Decline in oil and gas extraction leads to lower operating profit

Published:

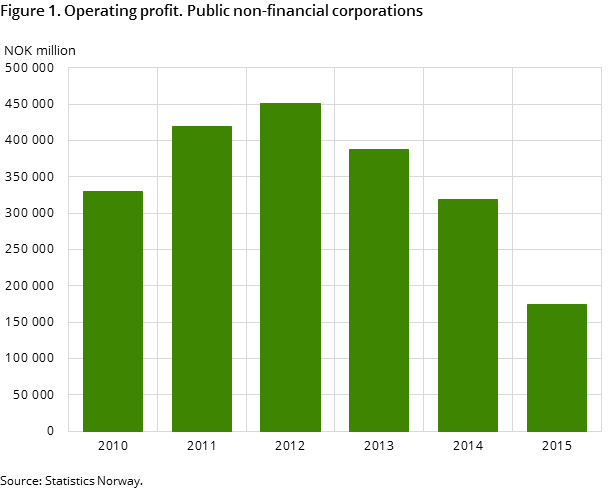

Public non-financial corporations achieved less operating profit in 2015 compared to 2014. Most industries had a decrease in operating profit in 2015 compared to the previous year. The decline was mostly in mining and quarrying as well as water supply, sewerage, waste management and remediation activities.

- Full set of figures

- Public corporations, accounts

- Series archive

- Public corporations, accounts (archive)

Public non-financial corporations achieved some NOK 163 billion in operating profit in 2015. This is about 16 per cent of the operating income. The corresponding figures for 2014 were NOK 178 billion and 14 per cent respectively.

The decrease in the profit is mainly the result of the reduction in profit of the mining and quarrying, and also the water supply, sewerage, waste management and remediation activities. In these industries, operating profit declined by NOK 110 billion from 2014 to 2015. State's Direct Financial Interest (SDFI) and Statoil ASA and BIR AS dominate these industries.

The electricity, gas, steam and air conditioning supply had a total of NOK 3 billion decline in operating profit compared to the previous year.

The information and communication industry achieved operating profit of NOK 8 billion. The transportation, storage industry realised operating profit of NOK 10 billion. The major corporations in this industry include Telenor ASA, Posten Norge AS and Norges Statsbaner AS.

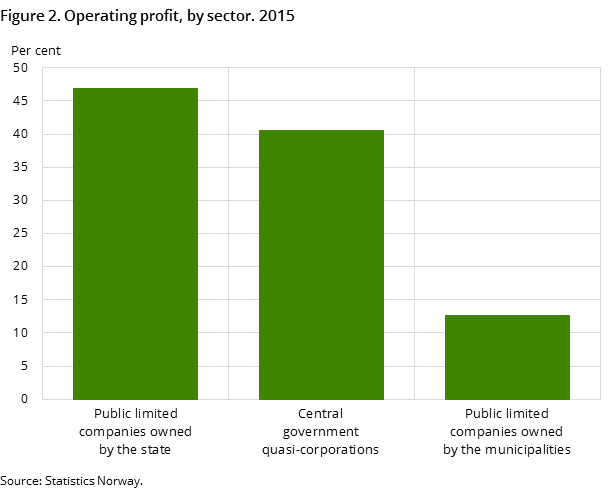

Major operating profit in central government corporations

While the operating profit in the central government quasi-corporations was just less than NOK 76 billion, the central government corporations realised a total operating profit of almost NOK 90 billion. The central government corporations and the central government quasi-corporations accounted for about 89 per cent of the total operating profit. SDFI achieved operating profit of slightly more than NOK 90 billion.

The operating profit of the local government-owned enterprises was just about NOK 20 billion in 2015.

Decline in asset value

Public non-financial corporations’ total assets value amounted to some NOK 3 236 billion at the end of 2015. This was a decline of about NOK 75 billion from the previous year. The value of the fixed assets declined by 0.8 per cent, while the value of the current assets declined by 8.2 per cent.

However, most of the capital is located in a small number of companies. Approximately 50 corporations contributed more than three quarters of the total assets. Each of these corporations has an asset value of more than NOK 7 billion. Eleven of these capital-intensive enterprises are owned by local government and these are all located in the electricity, gas, steam and air conditioning supply industry.

The financial situation

The public non-financial corporations had a relatively stable financial structure in the period 2010 to 2015. The equity ratio was about 46 per cent in 2015. Furthermore, the ratio of fixed assets to long-term capital has been relatively stable at around 1, but nevertheless had a slight decrease in the period 2010-2015. The fixed assets had mainly been financed by long-term capital.

The current ratio increased from 1.02 in 2014 to 1.04 in 2015. This means that the current asset has gone from being less than the current liabilities to being higher than the current liabilities. The figures do not necessarily illustrate the enterprises’ liquidity and therefore require careful consideration.

Central government quasi-corporations have been excluded here because the equity in these corporations cannot be compared with other public corporations.

Contact

-

Francis Kwamena Acquah

-

Statistics Norway's Information Centre