Content

Published:

This is an archived release.

Further decrease in the exploration estimate for 2016

Estimates for total investments covering oil and gas, manufacturing, mining & quarrying and electricity supply now show a sharper decline in 2016 than indicated in the previous survey.

| Final investments collected in Q1 the following year | |||

|---|---|---|---|

| 2015 / 2014 | 2014 | 2015 | |

| 1Values at current prices | |||

| Extraction, pipeline, mining, manuf. and elec | -9.7 | 258 348 | 233 315 |

| Extraction and pipeline transport | -11.5 | 214 311 | 189 598 |

| Manufacturing | -5.5 | 20 891 | 19 748 |

| Mining and quarrying | -41.8 | 1 469 | 855 |

| Electricity, gas and steam | 6.6 | 21 677 | 23 114 |

| Estimates collected in Q1 the same year | |||

| 2016 / 2015 | 2015 | 2016 | |

| Extraction, pipeline, mining, manuf. and elec | -9.0 | 235 627 | 214 400 |

| Extraction and pipeline transport | -13.3 | 189 049 | 163 913 |

| Manufacturing | 8.2 | 20 105 | 21 755 |

| Mining and quarrying | -45.0 | 1 150 | 633 |

| Electricity, gas and steam | 11.0 | 25 322 | 28 100 |

The downturn is mainly due to a further decrease in estimates in the category exploration, within oil and gas extraction.

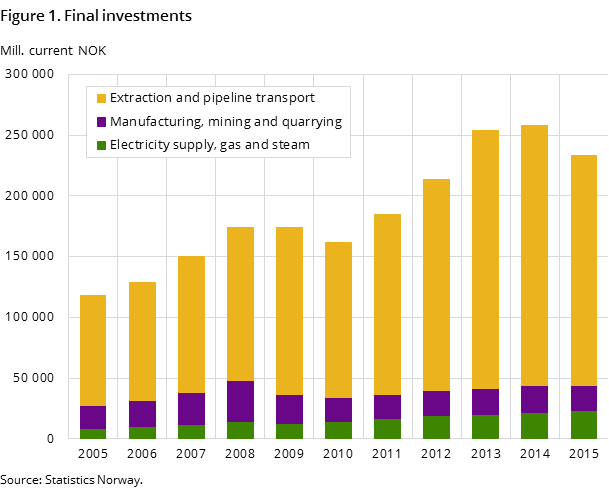

Final investments in 2015 covering oil and gas, manufacturing, mining & quarrying and electricity supply amounted to NOK 233.3 billion, measured in current value. This is 9.7 per cent lower than the corresponding figure for 2014. The decline is mainly due to a significant fall of 11.5 per cent within oil and gas. In addition, investments within manufacturing and mining & quarrying also fell by 5.5 and 41.8 per cent, respectively. Electricity supply on the other hand saw a solid growth of 6.6 per cent compared with 2014.

The latest estimates for 2016 show that total investments are expected to amount to NOK 214.4 billion. This is 9 per cent lower than the corresponding figure for 2015. The decline is mainly due to a substantial fall of 13.3 per cent within oil and gas. The fall in total investments is moderated by higher expected investments within electricity supply and manufacturing investments.

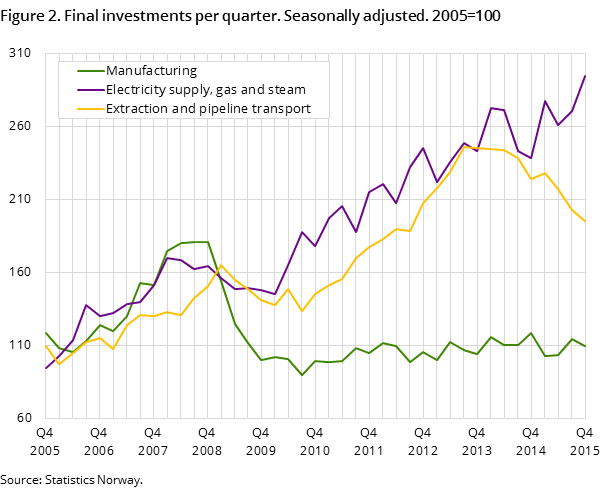

According to seasonally-adjusted figures there was a 3.7 per cent decrease in quarterly final investments for extraction and pipeline transport in the fourth quarter of 2015 compared with the third quarter of 2015. In the same period, electricity supply saw an increase in quarterly final investments equivalent to 9.1 per cent, while manufacturing fell by 4.5 per cent.

Final investments in 2015

Total investments in oil and gas extraction and pipeline transport for 2015 were NOK 189.6 billion. This is NOK 24.7 billion, or 11.5 per cent lower than final investments in 2014.

It is particular investments within field development, fields on stream and exploration that show decreases compared to final investments in 2014, while the investments in onshore activities and shutdown and removal show an increase.

2015 is the first year that shows a decrease since 2010. In the period 2010-2014, investments in oil and gas activity grew by 68 per cent in nominal terms. The main driver for the increase was a persistent high and relatively stable crude oil price during this period. The increased investment resulted in elevated demand for products and services from the suppliers, which again boosted the prices on the input factors in the oil industry. Consequently, there are reasons to believe that increased unit costs stood for more than ignorable parts of the investment growth in this period. The decreased investments in 2015 were mainly driven by cost-cut campaigns by oil companies. The fall was reinforced and entrenched by the sharp decrease in oil prices from around autumn, 2014. The decreased investments in 2015 have resulted in considerable reduction in production volume for Norwegian industries with significant deliveries to oil and gas extraction.

Distinct decrease in oil and gas investments are indicated for 2016

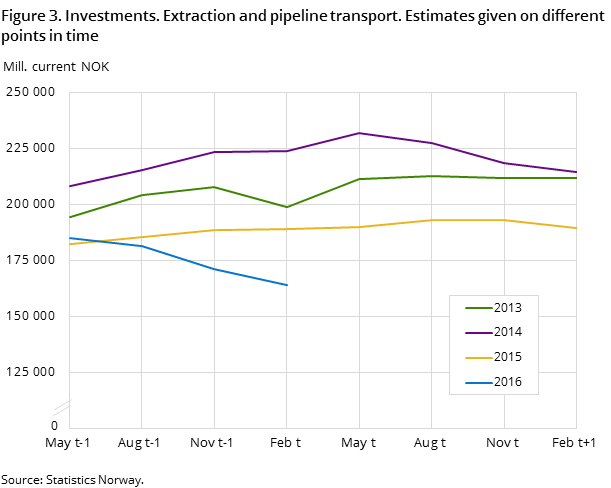

The investments in oil and gas extraction and pipeline transport for 2016 are estimated at NOK 163.9 billion. This is 13.3 per cent lower than the corresponding estimate for 2015, given in the 1st quarter of 2015. The decrease is due to lower investments in exploration, field development, fields on stream and pipeline transport.

The estimate in oil and gas extraction and pipeline transport for 2016 is 4.1 per cent lower than the estimate given in the previous quarter. The decrease is due to a sharp decline in the exploration estimate. The exploration estimate decreased by 25.5 per cent to NOK 16 billion. The further decline in oil prices sees in recent months have contributed to more uncertainty among oil companies regarding the long term oil prices. The price decline also results in distinct lower cash flow in the oil companies. These conditions affect both the will and the ability to make investments in the oil companies. Exploration investments do not affect production in the short run. Thus are these kinds of investments easy to cut. Many oil companies on the Norwegian Shelf have only exploration activity and can therefore only cut these kinds of investments.

Lower investment activity in 4th quarter

While the accrued investment costs came to NOK 46.6 billion in the 3rd quarter, the accrued costs decrease to NOK 44.8 billion in the 4th quarter. The investments in 4th quarter were 6.7 per cent lower than estimated in the previous survey. The decrease from 3rd to 4th quarter was due to lower activity within fields on stream, exploration and shutdown and removal, while the investments in field development showed an increase.

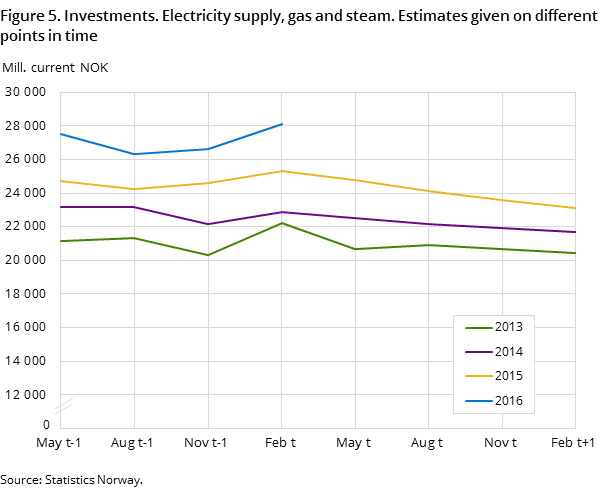

Record high investments in electricity in 2015 - further growth in 2016

Actual investments in electricity supply reached a record high level in 2015, amounting to NOK 23.1 billion. This is 6.6 per cent higher than the corresponding figure for 2014. The growth is mainly due to a higher level of investments in the transmission and distribution sector. This increase is particularly related to power grid upgrades in addition to installation of new power meters (AMS).

New estimates for 2016 suggest further growth in electricity supply in the current year. The estimate for 2016 is 11 per cent higher compared with the corresponding figure for 2015. Prospects of higher investments in production of electricity, together with further growth in transmission and distribution of electricity, explain this development. The investment growth in production of electricity is related to development of new wind farms, in addition to upgrades of old power plants.

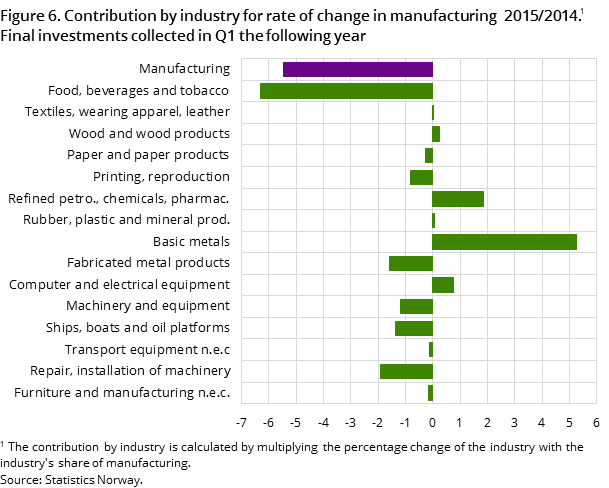

Oil-related industries and food led to fall in manufacturing in 2015

The final investments within manufacturing amounted to NOK 19.7 billion in 2015. This represents a decline, compared to 2014, of 5.5 per cent. A significantly lower level of investment in food products, as well as declining investments in oil-related industries such as fabricated metal products and repair and installation of machinery, explains much of the downturn. Investments in food products declined partly because several large projects were completed last year, while the downturn in the other two industries may be linked to lower activity in the petroleum sector. The total decline in manufacturing is somewhat mitigated by growth in export-related industries such as refined petroleum, basic chemicals and the pharmaceutical industry, and basic metals.

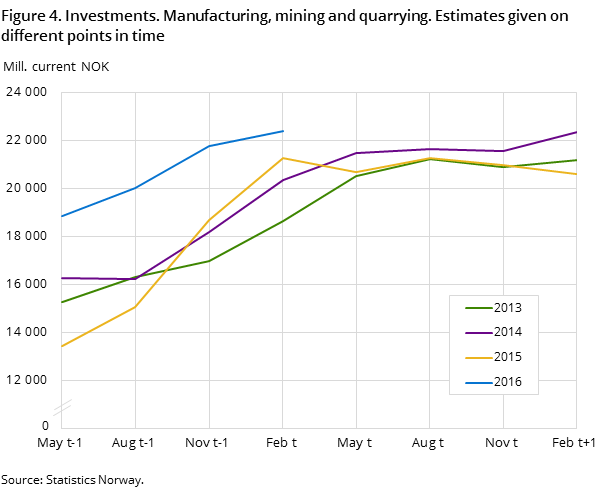

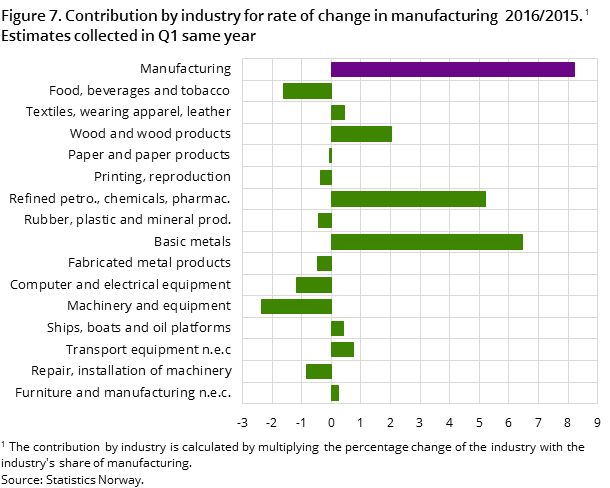

Positive forecasts for manufacturing in 2016

The enterprises' estimates for 2016 indicate a positive forecast for manufacturing in the current year with an estimate of 21.8 billion. This is 8.2 per cent higher than the corresponding estimate for 2015. The increase is due to a high level of investment in the industry group refined petroleum, basic chemicals and the pharmaceutical industry, as well as basic metals. The growth in these sectors is partly due to capacity expansion and modernization, and some of these projects will run for several years.

The growth rate for 2016 is, however, reduced compared with the previous survey (4th quarter survey in 2015). This is because the 2015 projections made in Q1 2015 were significantly higher than 2015- projections made in Q4 2014, see figure 4. For this reason, it is important to stress that early estimates and growth rates for the next year are often uncertain and must be interpreted with caution.

Sharp fall in mining and quarrying in 2015

Final investments for mining and quarrying in 2015 amounted to NOK 855 million. This represents a sharp decline of 41.8 per cent compared with the year before. The decline appears to continue in 2016.

The survey is merged with oil and gas activities, investments, starting with the next quarterly publicationOpen and readClose

As from the Q3 publication in 2015, the statistics on investments in manufacturing, mining and quarrying and electricity supply (KIS) were merged with the statistics on oil and gas activities, investments (OLJEINV). The combined statistics will provide a more comprehensive presentation of final and planned investments for oil and gas, manufacturing, mining and quarrying and electricity supply.

Find more figures

Fin detailed figures from Investments in oil and gas, manufacturing, mining and electricity supply

Contact

-

Ståle Mæland

E-mail: stale.maeland@ssb.no

tel.: (+47) 95 05 98 88

-

Edvard Andreassen

E-mail: edvard.andreassen@ssb.no

tel.: (+47) 40 90 23 32