Content

Published:

This is an archived release.

Lower interest rates on loans and deposits

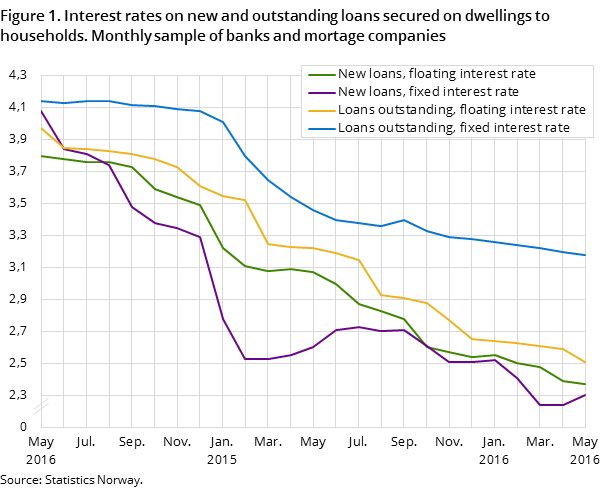

The interest rate on new mortgages to households fell by 0.02 percentage points in May 2016, while the interest rate on outstanding mortgages fell by 0.07 percentage points. Banks’ deposit rates fell by 0.04 percentage points. Banks’ loan margin on new loans was stable.

| May 2016 | April 2016 | Monthly change | |

|---|---|---|---|

| 1Banks and mortgage companies in monthly sample | |||

| Interest rates, new loans | |||

| Total loans secured on dwellings to households | 2.37 | 2.39 | -0.02 |

| Total loans secured on dwellings, floating interest rate | 2.37 | 2.39 | -0.02 |

| Total loans secured on dwellings, fixed interest rate | 2.30 | 2.24 | 0.06 |

| Interest rates, loans outstanding | |||

| Total loans secured on dwellings to households | 2.57 | 2.64 | -0.07 |

| Total loans secured on dwellings, floating interest rate | 2.51 | 2.59 | -0.08 |

| Total loans secured on dwellings, fixed interest rate | 3.18 | 3.20 | -0.02 |

| Loan margins | |||

| Loan margins, new total loans secured on dwellings to households | 1.38 | 1.38 | 0.00 |

| Loan margins, total outstanding loans secured on dwellings to households | 1.58 | 1.63 | -0.05 |

In May 2016, the floating interest rate on households’ new mortgages from a sample of banks and mortgage companies fell by 0.02 percentage points to 2.37 per cent, while the fixed interest rate on new mortgages increased by 0.06 percentage points to 2.30 per cent. In the same period, the fixed interest rate and the floating rate on households’ outstanding mortgages fell by 0.02 and 0.08 percentage points to 3.18 and 2.51 per cent respectively.

Lower interest rate margin on outstanding mortgages

In April 2016, the interest rate margin on new mortgages to households from a sample of banks and mortgage companies was stable at 1.38, while the corresponding interest rate margin on outstanding loans fell by 0.05 percentage points to 1.58 per cent. NIBOR fell by 0.02 percentage points to 0.99 per cent.

Lower interest rates also on loans to non-financial corporations

For new other repayment loans to non-financial corporations, the interest rates fell by 0.15 percentage points to 2.81, while the interest rate on outstanding loans was more or less stable at 3.09 per cent in the same period. The interest rate on new other repayment loans to households fell by 0.47 percentage points to 6.15 per cent. Please note that these series are revised for 2015 and 2016.

Lower deposit rates

The interest rate on total deposits from households and non-financial corporations fell by 0.06 and 0.03 percentage points to 0.79 and 0.68 per cent respectively in May 2016.

Contact

-

Gudrun Haraldsdottir

E-mail: gudrun.haraldsdottir@ssb.no

tel.: (+47) 40 40 72 16

-

Ola Tveita

E-mail: ola.tveita@ssb.no

tel.: (+47) 99 73 45 83