Content

Published:

This is an archived release.

Households’ net financial assets continue to increase

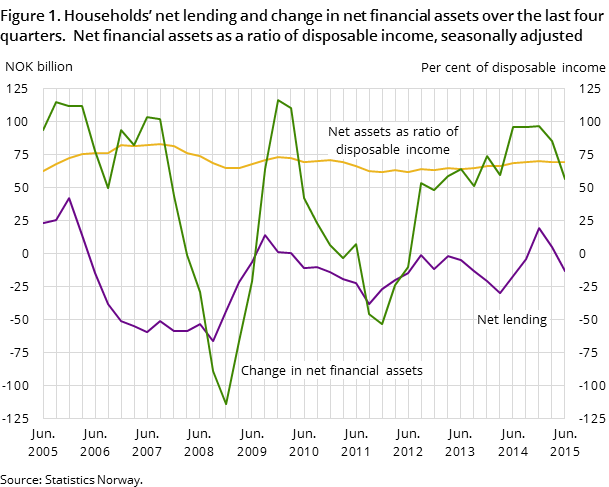

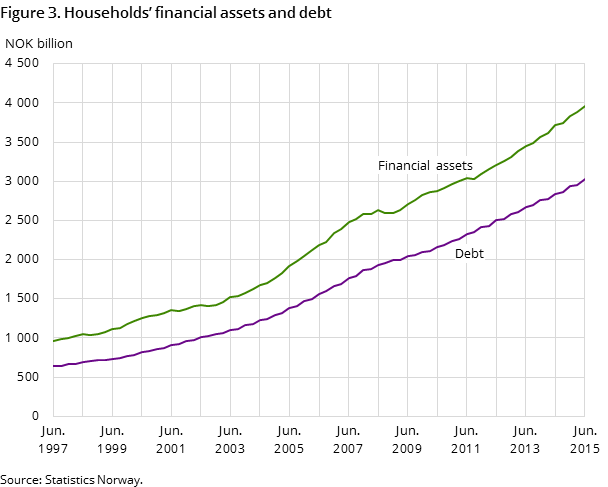

Households’ net lending over the last four quarters to the second quarter of 2015 amounted to NOK -13 billion, compared to NOK 5 billion in the previous four-quarter period. Households’ net financial assets, however, continued to increase.

| 2nd quarter 2014 | 3rd quarter 2014 | 4th quarter 2014 | 1st quarter 2015 | 2nd quarter 2015 | |

|---|---|---|---|---|---|

| 1Seasonal adjusted | |||||

| Assets | 3 714 852 | 3 744 483 | 3 828 032 | 3 883 192 | 3 960 237 |

| Liabilities | 2 841 223 | 2 862 889 | 2 933 924 | 2 954 774 | 3 029 484 |

| Net financial assets | 873 629 | 881 594 | 894 108 | 928 418 | 930 753 |

| Net lending | 93 | -2 925 | -2 363 | 10 247 | -18 254 |

| Other changes | 30 398 | 10 890 | 14 877 | 24 063 | 20 589 |

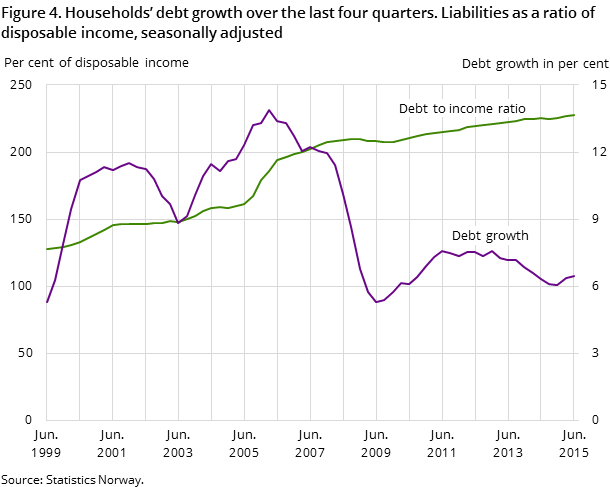

| Debt to income ratio1 | 225.2 | 224.7 | 225.5 | 226.6 | 227.5 |

| Debt growth (per cent)1 | 6.3 | 6.1 | 6.0 | 6.3 | 6.4 |

The increase in households’ net financial assets mainly resulted from capital gains in recent years, especially increased retained earnings in unquoted shares. There are uncertainties in the calculation of these gains, especially for 2013 and 2014, where the complete data sources for the calculation are still not available. Total gains on shares, fund shares and other equity amounted to NOK 50 billon in the last four-quarter period.

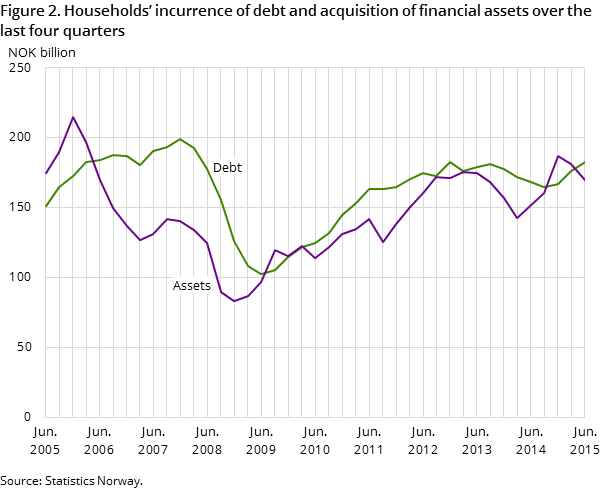

Decrease in households’ net lending

The decrease in households’ net lending is mainly driven by an increase in borrowing from banks and mortgage companies and lower investments in insurance technical reserves and other assets. Borrowing in the last four-quarter period amounted to NOK 174 billion compared to NOK 168 billion in the previous period. As a result, households’ debt growth increased from 6.3 per cent in the previous period to 6.4 per cent in the last period.

Revision of deposits

The introduction of new codes for deposits in bank reporting from April 2015 and a new interpretation of the definitions of the two types of deposits has led to a revision of the distribution between transferable and other deposits. The revisions date back to the first quarter of 2012.

Contact

-

Torbjørn Cock Rønning

E-mail: torbjorn.cock.ronning@ssb.no

tel.: (+47) 97 75 28 57

-

Jon Ivar Røstadsand

E-mail: jon-ivar.rostadsand@ssb.no

tel.: (+47) 21 09 43 69

-

Marit Eline Sand

E-mail: marit.sand@ssb.no

tel.: (+47) 40 90 26 74