year, which equals a twelve-month growth in deposits of 3.6 per cent. Deposits from domestic non-financial corporations constituted a share of 18 per cent of total deposits at end-August.

Largest share of deposits from foreign sources

At end-August, the deposits from foreign sources amounted to NOK 1 307 billion, which equals a share of 39 per cent of total deposits. Deposits from foreign banks and other financial corporations constituted a share of 87 per cent of foreign deposits at end-August. Interbank loans from foreign sources fluctuate from month to month, and are also affected by changes in exchange rates.

Households place most in transaction deposits

Total transaction deposits amounted to NOK 2 131 billion at end-August. Domestic households and non-financial corporations accounted for NOK 966 billion and NOK 515 billion of these deposits respectively. As a share of total transaction deposits, this constituted 45 and 24 per cent respectively.

Other deposits totalled NOK 1 254 billion at end-August, of which domestic households and domestic non-financial corporations accounted for approximately NOK 110 billion each.

New specifications on depositsOpen and readClose

From April 2015, a new specification of deposits was implemented in the banks’ reporting of deposits. This causes a break in time series for stocks by types of deposits, which means that the time series from April this year are not comparable to previous periods.

The background for the new specification of deposits was a restructuring of the monetary aggregate statistics according to the ECB’s guidelines. For more information, please see ‘Pengemengdestatistikken 2015’ (in Norwegian only).

Change in definition of deposit typesOpen and readClose

Transaction deposits increased by NOK 774 billion or 63 per cent from March to April, while other deposits declined by NOK 833 billion or 44 per cent. These large changes are a result of the new specification of transaction deposits and other deposits.

The definition of other deposits is now stricter than before, and requires that there is a fixed maturity and/or notice of withdrawal or a predetermined purpose. As a result, several types of savings accounts have been transferred from other deposits to transaction accounts.

The statistics is now published as Banks and mortgage companies.

Contact

-

Statistics Norway's Information Centre

E-mail: informasjon@ssb.no

tel.: (+47) 21 09 46 42