Content

Published:

This is an archived release.

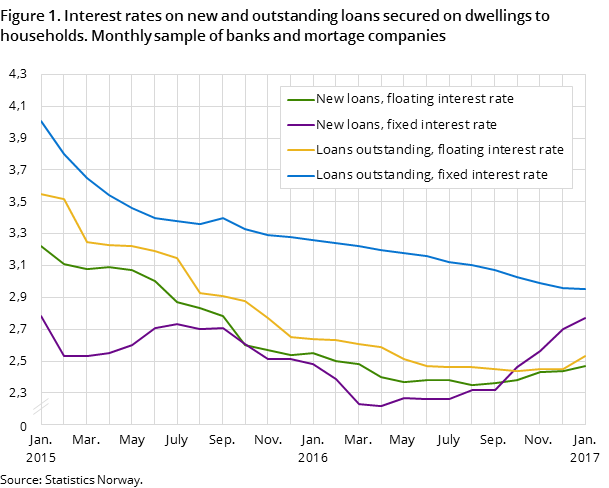

Fixed-interest rate on new mortgages at 2015 level

The interest rate on new mortgage loans increased by 0.03 percentage points 2.49 per cent in January 2017. The interest rate on outstanding loans increased by 0.07 percentage points to 2.56 per cent.

| January 2017 | December 2016 | Monthly change | |

|---|---|---|---|

| 1Banks and mortgage companies in monthly sample | |||

| Interest rates, new loans | |||

| Total loans secured on dwellings to households | 2.49 | 2.46 | 0.03 |

| Total loans secured on dwellings, floating interest rate | 2.47 | 2.44 | 0.03 |

| Total loans secured on dwellings, fixed interest rate | 2.77 | 2.70 | 0.07 |

| Interest rates, loans outstanding | |||

| Total loans secured on dwellings to households | 2.56 | 2.49 | 0.07 |

| Total loans secured on dwellings, floating interest rate | 2.53 | 2.45 | 0.08 |

| Total loans secured on dwellings, fixed interest rate | 2.95 | 2.96 | -0.01 |

| Loan margins | |||

| Loan margins, new total loans secured on dwellings to households | 1.45 | 1.27 | 0.18 |

| Loan margins, total outstanding loans secured on dwellings to households | 1.52 | 1.30 | 0.22 |

In January 2017, the fixed-interest rate on households' new mortgages from a sample of banks and mortgage companies increased by 0.07 percentage points to 2.77 per cent, the highest level since January 2015. The floating rate on new mortgage loans increased by 0.03 percentage points to 2.47 per cent. The interest rate on new credit lines secured on dwellings increased by 0.02 percentage points to 2.39 per cent. The interest rate on new mortgage loans has increased in the last five months.

The fixed-interest rate on outstanding mortgages to households was almost stable at 2.95 per cent. The floating interest rate on households’ outstanding mortgages increased by 0.08 percentage points to 2.53 per cent. The interest rate on outstanding credit lines secured on dwellings increased by 0.09 percentage points to 2.56 per cent.

Lower interest rates on deposits from non-financial corporations

The interest rate on deposits from non-financial corporations fell by 0.10 percentage points to 0.65 per cent, but was stable at 0.76 per cent on deposits from households in January 2017.

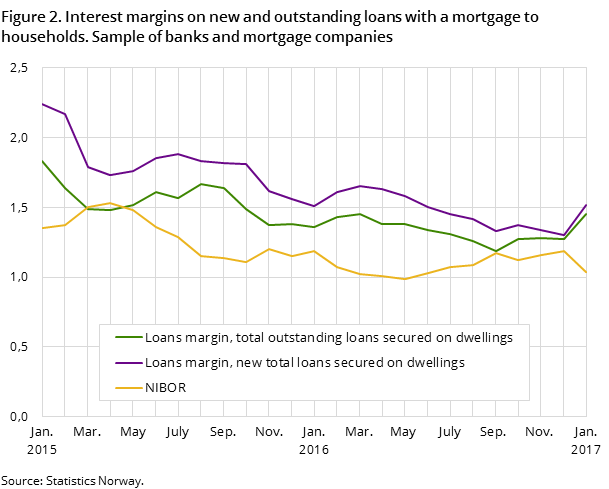

Higher interest rate margin

In January 2017, the interest rate margin on new mortgages to households from a sample of banks and mortgage companies increased by 0.18 percentage points to 1.45 per cent, while the corresponding interest rate margin on outstanding loans increased by 0.12 percentage points to 1.52 per cent. The banks’ deposit margin fell by 0.12 percentage points to 0.32 per cent. The banks’ NIBOR fell by 0.15 percentage points to 1.04 per cent in this period.

Lower interest rates on loans to non-financial corporations

The interest rate on new other repayment loans to non-financial corporations fell by 0.07 percentage points to 3.02 per cent, while the interest rate on outstanding loans was almost stable at 3.22 per cent.

Contact

-

Gudrun Haraldsdottir

E-mail: gudrun.haraldsdottir@ssb.no

tel.: (+47) 40 40 72 16

-

Ola Tveita

E-mail: ola.tveita@ssb.no

tel.: (+47) 99 73 45 83