Content

Published:

This is an archived release.

Lower interest rates

The interest rate on new loans secured on dwellings decreased by 0.04 percentage points in September. The decrease was due to a fall in the floating interest rate on new housing loans.

| September 2015 | August 2015 | Monthly change | |

|---|---|---|---|

| 1Banks and mortgage companies in monthly sample | |||

| Interest rates, new loans | |||

| Total loans secured on dwellings to households | 2.78 | 2.82 | -0.04 |

| Total loans secured on dwellings, floating interest rate | 2.78 | 2.83 | -0.05 |

| Total loans secured on dwellings, fixed interest rate | 2.71 | 2.70 | 0.01 |

| Interest rates, loans outstanding | |||

| Total loans secured on dwellings to households | 2.96 | 2.98 | -0.02 |

| Total loans secured on dwellings, floating interest rate | 2.91 | 2.93 | -0.02 |

| Total loans secured on dwellings, fixed interest rate | 3.40 | 3.36 | 0.04 |

| Loan margins | |||

| Loan margins, new total loans secured on dwellings to households | 1.64 | 1.67 | -0.03 |

| Loan margins, total outstanding loans secured on dwellings to households | 1.82 | 1.83 | -0.01 |

The interest rate on new loans secured on dwellings to the households from a sample of banks and mortgage companies fell from 2.82 to 2.78 per cent in September 2015. In the same month, the interest rate on outstanding loans secured on dwellings to households fell from 2.98 to 2.96 per cent.

Lower floating interest rates on new loans secured on dwellings

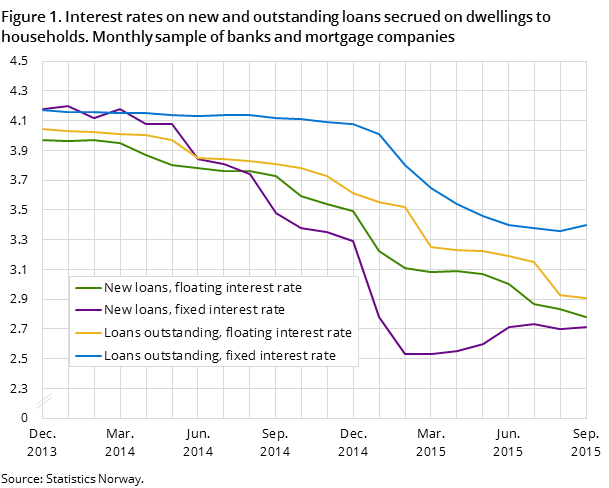

The floating interest rate on new loans secured on dwellings to households fell by 0.05 percentage points to 2.78 per cent. The floating interest rate on outstanding loans secured on dwellings to households fell by 0.02 percentage points to 2.91 per cent. The floating interest rate on outstanding loans secured on dwellings has fallen every month since December 2013, which is when the new interest rate statistics were introduced.

The interest rate on new fixed-interest rate loans secured on dwellings to households from a sample of banks and mortgage companies was 2.71 per cent by end-September, virtually unchanged since end-August 2015. In the same period, the interest rate on outstanding fixed-interest rate loans secured on dwellings to the households increased by 0.04 percentage points to 3.4 per cent. However, in the twelve-month period from August 2014 to August 2015, the fixed-interest rate on these loans has decreased every month.

Lower margins on new loans secured on dwellings

In September 2015, the margin on new loans secured on dwellings to households decreased by 0.03 percentage points to 1.64 per cent. The corresponding margin on outstanding loans and the NIBOR were virtually unchanged in the same period, at 1.82 per cent and 1.14 per cent at end-September 2015.

Lower interest rates on deposits

The households’ interest rates on total deposits fell by 0.04 percentage points from August to September 2015, to 1.17 per cent. The interest rate on deposits with conditions fell by 0.11 percentage points, while the interest rate on deposits on demand fell by 0.03 percentage points.

Historical low interest rates (census)

The quarterly interest rate statistics show that the interest rate on total loans from the banks was 3.73 per cent at the end of September 2015. This is the lowest interest rate level on loans since 1954. The deposit interest rate is also historical low, at 1.19 per cent at the end of September 2015.

Increased share of fixed-interest loans (census)

The share of fixed-interest rate loans secured on dwellings to the households from the banks and mortgage companies increased from June 2015 to September 2015, from 9.8 per cent to 10.2 per cent.

New specification of depositsOpen and readClose

From April 2015, a new specification of deposits was implemented in the banks’ reporting. This has caused a break in the time series for the detailed type of deposits’ interest rates. The time series for the total interest rates on deposits are not affected by the new specifications. The background for the new specification of deposits was a restructuring of the monetary aggregate statistics according to the ECB’s guidelines. For more information, please see ‘Pengemengdestatistikken 2015’ (in Norwegian only).

Contact

-

Gudrun Haraldsdottir

E-mail: gudrun.haraldsdottir@ssb.no

tel.: (+47) 40 40 72 16

-

Ola Tveita

E-mail: ola.tveita@ssb.no

tel.: (+47) 99 73 45 83